Reddit forum discussions swing from meme stocks to crypto

Discussion on Reddit’s main cryptocurrency forum has overtaken activity on the “meme stock” forum WallStreetBets this month, reflecting how many day traders have switched their focus from the equity market to digital coins in the hunt for quick returns and a bit of fun.

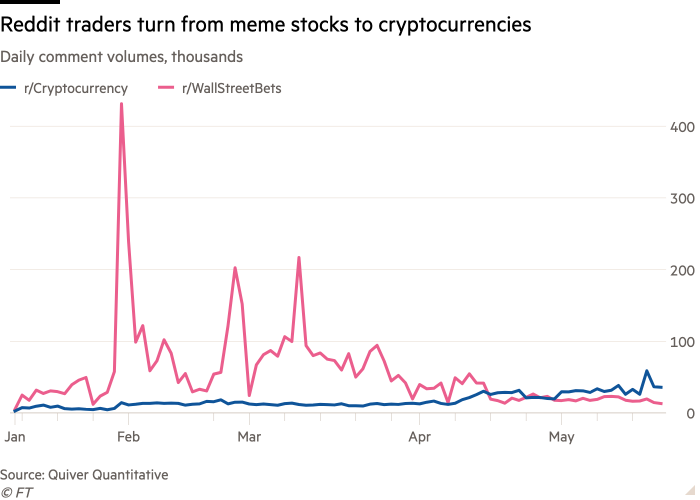

Data from the research group Quiver Quantitative shows that comment volumes on the social media site’s r/Cryptocurrency forum rose 82 per cent from May 1 to May 21, with almost 36,000 daily comments on Friday at the end of a volatile week for bitcoin and other digital currencies.

By contrast, the number of comments on r/WallStreetBets dipped 42 per cent over the same period, with just 13,000 on May 21.

WallStreetBets shot to prominence at the beginning of this year when commenters encouraged a short squeeze that drove GameStop and a handful of other shares higher, inflicting heavy losses on hedge funds that had bet against the stocks. The chief executive of Reddit was called to a congressional hearing into the frenzy.

Millions of Reddit users began following r/WallStreetBets around that time, but comments are down 97 per cent from the late-January record of more than 430,000 posts a day, according to Quiver data.

Cryptocurrency discussion is prohibited on r/WallStreetBets. The moderators ban posts about cryptocurrencies “or any other worthless securities that are susceptible to scams or pump and dump schemes”.

Discussion on r/Cryptocurrency “has been steadily climbing”, said James Kardatzke, founder of Quiver.

“Many active retail investors don’t just want to see numbers in their Robinhood [brokerage] account go up, they also want to invest in a narrative,” Kardatzke said, and while trading in meme stocks such as GameStop and AMC had been more muted in recent months, developments in cryptocurrency had been coming thick and fast.

In recent weeks, Tesla founder Elon Musk has publicly backed and then went cold on bitcoin and hyped the joke currency dogecoin; bitcoin’s giant carbon footprint has attracted attention; and the Chinese government has signalled its determination to curb the use of cryptocurrency.

“Crypto is having a lot of volatility and more interesting storylines,” Kardatzke said.

Musk was mentioned on r/Cryptocurrency more than 2,000 times in the immediate aftermath of tweeting earlier this month that his electric car company would no longer accept bitcoin, a move that caused a fire sale of the digital currency.

On Wednesday last week, as bitcoin hit its lowest price of $30,000, comments on the cryptocurrency forum surged to a record high of 59,000 in a day.

A recent study found that the number and tone of Reddit comments influenced intraday trading in GameStop during the short squeeze earlier this year.

A similar “social media drive and gamified” approach to trading was also apparent in crypto assets, said study co-author Brian Lucey, professor at Trinity Business School in Dublin. “You have a group of people who are looking for excitement. They have got a different perspective on risk and return.”

Steve Sosnick, chief strategist at Interactive Brokers, said: “Investors still love a meme stock. Crypto was a purer expression of meme trading. It took a lot of steam out of stock and options speculation.”

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday