Investors gear up for ‘gold rush’ in metaverse hardware

Sony late last year announced it had joined forces with the Manchester City football club to develop a digital recreation of the team’s Etihad home stadium for fans around the world to visit virtually. It was a quiet announcement, investors said, but the sound of football being sucked into the metaverse was deafening.

Companies participating in the Consumer Electronics Show in Las Vegas this week will be hoping for a similarly epic interpretation of their offerings. The aspirants include Samsung, which will give consumers the chance to decorate imaginary homes with digital versions of its household appliances.

“It’s no longer a fad, but a well-established trend of the future,” said Samsung of the metaverse.

As another exhibitor put it, the metaverse — a catch-all term for the theory that people will spend ever greater proportions of their lives in ever more immersive virtual worlds — lacks an exact enough definition for anyone to claim that they are an investable play on it.

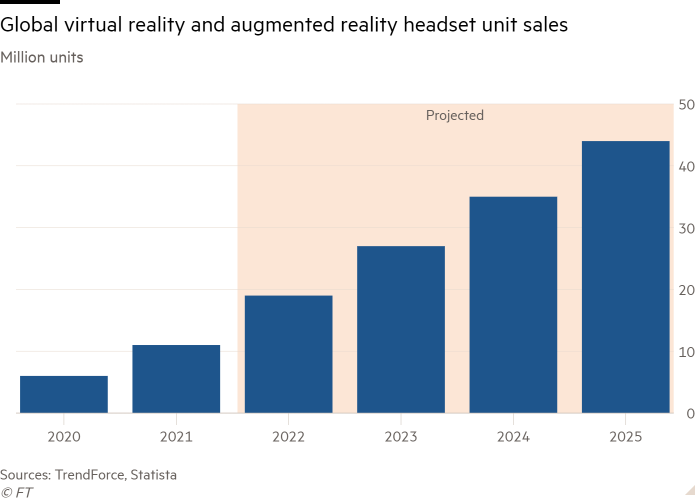

But to many, the parameters are already sufficiently clear to project heavy demand for certain products.

In particular, said the manager of a large global tech fund, 2022 could mark the first year in which investors, after decades of disappointment, considered virtual reality headsets more seriously.

“Investors need to think about the metaverse as nothing less than the digitisation of human activity and the disruption of everything that hasn’t yet been disrupted,” said Simon Powell, an equity strategist at US investment bank Jefferies. He noted that metaverse projects such as that between Sony and Manchester City would join a near-constant stream of real-world activities mirrored in a virtual space.

The process, he said, would ultimately require more processors, vastly more computing power and wearable devices that would drive a wave of hardware demand comparable to the early years of smartphones. The producers of components such as semiconductors, servers, sensors, cameras and displays stand to benefit.

“Think back to the early days of the mass-market internet investment gold rush. The best bets in those first stages were on the hardware — the picks and shovels,” said Powell.

Apple’s $3tn market valuation, added Powell, might already be fuelled by speculation it was close to unveiling a headset as revolutionary to consumer tech as the original iPhone.

The significant rise in the share prices of chipmakers Nvidia of the US and Taiwan Semiconductor Manufacturing Co suggested that a metaverse-driven bet on demand for raw computing power and cloud storage was already getting crowded, said Damian Thong, tech analyst at Macquarie in Tokyo.

A recent note by analysts at Citigroup identified a dozen stocks, including Taiwanese server designer Wiwynn and Chinese acoustic component maker GoerTek, whose products could also be in hot demand thanks to metaverse applications.

For Japanese and Korean companies not yet on such lists, the building excitement around the metaverse represents an urgent call to arms.

“Many Korean CEOs have a sense of crisis that they will fall behind if they fail to adjust to technological changes . . . therefore they will probably be the early adopters of the metaverse,” said Choi Joon-chul, chief executive of VIP Research and Management.

Korean gaming and entertainment companies have already begun buying film production and software companies to strengthen their visual effects and make their products more suitable for the metaverse, said James Lim, an analyst at US hedge fund Dalton Investments.

