Sell-off crushes UK companies that sought to ride Spac wave

UK companies that went public via a Spac listing in the past two years have been crushed by the market sell-off, losing on average 62 per cent of their value as investors dump the once-hot start-ups.

Electric vehicle company Arrival has suffered most, losing 93 per cent of its value since completing its Spac deal in March last year, while online used car retailer Cazoo’s shares have plunged 92 per cent since the start-up listed last August, according to Dealogic data.

Most of the UK companies listed in the US, losing on average 72 per cent of their value and underperforming even battered American companies, which are down 63 per cent.

The plight of UK ventures that merged with a Spac comes amid a broader tech sell-off and as investors ditch their holdings of early-stage, cash intensive start-ups that epitomised the Spac boom but which have since failed to meet their often rosy projections.

Special purpose acquisition companies raise money and list on the stock exchange as a cash shell, later searching for a private company to merge with and take public. They offer a faster route to market than a traditional initial public offering and allow companies to present rosy forecasts.

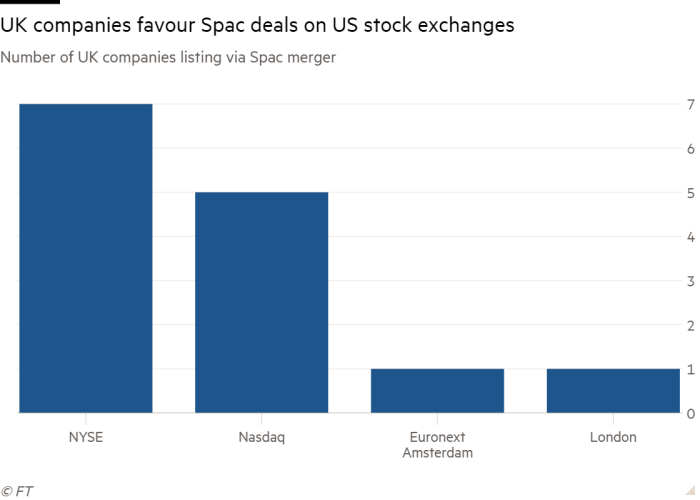

Fourteen UK companies have merged with blank-cheque vehicles since 2020, with newspaper publisher JPI Media, since rebranded as National World, the only one to choose to list in London according to Dealogic — and the only one of the group to rise in value.

In the US, Spacs surged in popularity to become Wall Street’s hottest investment product, with 231 US-listed Spacs merging with US companies since 2020, the Dealogic data finds.

The majority of UK companies that chose to list via a Spac picked the US as their listing destination, due in part to London’s tighter rules. Arrival, quantum tech company Arqit and data analysis business Wejo are among those that merged with New York-listed Spacs, adding to concerns that the London market was being deprived of tech companies.

The UK revamped its Spac rules in July 2021 in an effort to make the City more competitive, though it appears to have missed the boom. “The global Spac market was starting to turn quite considerably at that point,” said Paul Amiss, partner at law firm Winston & Strawn.

Investors have soured on Spacs following numerous scandals that left some investors nursing heavy losses. Earlier this year the US Securities and Exchange Commission also outlined a sweeping overhaul of the market, including clamping down on companies’ abilities to provide projections.

Electric van maker Arrival was valued at $13.6bn when it listed in New York in March 2021, a valuation that has plunged to just $1bn. In its Spac investor presentation, Arrival expected 2022 revenues to hit $60mn and production to reach 10,600 vehicles. Last month, the Hyundai-backed group said it expected to manufacture up to 600 vans “plus low volume” of buses this year.

The Spacs that (mainly) flopped

Arrival

Like many of the new electric car companies, Arrival broke on to the public markets before actually manufacturing a vehicle. The bus and van developer plans to use “microfactories” to avoid the production pitfalls that have ensnared other start-ups including Tesla, Rivian and Lucid. Denis Sverdlov, who founded Arrival in 2015, previously served Russian president Vladimir Putin as his deputy communications minister but has distanced himself from the Kremlin’s recent actions.

Cazoo

Online used-car seller Cazoo was founded in 2018 by Alex Chesterman, who had previously started Lovefilm. It listed in New York at an $8bn valuation but has since shed most of its worth, with its market capitalisation now under $600mn. The lossmaking online car marketplace cut 750 jobs across the UK and Europe this month as it warned of the threat of a recession due to rising inflation and disruption to supply chains.

Paysafe

Founded in London in 1996, fintech group Paysafe helps businesses handle their customers’ payments. The company was a constituent of London’s FTSE 250 index until it was taken private in 2017. In April 2021, it listed in New York after merging with a Spac backed by billionaire businessman Bill Foley — owner of the Vegas Golden Knights ice hockey team.

Babylon Health

Healthcare start-up Babylon was founded in 2013 by British-Iranian entrepreneur Ali Parsa. The tech company has received backing from Saudi Arabia’s sovereign wealth fund and data analytics group Palantir. Babylon’s “GP at hand” app allows customers to access their NHS doctors virtually.

GBT Travel Services UK

American Express’s business travel arranger was spun off by the payment group in 2014 and merged with a Spac backed by private equity firm Apollo Global Management in 2021. Videoconferencing company Zoom and buyout group Ares were among the investors in its Spac deal. The company helps businesses manage travel plans and expenses.

LumiraDx

Founded in 2014 by three scientifically-minded businessmen, LumiraDx has its headquarters in London and creates diagnostic products for patient care. The company merged with a healthcare Spac led by Larry Neiterman, former chief operating officer for global Deloitte Consulting.

Vertical Aerospace

Based in Bristol, Vertical Aerospace was founded in 2016 and develops electric aircraft. The company was set up by Stephen Fitzpatrick, who also leads energy retailer Ovo Energy.

Rockley Photonics

Founded in 2013 by Andrew Rickman, Rockley Photonics makes biomarker sensors for communication products. Based in Oxford, the company focuses on the healthcare sector and wearable health-tracking devices. Its “clinic on the wrist” device analyses users’ blood and skin to measure temperature, alcohol and glucose levels, among other issues.

Genius Sports Group

London-based Genius Sports Group is a data company that provides video, betting and other technology services to sports companies and associations including the Premier League and International Basketball Federation.

BenevolentAI

Artificial intelligence drug discovery company BenevolentAI was founded in 2013. With headquarters in London and a research laboratory in Cambridge, the pharma company uses machine learning to find new treatments. The company’s atopic dermatitis treatment is its only programme currently in phase 2 trials.

Wejo

Founded in 2013 in Manchester, Wejo is a connected vehicle analysis company. Backed by General Motors, Palantir and Microsoft, Wejo collects and processes data on traffic and driving.

Arqit

Quantum encryption company Arqit was founded in 2017 by David Williams, a former investment banker. It merged with a Spac launched by London-based investment firm Centricus, which has close ties to SoftBank.

JPIMedia Publishing

JPIMedia Publishing was formed in 2018 after the acquisition of the assets of national, regional and local newspaper company Johnston Press by its lenders. The company runs about 200 titles across the UK, with flagships such as The Scotsman and The Yorkshire Post. It listed on the London Stock Exchange in January 2021.

Super Group SGHC

Headquartered in Guernsey, Super Group is the parent company of online gambling platform Betway and casino site Spin. It has ridden the wave of gambling legalisation and sports betting in the US, signing deals with San Francisco’s Golden State Warriors basketball team, among others.

Additional reporting by Peter Campbell