Global industry groups push back on climate disclosure rules

This article is an on-site version of our Moral Money newsletter. Sign up here to get the newsletter sent straight to your inbox.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

Welcome back. It has been impossible to miss the gathering pace of green financial regulation in recent months — whether it is the EU’s evolving sustainable investment taxonomy or the US Securities and Exchange Commission’s hotly debated effort to draw up climate-related disclosure rules. (For a sense of SEC chief Gary Gensler’s latest thinking on that, see this recent Twitter thread, in which he compares companies with Olympic skiers.)

To many in the climate space, this regulatory movement looks like a vital — if incomplete and long overdue — step towards a more sustainable world economy. But there are growing signs of pushback from some in the financial sector who say the new rules will prove unduly burdensome.

That is the focus of two of our items today. Our first note looks at a new intervention from the International Capital Market Association on the EU’s green disclosure rules for investors; our second highlights US bank lobby groups’ resistance to climate stress test proposals from the Basel Committee on Banking Supervision.

Some readers may feel there are valid concerns to be raised about the emerging shape of regulations in this field. Others may worry that this looks like an effort by lobbyists and vested interests to water down badly needed reforms. Whatever your view, as always, we want to hear it. Drop us a line at moralmoneyreply@ft.com. Simon Mundy

EU’s new green disclosure rules come under fire

In recent weeks we’ve been keeping you abreast of a huge wave of controversy around the EU’s emerging rules on sustainable investment. The latest uproar surrounds plans to label nuclear power and some forms of gas as green in the new taxonomy, a framework that defines which assets and activities can be considered sustainable.

But it is not just those definitions within the taxonomy that are being contested. Also in the spotlight is the practical question of how investors will be expected to use the taxonomy under new rules requiring them to disclose their level of “alignment” with the framework. Some fund managers have been voicing concern about the level of cost and time this could consume — particularly those at smaller companies with fewer compliance resources.

Now the ICMA, a financial industry trade group that counts more than 600 institutions among its members, has pitched in with a paper arguing that the new regulations could undermine the wider goals of the taxonomy initiative. “The risk here is that we will end up with a very elaborate classification tool that actually cannot be used for its intended purposes in sustainable finance,” Nick Pfaff, ICMA’s head of sustainable finance, told Moral Money.

The thrust of ICMA’s argument is that the alignment regulations require too much in the way of detail from fund managers. Pfaff said some funds had already started reporting alignment scores of zero, because the managers had so little confidence in the available data and erred on the side of caution. “Can you think of a more self-defeating outcome?” he said.

The ICMA has set out several requests for the officials behind this evolving framework. For one thing, it wants them to scale back the requirement for “excessively granular data” to show that an investment does no significant harm to the environment or society. In the absence of authoritative data on specific assets or companies, the ICMA says, estimates should be permitted. And rather than apply European standards to assets all over the world, it argues, the rules should take account of local conditions — applying a different standard for the energy efficiency of investments, say, in a coal-reliant country such as Indonesia.

The data scarcity problem will be alleviated next year when European companies start filing mandatory reports on their own taxonomy alignment, under the Corporate Sustainability Reporting Directive (though many of those companies are likely to face struggles of their own in complying). But Pfaff maintained that a fundamental change to the rules is in order — and he rejected the suggestion that this is just another predictable instance of an industry lobby group pushing back against irritating new regulation.

“We’re not against regulation, we’re not against rules,” he said. “We’re simply saying ‘let’s find the right balance around what rules can work’.” (Simon Mundy)

Banks to Basel: less stress on climate, please

Ever since the 2008 financial crisis, the Basel Committee on Banking Supervision has been closely watched as a standard-setter for global banking risk surveillance. So it makes sense that banks are getting anxious about how Basel will take on climate concerns. In November, BCBS proposed principles for supervising climate-related financial risks — guidance that recommended bank supervisors consider including climate threats in stress testing.

Comments are due today and already US bank lobbying groups are voicing opposition to Basel’s climate consultation.

The Financial Services Forum, chaired by Goldman Sachs chief David Solomon, said in a letter to Basel that “we strongly oppose climate stress testing that could potentially impact banks’ regulatory requirements.

“It would be inappropriate for any kind of climate scenario analysis or stress testing to potentially lead to adverse regulatory consequences for banks,” the lobbying group said in a February 14 letter.

The American Bankers Association said “it would be premature and counterproductive” to add climate consequences to financial risk assessments. Regulators should be wary of coming up with climate risk scenarios with the goal of “hasten[ing] a response to climate-related risks,” the group said.

