India’s tech sector faces moment of truth with Paytm IPO

This article is an on-site version of our #techAsia newsletter. Sign up here to get the newsletter sent straight to your inbox every Wednesday

Hi, this is Kenji from Tokyo. This week, we zoom in on India, where the country’s biggest IPO ever is expected tomorrow, by fintech unicorn Paytm (The Big Story). SoftBank’s Vision Fund in particular is primed to benefit from the latest wave of listings in India (Art of the deal). China, on the other hand, is set to tighten its control over tech listings in Hong Kong, while the amount raised by mainland Chinese tech companies is headed for the first annual drop in seven years (Mercedes’ top 10). Singapore’s Temasek is pausing its Chinese tech investments because of the crackdown (Spotlight). Finally, Francis Fukuyama weighs in on the differences between the Big Tech clampdowns in China and the west (Our Take). See you next week.

The Big Story

A momentous test for India’s technology sector has arrived. Paytm, India’s biggest fintech start-up, is set for a $2.5bn listing tomorrow, in what will be the country’s largest-ever initial public offering.

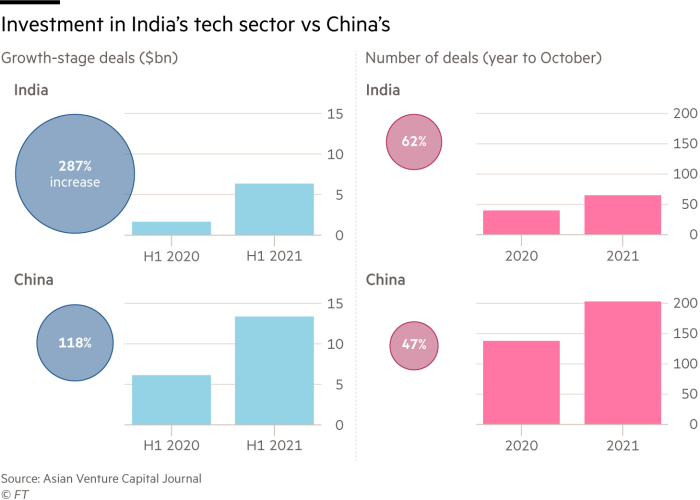

Long a promising but second-choice Asian market for investors, India has emerged as a top beneficiary of China’s relentless crackdown on tech companies, from education providers to delivery services. For every dollar invested in Chinese tech in the quarter that ended in September, $1.50 went into India, according to the Asian Venture Capital Journal (see Smart data for more).

Key developments: Paytm’s listing will be the biggest indication to date of whether Indian start-ups can recreate the success of a generation of Chinese tech groups, which remade the country’s stock market, and provide the exit routes investors need to have confidence in the local market. Crucially, the listing comes one year on from the scuppering of the Ant Group IPO in China, further demonstrating the diverging fortunes of the two countries’ tech industries.

Upshot: There are fears that India’s buoyant tech markets are already overheated as competition to buy stakes inflates valuations and leaves companies and retail investors vulnerable to corrections. Sceptics see the Ant- and SoftBank-backed Paytm — whose lossmaking businesses have struggled against Google and Walmart’s Flipkart — as a test of how far investors will buy into the hype.

Additionally, the threat of regulation looms over India. Two days prior to Paytm’s blockbuster listing, the country’s regulator proposed tighter listing rules in an attempt to curb some of the frenzy and protect retail investors.

Mercedes’ top 10

-

China’s internet regulator is turning its crackdown microscope on tech IPOs in Hong Kong. (FT)

-

Japan’s Murata, an important iPhone parts supplier, is setting aside $2bn to offer better and differentiated products for smartphone makers in the 5G world. (Nikkei Asia)

-

Meanwhile, funds raised by mainland Chinese tech start-ups through public listings are on track for the first annual drop in seven years. (FT)

-

Audrey Tang, Taiwan’s digital minister, thinks the “digital democracy” can be a model for the Indo-Pacific. (Nikkei Asia)

-

Indonesia is getting increasing attention from global electric vehicle makers thanks to its nickel reserves. (Nikkei Asia)

-

Top Chinese chipmaker Semiconductor Manufacturing International Corp is on track to triple production capacity despite a US blacklisting. (Nikkei Asia)

-

Shaking off widening losses and riding high on a surging share price, India’s Zomato is on a deal spree as it turns the heat on its rivals. (Nikkei Asia)

-

Singaporean gaming and ecommerce giant Sea is expanding in Europe, India and the US, having already done so in Latin America. No other south-east Asian tech group has gone global at this level. (Nikkei Asia)

-

Great column on why the proliferation of wearable devices and the digitisation of human beings will “make a parody out of ‘doctor knows best’”. (FT)

-

How did regulators lose control of the $2tn crypto market, and can they get a grip? Excellent FT Film with input from players including Binance boss “CZ”.

