Persuading the world to back a carbon border tax

FT premium subscribers can click here to receive Trade Secrets by email.

Hello from Brussels, where things are relatively quiet on the trade policy front this week, there is no major vaccines crisis and member states are mainly getting on with actually vaccinating their populations rather than picking public fights about it. We’re sure that fractiousness-as-normal will be resumed at some point.

There was a bit of slapstick comedy over the Channel as some galaxy brain in the UK government decided that the way to get bilateral UK-Australia trade talks moving was briefing a stenographic newspaper that the visiting Australian trade minister wasn’t very good at his job. A rapid walk-back followed as someone remembered that, as cricket fans will know, sledging Australians is a risky business.

We’ll have a look at just how well the UK is doing at running an independent trade policy at some point. Today’s main piece is on the shifting politics of trade and the environment, particularly in light of President Joe Biden’s climate summit, and particularly on the political economy of the EU’s proposed carbon border tax carbon border adjustment mechanism (CBAM). Tall Tales is more on the Biden administration, trade and the environment, while Charted Waters looks at how the Suez blockage is affecting freight rates.

Don’t forget to click here if you’d like to receive Trade Secrets every Monday to Thursday. And we want to hear from you. Send any thoughts to trade.secrets@ft.com or email me at alan.beattie@ft.com

Summit to think about on trade and climate

Biden’s two-day climate summit kicks off on Thursday with familiar promises to do something in thirty years’ time, or ten if you’re lucky. That’s easy to say for a bunch of politicians who will mainly be out of office by the end of the decade, with China’s Xi Jinping as a possible exception.

If you’re serious about reducing carbon emissions, you’re going to struggle getting there just by setting target dates for achieving net zero. Even pouring trillions of dollars into electric cars and so on probably won’t be enough without shifting relative prices by raising the cost of carbon emissions.

If Biden appreciates this, he can pick up the plans for carbon pricing that Congress narrowly failed to get going in 2010 under Barack Obama. And if he does, he’ll very likely revive talk of the carbon border provisions that came with them and ally with the EU, whose CBAM is quite far advanced. Whatever the actual extent of carbon leakage, carbon border measures will certainly assuage those domestic companies complaining about it.

We’ve written before about the EU proposals, and the idea of getting the US onside to create a critical mass of governments. There are mixed signals from Washington: Biden’s administration has equivocated about carbon pricing and said carbon border adjustment is a last resort, but without ruling out either. The EU insists it will go ahead on its own with its CBAM if necessary, but the US is more likely to take the plunge if it knows it will be part of a gang. Washington doesn’t want to spend the next few years in World Trade Organization litigation against half the world. So: what does the rest of the world think about carbon pricing and a CBAM? How does the political economy situation here work?

One problem is that the EU, the leader of the pack, isn’t 100 per cent reliable. (Sound familiar?) As usual the European Commission is talking a good game but member states are more wobbly. Germany’s car and other manufacturing industries use imported steel whose price they don’t want to see rise, and in any case are wary of a unilateral CBAM ending up triggering retaliation against their exports elsewhere.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here

In other part of the advanced world the UK will probably fall into line with the EU, while no doubt claiming its carbon border tax is somehow more British and better. Japan already prices carbon domestically and probably won’t be a big objector. Australia, which has a disturbing degree of political climate-change denialism, is flat against, though that might change with a different government.

It will be tough, though, getting middle- and low-income countries onside. The “Basic” grouping (Brazil, South Africa, India and China) have said some pretty fierce things about the CBAM, amplified last week by Xi after a call with Angela Merkel and Emmanuel Macron. It’s not just about China: India exports iron and steel to the EU, and Brazil wood pulp.

A solution to some of this comes to hand in the form of a paper by the Centre for European Reform’s Sam Lowe — “Big Sam” to give his official Trade Secrets title, though not that Big Sam. Lowe argues that the EU can adapt its current preference schemes for developing countries — Everything But Arms for the least-developed countries and the Generalised Scheme of Preferences (GSP) for middle-income countries — to exempt them from the carbon border measure.