As bank lobby groups are doing what they can to dodge regulations, investors are already focused on how banks will handle climate stress tests. The European Central Bank is running a supervisory climate risk stress test, and on a February 10 earnings call the Belgian banking group KBC was asked about it.

“Are we positioned well? I think so,” KBC’s chief financial officer Roger Elie Popelier told analysts. “We are at least working hard and on the basis of the [measure], which was shared with us by the ECB, we’re doing quite well.”

Whatever Basel and various bank regulators come up with, investors are showing deep concern for how well banks can weather climate challenges. (Patrick Temple-West)

Japan’s bet on ‘clean coal’ lacking

At COP26 last year, Japan’s prime minister Fumio Kishida pitched “clean coal” technologies as a way for Japan to cut emissions, while the rest of the rich nations in the west were trying to exit from coal entirely.

But the unproven technologies’ high costs and limited emission reduction capabilities could hamper Japan’s ability to achieve its climate goals, warns new research from TransitionZero, not-for-profit climate analytics think-tank backed by Al Gore. Japan has pledged to cut emissions by 46 per cent by 2030 and to reach net zero by 2050.

Policymakers are promoting three clean coal technologies to reduce pollution from burning coal: ammonia co-firing, coal gasification (IGCC), and carbon capture and storage (CCS). However, TransitionZero’s analysis shows that even with the new technologies, Japan’s carbon intensity would be five times higher than levels needed to achieve net zero by 2050. Meanwhile, these technologies cost more than twice that of solar power.

Japan has long had a reputation for its reliance on coal; it derives approximately 30 per cent of its electricity from the fossil fuel. “It seems that Japan is widely promoting [these] technologies under the guise of ‘clean coal’ as they provide an easy and convenient means for the country to keep its coal plants operating for longer,” said Jacqueline Tao, analyst at TransitionZero.

Japan’s gambit on novel technologies represents its struggle with how to balance energy security and decarbonisation. While the world’s third-largest economy consumes a large sum of electricity, the island country lacks the space to spread massive solar and wind parks that the US and China can afford. Expanding nuclear capability has faced a huge pushback since the 2011 Fukushima disaster.

In addition, Japan is desperately looking for breakthrough technologies it can export after “the lost decades” of economic stagnation — and there is high demand for cleaner coal technologies, especially among developing countries in Asia.

But for clean coal technologies to become successful, more investment from overseas will be needed. Until then, Tao recommended Japan’s policymakers pivot to more mature renewables, such as offshore wind. Please write to us if you have thoughts on how to make Japan’s energy supply more sustainable. (Tamami Shimizuishi, Nikkei)

Chart of the day

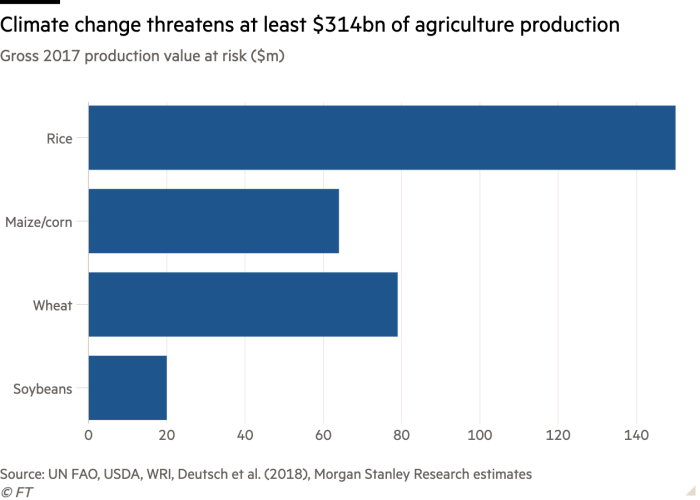

A new Morgan Stanley report on water issues raises some alarming points about the effects of climate change on agriculture, with global food demand set to soar while rainfall becomes more erratic. At least 44 per cent of wheat, 43 per cent of rice, 32 per cent of maize and 17 per cent of soyabean production is threatened by climate change, according to the report. This puts the total value of annual agricultural production threatened by climate change at $314bn.

Smart read

-

For an insight into the evolving strategy of oil company BP, don’t miss chief executive Bernard Looney’s interview with the FT’s Tom Wilson. Looney talked about his plans for a slimmed-down oil division concentrated on six key regions — “it’s going to be beautiful” — and about the company’s target of slashing its operational carbon emissions by 50 per cent this decade. “That’s what society is expecting, and I’m not here to fight society,” Looney said.