Return on Equity Trends Up, As Leaders’ Bets Pay Off

A combination of large pay-outs for different kinds of carriers and the impact of low interest rates in developed markets has caused the average total shareholder return of publicly held insurance companies to drop into negative territory. The average return was much below the 15% average return recorded in other industries, pushing insurance to near bottom.

Insurers’ returns have fallen sharply in the last five-year cycle. The average annual shareholder return was 5.1% from 2016 through 2020, 3% lower than in the previous five-year period—and significantly below the average insurer’s cost of equity. Returns fell in each insurance segment, with the decline being steepest among reinsurers. The pandemic-related uncertainty along with spike in natural catastrophes globally hurt reinsurers, as the named storms in the US alone crossed 70 in 2020. Multiline insurance had the next biggest drop in the latest five-year period, falling more than 5 percentage points to 3.6%. P&C insurance also fell significantly, but it remained the highest performing segment.

The contributing drivers include the challenges posed by subdued interest rates in life-insurance, growing startup competition, and the new waves of regulation that add cost and complexity.

In general, a company’s success is measured by its return on equity (RoE). However, this performance measure isn’t as frequently used for insurers. Instead, the combined ratio (CR) is used for technical performance, which puts claims expenditure and operating expenses alongside premiums. The CR, however, falls short by disregarding the risk variance for individual carriers and business lines. The RoE helps measure an insurance company’s success. It’s the ratio of profit to average net worth. Net worth in insurance is referred to as policyholder surplus and is the difference between a company’s assets and its liabilities. Net worth is capital that belongs to the company’s owners. Owners of capital expect a rate of return on their investment that is commensurate with the risk they assume.

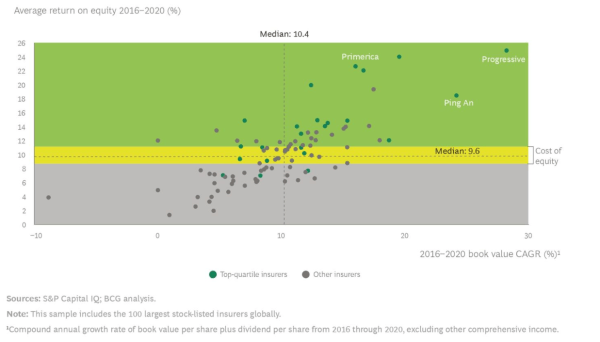

More than half of the difference in insurance valuation multiples globally is explained by differences in insurers’ return on equity. Downward pressure on insurance valuations is often a reflection of investors’ expectations for RoE declines, especially in life and reinsurance segments with the large dependence on investment returns. That being so, top-quartile insurers have delivered returns that were nearly thrice the insurance industry median. What has helped top-quartile carriers to deliver market-beating returns are a differentiated transformation strategy with strong execution.

Leading reinsurer Swiss Re has set an RoE target of 14% for 2024, up from 5.7% in 2021. It expects to achieve this through higher L&H Re profits, superior margins in P&C businesses and continued cost discipline. L&H Re’s earnings outlook is supported by the expected post-pandemic normalization, recovery in legacy portfolios and the transition to IFRS in 2024. P&C Re is positioned to seize profitable growth opportunities in an attractive market environment, while continuing to make higher margins.

Another leading carrier, Travelers Insurance announced core income of $1.3 billion in its last quarterly result with return on equity of 19.8%. Strong underwriting income and returns from their investment portfolio were key performance drivers. The higher underlying underwriting income resulted from record net earned premiums of $8 billion and an underlying combined ratio of 88.7%. Their “Perform and Transform” call to action bore results, as an ambitious innovation agenda entailed investing in digital tools and virtual capabilities, deploying robotics and proprietary AI models, and hiring and developing top data scientists, engineers and meteorologists.

The value creation gap between the companies at the top and those in the middle or at the bottom keeps widening as leaders take decisive actions and continue to invest in new capabilities. RoE is a crucial element of the capital governance equation, as it drives key strategic decisions — whether to discontinue businesses, adjust geographical presence as well as product and channel mix.

You get 3 free articles on Daily Fintech. After that you will need to become a member for just US$143 a year (= $0.39 per day) and get all our fresh content and our archives and participate in our forum.

#metrics #returnonequity #SwissRe Default/Ignore InsurTech travelers