Lloyds Market’s Extended Innovation Factory: Lab’s Cohort 6

Lloyd’s Lab is an accelerator launched in September 2018 by Lloyds, the insurance market. After intensive global talent searches that attract several hundred applications, selected companies receive privileged access to its market for specialist insurance and reinsurance. These teams are tasked with driving innovative solutions to unique challenges the market faces. Over a ten week period, teams are proffered guidance as they develop products, platforms and processes to potentially transform Lloyd’s. The start-ups receive expert support from market participants, catalyzing development of ideas for their unique needs.

Generally, accelerators are fixed-term, cohort-based programs where a sponsor offers expertise to help develop solutions. The average cohort has 16 businesses running for 6 months. Sponsors benefit from cutting-edge solutions that participants co-create while gleaning first-hand insights from latest trends.

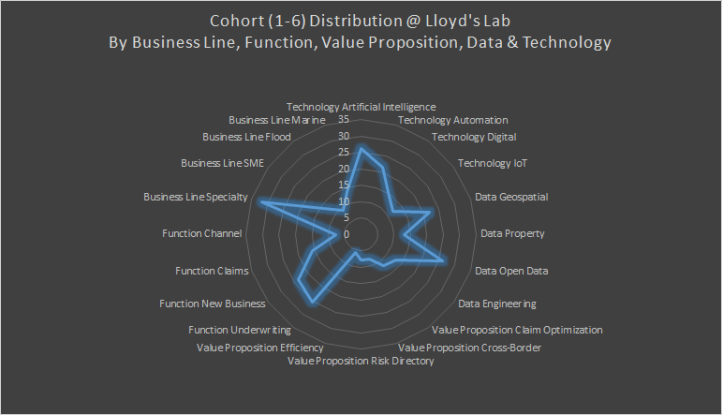

Since the first Lloyd’s Lab cohort of ten companies, five similarly sized cohorts have followed. The latest, due to start later this month, is themed on creating simpler products for customers and building solutions mitigating climate risks. Each of the previous cohorts had distinctive themes, focused on enhancing customer experiences, powering data-driven underwriting with new insight sources or creating smarter insurance products. While few emphasized enabling back-office efficiencies, one cohort specifically targeted addressing COVID-19 challenges. An overarching driver is to find solutions that contribute to its services ecosystem, part of the “Future of Lloyd’s” vision.

Word Cloud (Cohorts 1 -6)

A recurring emphasis has been to draw rich, alternative data sets for precise risk understanding and improved underwriting profitability, such as to flag high risk policies or predict future claims. The accelerator solicits innovations in new algorithms, models and statistical techniques to create more personalized experiences while closing protection gaps. The latest cohort will begin virtually and is expected to return to the physical workspace in June. The final ten selects represent solutions based on four themes: climate change, geopolitics, data/models and claims support services.

Three of the selects offer analytics and automation solutions tackling climatic risks:

Tesselo is 2017 founded Lisbon-based insurtech that simplifies accessing environmental insights from Earth Observation data, combining satellite imagery with AI to produce actionable spatial intelligence. By classifying tree species, measuring and predicting forest growth, monitoring plantation harvests, detecting pests and estimating the risk or impact of forest fires and other natural disasters, it provides insurance and certification to help businesses develop adequate responses to natural hazards and give timely damage estimates post-disaster.

California based Jupiter Intelligence models catastrophic risk outcomes and helps customers anticipate financial impact of different climate-change scenarios. Jupiter’s models predict asset-level impact from flood, fire, heat, drought, wind and hail events at less-than-one-meter resolution. These models have been used to assess the risk that intense heat waves pose to power grids and inform public-sector infrastructure investment in coastal areas based on expected changes to tide levels and storm surges.

CarbonChain provides a platform that enables companies in polluting industries such as metals, mining, oil and gas to track supply chain greenhouse gas emissions to help transition to a low-carbon economy. With its exhaustive repository of greenhouse gas emission factors, it supports a wide range of hard and soft commodities, providing companies visibility to high polluting transactions to protect supply chains against rising carbon prices and downstream benefits ranging from lower interest rates to ESG leadership recognition.

Remaining 7 from Cohort-6

A key benefit for accelerated start-ups is better access to initial funding rounds, though for subsequent rounds, the impact of accelerator participation tends to wane. Whether companies in a cohort succeed or fail, the ecosystem gains as the initial set of start-ups helps form a critical mass for the innovation. Fortuitous connections forged between entrepreneurs, investors and talent all feed back into the insurance ecosystem, facilitating insurtech innovation and benefitting non-cohort start-ups too.

You get 3 free articles on Daily Fintech. After that you will need to become a member for just US$143 a year (= $0.39 per day) and get all our fresh content and our archives and participate in our forum.