Pipe to move into securitisation as it hits $2bn valuation

Pipe, the US start-up that allows companies to sell their future revenue streams for discounted sums, plans to launch securitised products by the end of the year, as it responds to demand during the pandemic.

Investors led by Greenspring Associates valued Pipe at $2bn in a $250m round of funding, including the new capital, the company said on Wednesday. The new valuation represented a more than 10-fold increase from its mark during a seed financing one year ago, according to Financial Times data.

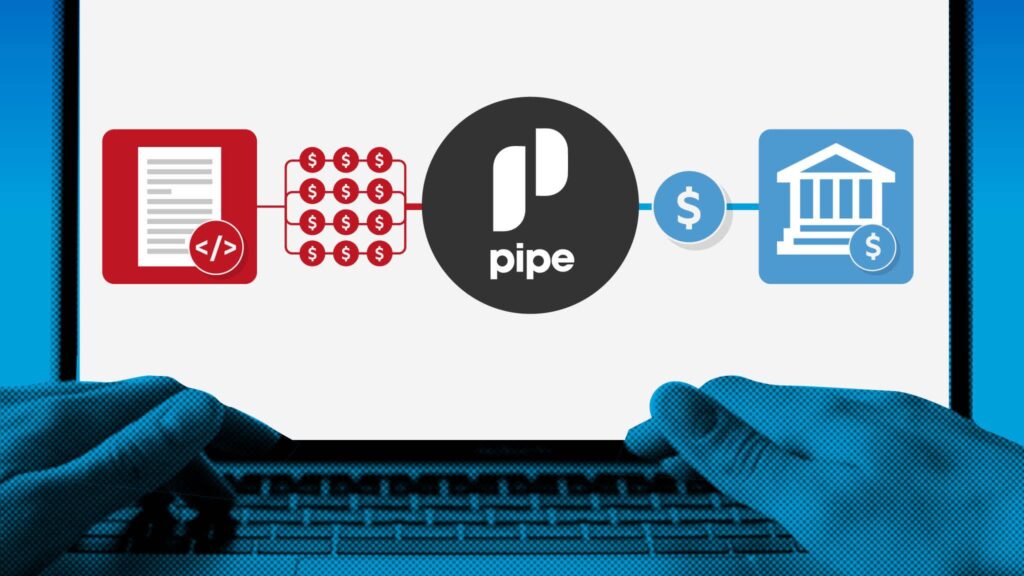

Pipe acts as a middleman between investors and companies wishing to sell their future revenues, in transactions modelled on invoice factoring. The company said it had received more than $1bn in commitments from buyers and had facilitated “tens of millions” of dollars in transactions per month.

Pipe’s platform has attracted interest during the coronavirus emergency, with investors seeking reliable but high-yielding sources of income and tech companies exploring alternatives to venture capital.

Harry Hurst, co-chief executive, said the company aimed to become regulated as a broker-dealer and alternative trading system before selling a securitisation by the end of the year.

Hurst added that a quarter of Pipe’s business came from companies outside the subscription software sector, which was the start-up’s initial focus. He cited customers in sports, property management and venture capital fund management as examples of new sources of revenue.

“My thesis is that the majority of revenues are going to be recurring and predictable,” Hurst said. “If businesses don’t have recurring revenues today, they’re thinking about how to add a predictable recurring revenue element.”

Morgan Stanley’s Counterpoint Global mutual funds, Japan’s SBI Investment, Chinese lender CreditEase and other investors also participated in the round of funding, according to Pipe. Hurst said he increased the size of the financing by $100m to accommodate the new investors.

Pipe said in March it had raised $50m from investors including the ecommerce platform Shopify and Salesforce chief executive Marc Benioff.

“These institutional investors, they’re recognising just how big this opportunity is,” Hurst said.

Pipe’s plans to tap securitisation markets would spread the risk of the revenue contracts to a wider group of investors, beyond buyers on the marketplace.

But some observers have cast doubt on the prospect of securitising software revenues, and investors using Pipe hold no liens on the underlying businesses. “The devil will be in the details: for example, are the cash flows sufficiently large to justify the costs of implementing the securitisation transaction,” said Steven Schwarcz, a professor of law and business at Duke University, who has studied asset-backed securities.

Hurst said Pipe could easily monitor the contracts, and its quantitative models would ensure that investors received a diverse and reliable stream of cash flows.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

An investor on Pipe had recently purchased a contracted stream of revenues for 98.7 cents on the dollar, and buyers pay 92 cents for the cheapest contracts, Hurst said.

“Our goal is to provide the absolute cheapest, most efficient way of financing your company, globally,” added Hurst, who said that investors had yet to lose any money on the contracts.