Nestlé to take on Oatly with pea milk brand

Nestlé is taking on Oatly in Europe with the launch of pea milk brand Wunda, in a belated play by the world’s largest food company for a share of the growing $17bn plant-based dairy market.

The rare creation of a new brand by Nestlé comes as China Resources-backed oat milk maker Oatly pushes for a valuation of as much as $10bn in its forthcoming initial public offering on New York’s Nasdaq exchange.

While Nestlé has been expanding in meat substitutes, it is relatively late to a plant-based dairy market propelled by consumers’ appetite for environmentally friendly products and their perceived health benefits.

“Plant-based in food and drinks is really on the rise and I think it’s very structural. I’ve been in the business for many years and I’ve never seen a category growing so fast or so strong,” said Cédric Boehm, head of dairy for Europe, the Middle East and north Africa at Nestlé.

Wunda, developed by Nestlé researchers and made from yellow peas, will be launched in France, the Netherlands and Portugal first, mainly through retailers, with an eye to pushing into more European markets.

The product line is Nestlé’s first global plant-based dairy brand, though it offers plant milks under its Nesfit brand in Brazil and plant-based versions of drinks such as Milo and Nesquik.

As well as its original recipe, which includes sugar for flavour and sunflower oil to help the components mix, the Wunda range includes a “barista” version for coffee, plus unsweetened and chocolate versions, the group said.

Nestlé chose to use yellow peas rather than the more popular almonds, oats or soya, arguing the product offers a higher protein content and more versatility for use in drinks and cereals.

Existing pea milks, which include products made by California-based Ripple and UK-based Mighty Pea, have attracted mixed reviews including complaints of a legume taste.

Nestlé will have some catching up to do with other plant-based milk brands on the market.

French rival Danone, which owns the Alpro and Silk brands, sold €2.2bn of plant-based dairy alternatives in 2020, up from €1.9bn a year earlier, and this year acquired US-based Earth Island, maker of Follow Your Heart vegan mayonnaise and spreads.

Oatly, based in Malmo, Sweden, had global revenues of $421m last year, with Europe, the Middle East and Africa accounting for $302m.

Nestlé itself sold SFr100m ($109m) of plant-based dairy alternatives in 2020, along with SFr200m of meat substitutes under brands such as Garden Gourmet and Sweet Earth, it said. The company’s total sales were SFr84.3bn.

Boehm said Nestlé had considered acquiring plant-based dairy brands but “the prices are really high. There is a kind of craze around a lot of M&A.”

He said the Swiss group expected further growth in the plant-based dairy market. “We wouldn’t go [into this market] if we didn’t believe that we were in a position to win,” he said, adding that Wunda could expand beyond pea-based products.

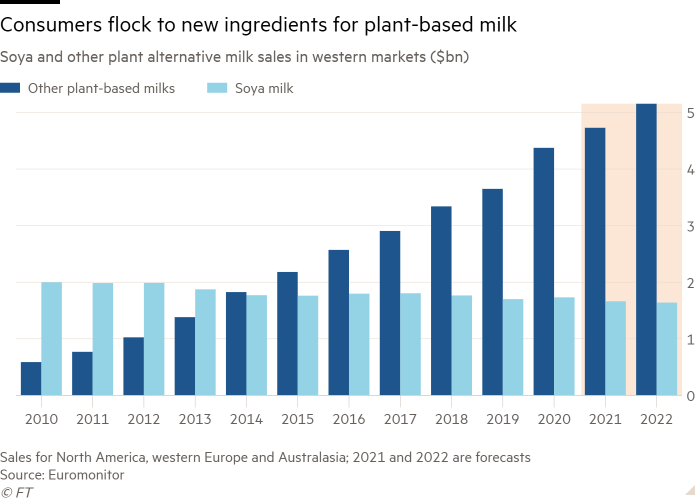

In western Europe, North America and Australasia, soya milk consumption has stagnated but sales of other plant milks, including almond and oat, have shot up by double-digit figures in all but one of the past 10 years. In 2020, sales grew almost 20 per cent to $4.4bn, according to data from Euromonitor.

Nestlé has placed sustainability at the forefront of the Wunda brand, with its carbon footprint certified by advisory group the Carbon Trust.

Wunda Original produces 0.58kg of carbon dioxide equivalent per litre, compared with 0.44kg per litre of Oatly Barista and about 1.25kg per litre of UK-produced cow’s milk, according to the Agriculture and Horticulture Development Board.

Nestlé said Wunda would be carbon neutral. It will offset emissions that cannot be eliminated, with more than 2,500 tonnes of carbon dioxide equivalent in 2021 offset through a forest protection project in Cambodia.

Follow @ftclimate on Instagram

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here