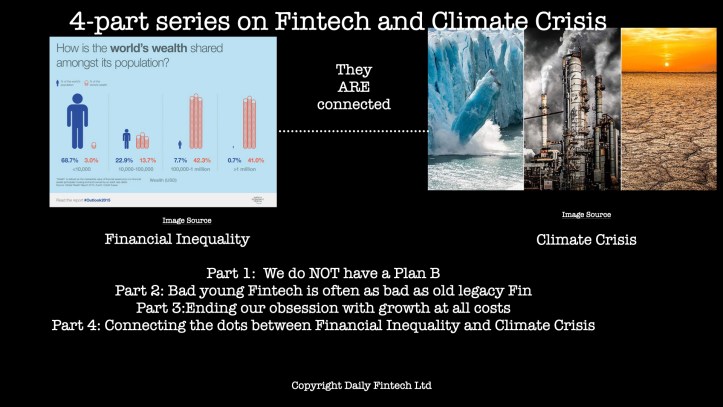

Part 4 How “sustainable capitalism” connects the dots between Financial Inequality and Climate Crisis via Fintech

The concept of “sustainable capitalism” does NOT mean the latest CleanTech unicorn ie growth at all costs to make a few shareholders vastly wealthy. That may produce solutions to help mitigate the Climate Crisis, but “sustainable capitalism” is a more radical concept that is about enabling billions to earn a good living – within a capitalist system. Sustainable capitalism will be enabled by four types of Fintech driven innovation:

- New pools of high risk/high return early stage capital. Science based solutions are needed to mitigate the Climate Crisis and funding innovation based on hard science is high risk; these investors should have the opportunity of high returns. Today, retail investors are classed by Wall Street as “muppets” and sold highly valued high risk companies. Sustainable capitalism solutions would create new pools of high risk/high return early stage capital – at low valuations. Early stage typically means low valuation as well as super high risk – maybe 1% of ventures deliver stunning returns like 100x. New pools of high risk/high return early stage capital would lower that risk by putting your capital into say 100 ventures, one of which might get 100x returns, with many failing and many just getting their capital back. The planet needs about 6x the amount of investment into clean energy solutions. That means getting a good risk adjusted return for retail investors, not selling them highly valued high risk companies late in their value creation cycle.

- Digital Cooperatives. Way back in the crypto bear market of 2017, I wrote Digital Cooperatives may become the default corporate structure in the Blockchain Economy. I am reproducing the image from that post because “a picture paints a thousand words”. The concept of digital cooperatives is simply that the interests of workers, customers and shareholders/owners are aligned because the controlling shareholders/owners are workers and customers. This concept is enabled by crypto/Fintech innovation such as Security Tokens helping manage issues such cap tables and governance.

- New pools of equity for butchers, bakers and candlestick makers. During the dark days of the pandemic in 2020, I wrote Small Business Fintech is levelling the cost of capital playing field. My headline should have been more about hope than reality which is that big business could withstand the revenue hit of the pandemic based on a much lower cost of capital. Patient capital for Butchers, Bakers & Candlestick Makers ie for main street businesses is based on A being better than B despite Wall Street lining up to fund B.

-

- A = 100 family owned hairdressers each making $100k annual profit ie $10m net aggregate profit

- B = a rollup of 100 family owned hairdressers each making $100k annual profit, making a gross contribution of $10m less $5m of overhead costs ie $5m net aggregate profit.

- Globalization for billions of us. Today globalization works for a few big companies but not for most people, which is why there is populist backlash against globalization. Simple innovation around cross border payments and smart contracts will enable gobalization for billions of us and that will make for an inclusive sustainable capitalism. Globalization for us will be good for people in low-cost countries as well as their customers in high-cost countries

None of these innovations has any significant tech risk – the solutions will use technology that already exists and that is well proven. I hope this innovation happens within a capitalist system. If capitalism fails to produce this innovation, populist authoritarians from both right and left will make the world a much worse place for all of us.

Some subjects are too complex for our short attention spans, so we do 4 posts one week apart (see here for 1,2,3 some may not be published yet), each one short enough not to lose your attention but in aggregate doing justice to the complexity of the subject. Stay tuned by subscribing.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.

climate change financial inclusion Fintech General hypercapitalism