SenseTime shares jump more than 20% on delayed Hong Kong IPO

Shares in SenseTime jumped more than 20 per cent on its first day of trading almost three weeks after it postponed its initial public offering when the US blacklisted China’s biggest artificial intelligence company.

SenseTime raised $740m in Hong Kong on Thursday after its original listing plans were derailed when Washington barred Americans from investing in the company.

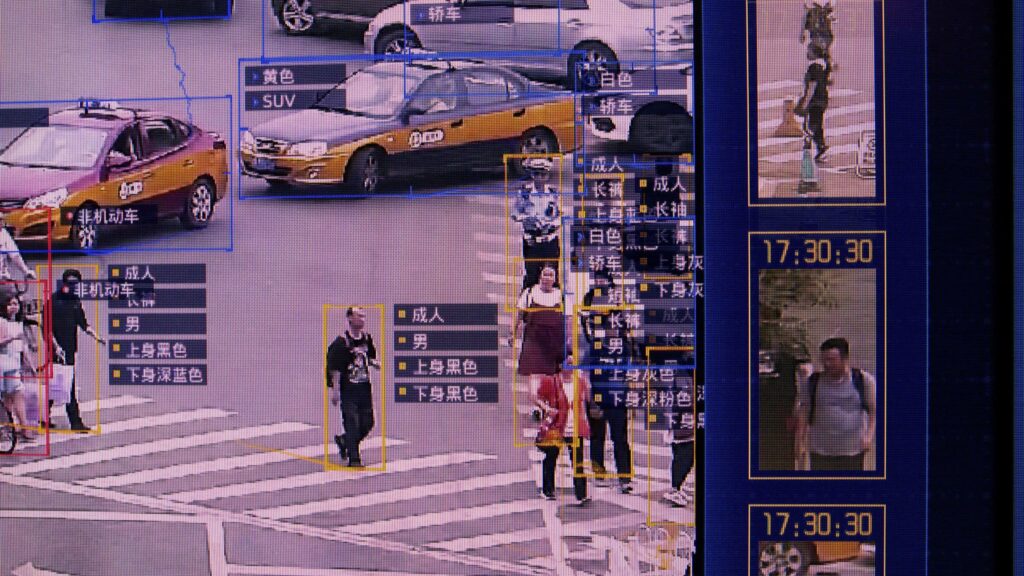

Joe Biden’s administration has accused SenseTime, which specialises in facial recognition software, of enabling human rights abuses against Muslim Uyghurs in China’s north-western Xinjiang region. The company has denied the charges.

The listing was swiftly revived after Chinese state-backed entities stepped in and pledged to buy about two-thirds of the offering, with cornerstone investors increasing their pledges from $450m to $511.6m.

The company priced the shares at the bottom of its range at HK$3.85 (US$0.49), giving it a valuation of $16.4bn. SenseTime’s shares closed the session trading at HK$4.10, giving the company a market capitalisation of $17.5bn.

The largest cornerstone investor, the state-backed Mixed-Ownership Reform Fund, bought $200m worth of shares, while the Shanghai local government fund Xuhui Capital purchased $150m shares.

Other state entities pledged to purchase more shares after the blacklisting forced backers of SenseTime such as Focustar Capital, the US investment firm, to pull out. They are locked in to their shares until the end of June 2022.

SenseTime is not profitable and will spend 60 per cent of the funds raised on research and development. This includes building a new AI supercomputing data centre near Shanghai that is set to be completed in 2022 and developing its own AI semiconductors.

Andy Maynard, a trader at investment bank China Renaissance, said the demand was a mixture of Hong Kong retail buyers and global and regional hedge funds.

“SenseTime’s listing [was] well supported by domestic investors,” said Ke Yan, an analyst at DZT Research. “Increasing adoption of its AI technology is a trend but how much the company can monetise on that trend is another question.”

The IPO has boosted the wealth of the company’s founder, Tang Xiao’ou, who holds a 20.8 per cent stake in the company. Tang worked on visual computing at Microsoft Research Asia before co-founding SenseTime in 2014. The company provides surveillance technology to Chinese government authorities.

SenseTime said in a filing to the Hong Kong stock exchange that Washington’s investment restrictions “do not at present apply” because the US Treasury department singled out its subsidiary, not the parent company that is going public.

Additional reporting by Ryan McMorrow in Beijing

#techAsia newsletter

Your crucial guide to the billions being made and lost in the world of Asia Tech. A curated menu of exclusive news, crisp analysis, smart data and the latest tech buzz from the FT and Nikkei