Parametric Micro-Insurance: The Opportunity, Enablers and Distribution Models

Risk management and social protection are generally well established in developed countries, on the back of insurance markets. North America generates over half of nonlife premiums globally, with the US being the largest market. Despite this, a sizeable chunk of the population even in the US economy is uninsured or underinsured for natural disasters, with low-income households lacking standard property or renters coverage with policies excluding disasters, such as flood and earthquake. On the other hand, these groups suffer disproportionately in the aftermath of disasters and recovery is arduous. Follow-on financial impacts, such as declines in credit scores, can persist for years. Devoid of safety nets, disasters become tipping points into abject poverty, with loan defaults, accumulated debt and erosion of small savings.

Federal Emergency Management Agency (FEMA) estimates that nearly 3.3 million homeowners and renters in the 100-year floodplain lack flood insurance. These households have significantly lower income than those with flood insurance. Half of them have low or very low income. Back-of-envelope calculations finds nearly 1.68 million households at risk of flooding, who struggle to pay for indemnity flood policies and can benefit from parametric microinsurance.

Parametric microinsurance cover the probability that predetermined events (such as flooding) occur and pay the insured once parameters defined by the policy are activated. Different from a traditional policy, they do not mandate physical damages to property and payouts happen sans adjustments.

There are three prevalent means to make insurance more affordable for lower-income households:

- Reduce coverage levels or design for less-frequent events

- Reduce administrative and transaction costs to pass savings to consumers

- Provide direct public subsidy.

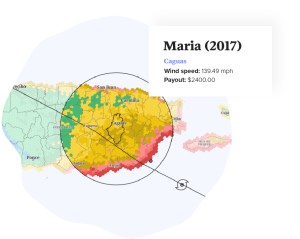

Parametric microinsurance can increase the financial resilience of lower-income households by harnessing all three enablers. Raincoat began offering a microinsurance policy for hurricanes in Puerto Rico. Facilitated by new regulations aimed at fostering parametric microinsurance, no proof-of-loss requirements are needed and the premium is limited to 2% of minimum wage salaries.

Another example, Barbados-based Microinsurance Catastrophe Risk Organisation (MiCRO), offers parametric microinsurance to protect small businesses and low-income families against natural disasters. The policy is triggered automatically by predetermined events that are verified by objective data sources, including NASA satellites. The product covers business interruption losses from excessive rainfall, severe drought and earthquakes.

Another example, Barbados-based Microinsurance Catastrophe Risk Organisation (MiCRO), offers parametric microinsurance to protect small businesses and low-income families against natural disasters. The policy is triggered automatically by predetermined events that are verified by objective data sources, including NASA satellites. The product covers business interruption losses from excessive rainfall, severe drought and earthquakes.

Microinsurance has been offered for health, life and agricultural lines and needs to be affordable, accessible and efficient. Due to these needs, microinsurance tends to fit parametric designs. Distribution models in use for parametric microinsurance are based on:

- Aggregators

- Mobile-based technologies

- Embedded products

Aggregators purchase a single, large policy and disburse claim payments. They usually are community non-profits, local agencies or NGOs, who negotiate contracts and secure needed funds. This model reduces costs, improving affordability and overcomes lack of demand since coverage is secured on behalf a larger group.

In mobile-based models, an insurer offers policies directly to households through a mobile app, allowing for sales, service, communication and education. Mobile money platforms (such as M-PESA in Kenya) allow premium and claims payments for the unbanked, providing value-added services to improve risk management, like localized weather forecasts.

The third model is where an insurer partners with another firm to offer embedded products, targeting a wider customer base. MicroEnsure Ghana offers embedded microinsurance with existing services provided by front office partners. The company’s products provide insurance to customers of microfinance institutions via loans and savings, and to customers of mobile phone companies via airtime and mobile wallets.

Parametric microinsurance is proving to be a viable approach to improve financial resilience of lower-income households. Benefits include affordability, rapid payouts and immediate post-disaster assistance. The property insurance market continues to shift from a one-size-fits-all to offer variety to meet risk management needs, with parametric microinsurance playing an important role.

Cover Image

You get 3 free articles on Daily Fintech. After that you will need to become a member for just US$143 a year (= $0.39 per day) and get all our fresh content and our archives and participate in our forum.

#MiCRO #raincoatinsurance InsurTech microensure MicroInsurance parametric