Our take

At the same time that US president Joe Biden and his Chinese counterpart Xi Jinping were meeting virtually yesterday, Francis Fukuyama, a scholar best known for his global bestseller The End of History and the Last Man, was on a Zoom conference explaining the differences between the pressures being exerted on Big Tech in China and the west.

“I don’t want to pretend what the Chinese are doing is the same as [what] the Europeans and the Americans are doing,” the renowned Stanford University professor said at a webinar hosted by the Asian Development Bank Institute. Fukuyama conceded that regulators in Beijing had said the “right things” to a certain extent, such as criticising tech companies over inadequate privacy protections, similar to what US groups including Google and Facebook were facing at home and abroad.

“But the trouble is, the Chinese government has access to all [the] data also and uses it for political purposes,” he said. “They use it for purposes of political controls in ways that tech companies in western countries are simply not permitted to do.”

Another source of trouble, Fukuyama added, is that nobody knows yet “what the real intentions of the Chinese government are”. The ostensible policy goal of user protection could be reasonable, or even sincere, Fukuyama pointed out, but it could also be “an exercise to demonstrate that the government has the power to stop these companies from doing things that they don’t want . . . In other words, they really want this power for the sake of power and for political control.”

Fukuyama expressed distrust in Facebook, Google and other US Big Tech companies over their handling of data and the substantial powers they have acquired in recent years. But the scholar was clear on his baseline judgment: “I would worry more about [data] in the hands of the Chinese government than I would in the hands of a profitmaking American company.”

— Kenji

Smart data

We are the first to admit that when it comes to dealmaking, India’s tech sector still has nothing on China. There is a sizeable gap between the number of deals and their volumes. But India’s growth rates are looking interesting against the backdrop of a regulatory crackdown in mainland China over the past year, and many global investors appear to be pivoting to India as a safer bet. Their timing could not be better — India’s start-ups are going public at a record pace. But is the country’s tech sector already overheating as a result?

Spotlight

Temasek chief investment strategist Rohit Sipahimalani is hitting pause on China. The Singaporean state investment company, whose exposure to China surpassed even that in its home market in 2020, has concerns about Beijing’s crackdown on the tech sector and the impact on valuations.

“We will probably wait to deploy more capital till we have a little bit more regulatory clarity in that space,” said Sipahimalani. “I would expect in the next few months you will have regulatory clarity, and that will shape some winners and losers out there.”

Sipahimalani, who has been in the job for almost two years, has reason to be cautious. Temasek has backed Alibaba, Tencent, financial technology giant Ant Group and ride-hailing company Didi Global — all companies that have felt Beijing’s regulatory fire.

“When there is no clarity about the regulatory rule book, it is difficult to say — is this fair value or not fair value — so I think we would rather be patient and wait,” Sipahimalani added.

Art of the deal

SoftBank is in pole position to receive a windfall from India’s first wave of start-up IPOs. The Japanese conglomerate — whose Vision Fund disclosed a record quarterly loss this month as some of its publicly traded investments faltered — can bank on about $7bn from the public listings of Paytm, PolicyBazaar, Oyo and others.

The Tokyo-headquartered investment group’s two Vision Funds have invested about $11bn in Indian start-ups. The gains will also offer a respite for SoftBank, which is battling investor scepticism over flagging share prices.

SoftBank’s publicly traded Chinese portfolio companies, including Didi Global, digital freight platform Full Truck Alliance and housing broker Ke, have tumbled amid the crackdown in China. Other big bets, such as South Korean ecommerce company Coupang, have also struggled.

If the IPO of Zomato, the Indian food delivery company whose shares have almost doubled since going public this year, was any guide, the wave of upcoming listings might help SoftBank recover some of those losses.