Global investor group begins to step up pressure on steel industry

Investor activism updates

Sign up to myFT Daily Digest to be the first to know about Investor activism news.

An influential institutional investor group with assets of $55tn under management has begun to step up pressure on the steel industry over its failure to make progress on reaching climate change goals.

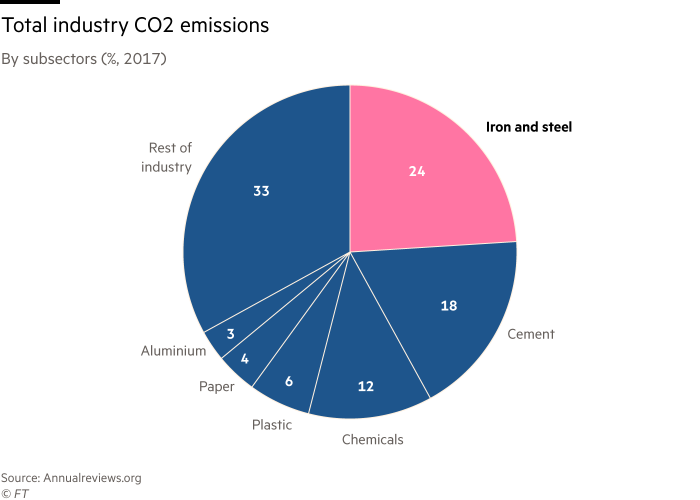

The Climate Action 100+ coalition said steel producers were “not on track” to meet the 91 per cent cut in carbon emissions needed by 2050 if the world was to reach a net zero goal necessary to curb global warming.

Just nine leading steel companies — China Baowu, ArcelorMittal, Nippon Steel, China’s HBIS, Posco, US Steel, Thyssenkrupp, SSAB and Outokumpu — have committed to achieving net zero emission targets. There were 107 steel companies that produced more than 3m tonnes of steel last year, according to the World Steel Association, a trade body.

In a highly fragmented industry, the top ten steelmakers together accounted for about 27 per cent of global output, according to WSA data. China Baowu, ArcelorMittal and HBIS ranked as the three largest producers, together making just 13 per cent in 2020.

Despite the challenges, it was still “technically feasible” for the steel sector to reach net zero by 2050, said Stephanie Pfeifer, chief executive of the Institutional Investors Group on Climate Change that brought together the CA100+ coalition.

It would require a combination of new investment, technological advances, reductions in green energy prices and considerable policy support by governments, she said.

Cuts in emissions could be achieved via increased recycling of scrap steel into fresh supply along with improvements in the energy efficiency of existing steel plants. Massive investments will also be required in new low-emission production facilities that can be powered by hydrogen and by applying carbon capture and storage to steel plants that continue to rely on fossil fuels.

However, some of these technologies are still in the development phase. Korea-based Posco is the only big steel company so far that has committed to establishing a large-scale green hydrogen production capacity.

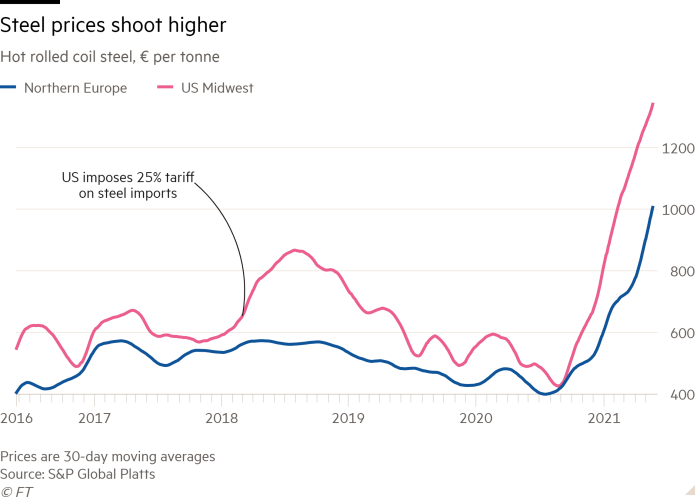

Additional funding requirements for steel companies to reach net zero are significant and will drive up costs. ArcelorMittal has estimated the cost of meeting net zero targets across its European operations alone could reach $65bn.

Estimating the capital spending needed for the entire steel industry to reach net zero is highly problematic, but it could reach $1.3tn, according to CA100+.

Adam Matthews, chief responsible investment officer for the Church of England Pensions Board said that institutional investors had a vital role to play in incentivising the low-carbon transition within the steel industry.

“For investors to play this role will require not only clear but detailed transition plans,” said Matthews.

Steelmakers would need to reduce global emissions by 29 per cent as soon as 2030 to get on track with the IEA’s road map to reach net zero by 2050.

CA100+ plans to hold twice-yearly roundtables to discuss progress with the steel industry and to extend this dialogue to other carbon-intensive sectors such as trucking, utilities, and oil and gas production.

Price rises for so-called green steel, at least in the near-term while the cost of renewable energy continues to fall, could drive customers in sectors such as the construction and automotive industries to continue buying lower-cost steel from emissions-intensive producers.

Achieving net zero for the steel industry would require co-ordination with other industrial sectors and firm commitments to buy green steel, said Matthews.

The WSA said the industry had “progressed astonishingly” over the past five years. Nicholas Walters, a director, said most big steelmakers were investing heavily in radically different technologies required for its transformation.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here