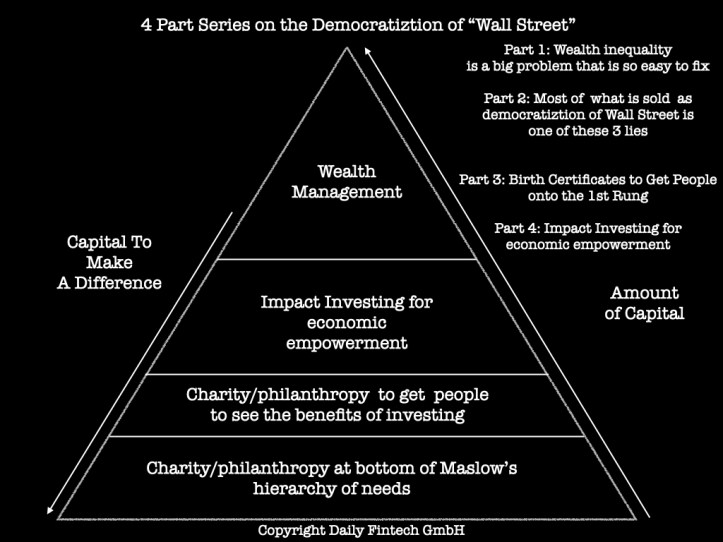

Part 4: Impact Investing for economic empowerment

There is a big difference between philanthropy/ charity and impact investing. Philanthropy/charity has no revenue model. Such pure giving is needed at the lower levels of Maslow’s hierarchy of needs where the donees have no capacity to pay anything.

The big problem with philanthropy/charity is the continuous need for fund raising.

However, impact ventures have a revenue model, so the ventures should be able to get off the fund raising treadmill. Although impact ventures have a revenue model, they are different from pure commercial ventures in that they serve two masters. They must show positive impact as well as profit.

The problem for impact ventures is that measuring impact is hard. Many pure profit ventures use the impact messaging but it is PR only and not real positive impact (for more, please read Part 2).

Impact investing for economic empowerment works best at what this site describes as “growth needs” as opposed to “deficiency needs”, which arise due to deprivation (once they are satisfied, you don’t need more). Growth needs don’t stem from a lack of something, but rather from a desire to grow and the motivation to get more drives our growth as a civilisation.

The big question is whether Fintech only serves big companies or whether it can be used by all of us? Is it Fintech4Us or Fintech4Big&Wealthy? Can the 99% use Fintech to better their lives? Is there a real level playing field?

The impact of economic empowerment is relatively simple to measure. An impact venture focused on economic empowerment has customers who vote with their wallet rather the donees served by philanthropy/ charity. If a lot of poor people use the services of an impact venture focused on economic empowerment, then it is having a positive impact. It is as simple as that.

Some subjects are too complex for our short attention spans, so we do 4 posts one week apart, each one short enough not to lose your attention but in aggregate doing justice to the complexity of the subject. Stay tuned by subscribing.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.

charity democratization of wall street equities birth certificates fintech4us impact investing philanthropy WealthTech