The likelihood of EU emissions-intensive industries moving to very low-income countries is pretty small anyway. The exemptions would be linked to those countries’ income levels: as they got richer, they would become liable. There would be an exception to the exception for GSP countries that were highly competitive in a particular sector. India, for example, would probably have to pay carbon border taxes on its ferrous metal sales to the EU, where it is one of the top five sources of imported steel.

Intellectually this is a neat solution and might peel off some low-income nations from what could otherwise be a solid bloc of developing countries opposed to the CBAM. (Divisions among the developing world on trade, even as their governments proclaim solidarity, are a familiar feature of trade policy.)

But it still leaves the problem of the likes of China and Brazil, who aren’t eligible for GSP and have very weak or no carbon pricing. It’s hard to see a diplomatic effort persuading them that the CBAM is fair. In that case, the only real option is a unilateral CBAM (or plurilateral if the US and others join in) which can hopefully survive litigation at the WTO. It’s quite a risk to take. Then again, the future of humanity is at stake, so maybe it’s one worth taking.

Charted waters

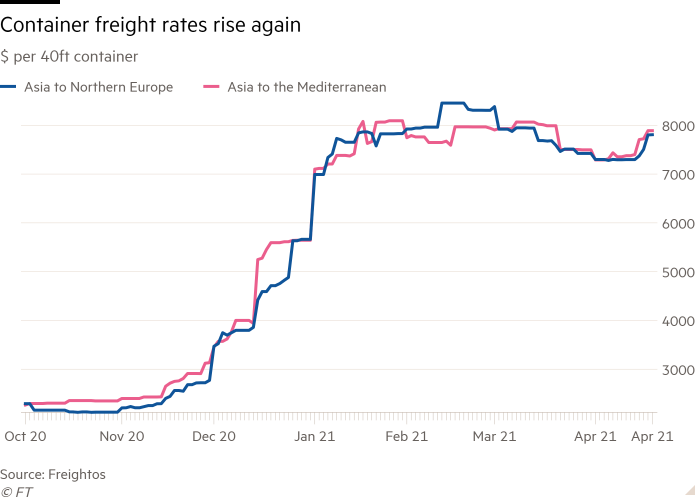

We think it will take a few months to gauge the full impact of the Suez Canal blockage on trade flows. One of the effects that people are on the lookout for is the impact on prices.

Regular readers will be aware that shipping costs have soared since the second half of last year — and nowhere more so than on the East Asia to Europe route that has been most affected by the Ever Given getting stuck. Signs are that, after a brief dip in March, they’re now rising again. While they’re unlikely to keep rocketing, the blockage does look as though it will delay the pace at which freight costs return closer to levels seen before the pandemic.

Tall Tales of Trade

Talking of the environment, US Trade Representative Katherine Tai gave a speech last week saying that trade rules hadn’t done enough to green the economy and so on. Some of her remarks caused raised eyebrows here at Trade Secrets, including the contention that climate mitigation would require “cultivating strategic international supply chains” to ensure the availability of clean energy equipment, renewable vehicles and so on. Hmm.

Tai should totally have a word with her former Democratic colleagues in Congress, where she worked as a trade counsel, who assiduously tried to raise the cost of solar cells from China, possibly violating WTO rules. Apparently, it was more important that solar power kit be manufactured in the US than it be made affordably. Now, to be fair, Tai did specify “strategic” supply chains: relying on China isn’t always safe. But, really, was the US in danger of being held to ransom by Beijing over solar cells? You can either advance clean energy the fastest and cheapest way possible, or you can insist that the equipment be made at home. You can’t do both.

Don’t miss

-

Renault has warned that the car industry’s chip shortage is worsening and that winter storms in Texas and a fire in Japan last month are just starting to have a serious knock-on effect on its production schedules.

Read more -

Slovakia’s new prime minister has urged the EU to inject more flexibility into its bloc-wide Covid-19 vaccine distribution programme or risk failing to achieve “community immunity” owing to diverging immunisation rates between member states.

Read more -

Bosch, Europe’s largest car-parts supplier, has hit out at the EU for being “fixated” on electric vehicles, while overlooking other low-emission transport technologies, such as hydrogen and synthetic fuels.

Read more

Tokyo talk

The best trade stories from Nikkei Asia