“Com2uS acquired WYSIWYG Studios. Hybe invested Won4bn [$3.3m] in Giantstep. They are trying to acquire software companies that can make graphics quickly if they have strong content,” said Lim.

For consumers, the types of hardware purchases they make will depend on how they use the metaverse — whether for virtual offices or to attend live concerts performed within video games, investors said. How immersive the metaverse can become will depend on the quality of the virtual reality involved, said Choi.

“3D TVs were launched to much fanfare but demand for the product has fizzled. The metaverse requires more upgraded graphics technology to enhance the sense of reality. For example, the metaverse experience provided by Naver’s Zepeto platform doesn’t feel real enough yet,” he added.

Arthur Lai, a tech analyst at Citigroup, said investors needed to accept that the metaverse would substantially affect the way people consumed social media and entertainment and interacted with one another. Smartphone, PC and physical interactions could be replaced once tech sensitivity to voices, eyeball movements and gestures advanced and headsets shed their reputation as “stupid and heavy”.

But that will not happen immediately. Even according to the most optimistic manufacturers, the headset market will lag behind smartphones for years, said Lai. “But it’s not about virtual reality versus the smartphone. It’s about a general move of smarter gadgets becoming more complementary,” he said.

There are different theories about what type of metaverse experience would ultimately dominate. Metaverse experiences can cover a range from virtual reality to augmented reality, mixed reality and extended reality (XR), encompassing content that is fully synthetic to synthetic content that interacts with the real world.

Either way, said Lai, investors looking at component makers should expect at least 15 cameras and sensors to be mounted in future generations of headsets.

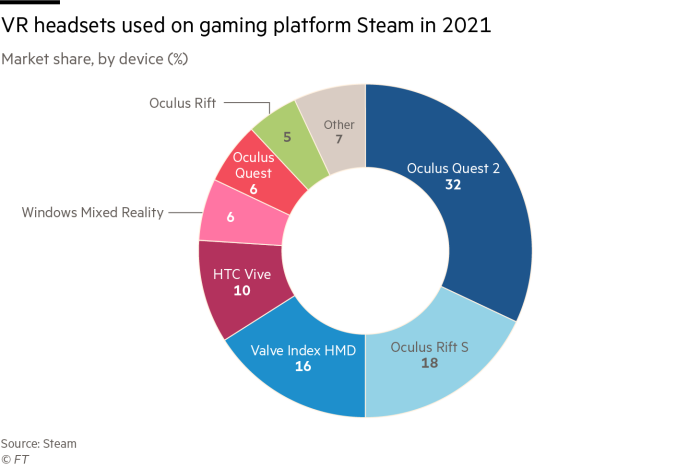

The development of smaller, more powerful, longer-lasting batteries would make headsets lighter and more comfortable to wear for extended periods, a big hurdle with current products. Standout names include the Oculus series of Facebook parent Meta, Sony’s micro-OLED displays, which analysts expect to be central to Apple’s future glasses or goggles, and Taiwanese optical lens maker Genius, said Lai.

Lee Kyung-hak, chief executive of Warp Solution, a South Korean maker of head-mounted display wireless charging devices, said demand for metaverse applications would pick up in the second half of the year, and mass consumption could occur by 2023.

“But the metaverse lacks killer content, so people are not that interested in it yet,” said Lee, projecting that the field would probably not displace mobile phones within the next 10 years.

Ultimately, the development of the metaverse would hinge on the next generation of personal VR, AR and XR devices, said Kim Young-woo, an analyst at SK Securities. These rely heavily on DRam chips and image sensors, sectors in which South Korea’s Samsung, SK Hynix and LG Innotek are global leaders.

South Korean companies are not directly producing devices to enter the metaverse, with Samsung ceasing production of a VR device in 2019 because of low demand.

“However, companies like Samsung can quickly launch a new device to catch up, if there is enough demand,” said Kim.