HeidelbergCement aims to tackle emissions with new carbon-neutral cement plant

HeidelbergCement plans to build the world’s first carbon-neutral cement plant in Sweden by 2030 in a move to reduce the polluting cement sector’s high level of emissions.

The world’s fourth largest cement producer is aiming to capture 1.8m tonnes of carbon dioxide annually produced at its Swedish plant in Slite, which would become its second large-scale carbon capture and storage facility.

The 1.8m figure is more than four times the volume the German company intends to store underground from its first big carbon capture plant in Brevik in Norway, which gained final government approval late last year.

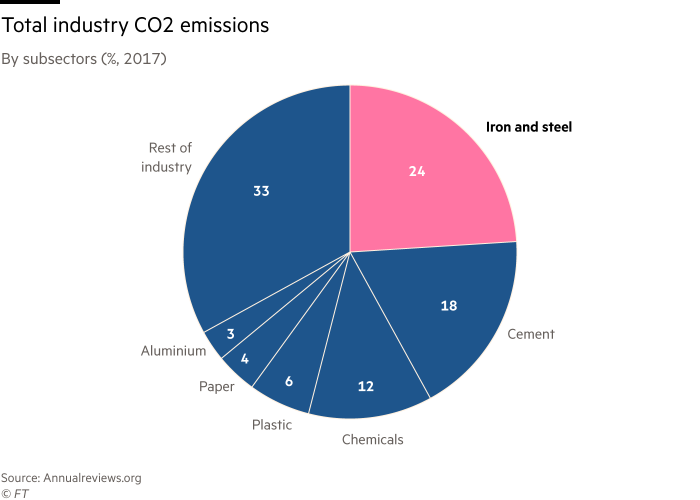

Carbon capture, the process of capturing and storing CO2 before it reaches the atmosphere, is being promoted as a solution to reduce pollution in industries such as cement, which releases 8 per cent of global CO2 emissions.

It is also difficult to decarbonise production of cement because about two-thirds of its emissions come from the calcination of limestone during the manufacturing process, which cannot be reduced using traditional means such as fuel substitution.

Cement companies have many pilot carbon capture projects under way, but the two Scandinavian projects are the industry’s first large-scale ones to be announced.

However, HeidelbergCement and the Swedish government still have to reach agreement on financing before the Slite project can become reality.

Sweden’s minister for enterprise Ibrahim Baylan said the cost of the site would be three or four times that of Brevik, estimated to reach NKr3.3bn ($397m) for carbon capture, which is part of a broader NKr25bn investment that also covers transportation and storage.

Baylan said government support was “not in the vicinity” of the two-thirds of the financing offered by Norway for the carbon capture and storage project related to Brevik, set to come online by 2024.

“We’re initially supporting the company with some funds,” he said. “In the long-run, we expect industry to make these investments for themselves.”

Dominik von Achten, chair of the managing board of HeidelbergCement, said it was the right time to signal its willingness to ramp up its ambitions on carbon capture.

“We have the confidence now that we can pull it off from a project management perspective and get the right balance in terms of financing from the government.”

The Slite cement plant on the island of Gotland is Sweden’s largest and pumps out about 4 per cent of the country’s carbon emissions, so the project would be a significant step towards reaching its 2045 net zero target.

The carbon dioxide will initially be stored underground in oil and gasfields, but the company has its sights set on potentially creating a new revenue stream by selling captured carbon to industries that need the gas to produce fertilisers or synthetic fuels.

Baylan warned that industrial companies and nations would lose market share and jobs if they were slow to invest heavily in infrastructure to decarbonise energy-intensive manufacturing.

“When I talk to industry, I pick up my iPhone. In 2008, who was dominant? Nokia had 40 per cent at the time. How many phones are they selling at the moment? I think this is the same. If they do miss the shift at these times, they could be off forever or for a very long time.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here