EU leaders battle over carbon price as energy costs soar

A group of EU leaders have demanded that Brussels intervene to help curb the record price of carbon, arguing that potential market manipulation was raising energy costs and exacerbating Europe’s winter gas crisis.

European member states led by France and including Spain, Poland, Hungary, Latvia, and the Czech Republic objected to the European Commission’s assertion that there were no irregularities in the EU carbon market, as they come under pressure over the cost of energy.

The complaints were raised at an EU leaders’ summit in Brussels on Thursday, after European gas prices earlier in the week hit their highest level since October. The gas supply crunch has provided an incentive to energy producers to switch to cheaper but more polluting coal.

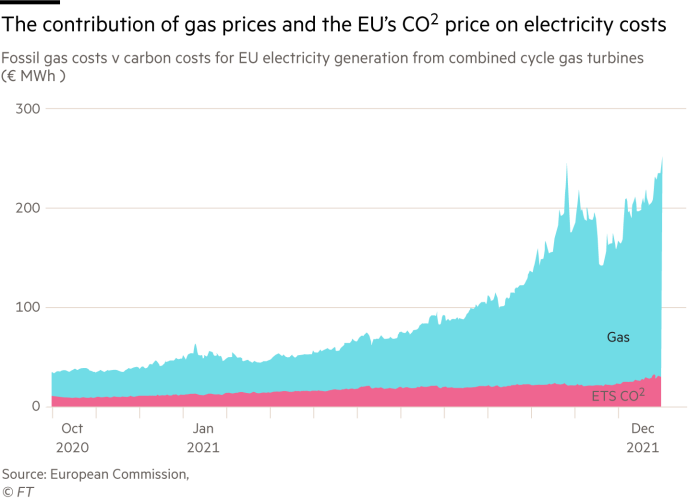

The carbon price under the bloc’s emissions traded system surged to more than €90 per tonne of carbon dioxide last week.

Heavy polluters are obliged to buy allowances under the system to cover their carbon emissions, in an effort to place a cost on the dirty fuel and curb the greenhouse gases that cause global warming.

But EU diplomats told the FT that a number of leaders demanded the Commission carry out more rigorous scrutiny of the price dynamics in the cap-and-trade system that covers carbon emissions. Some suggested direct political intervention in the market.

The dramatic increase in the price of the carbon allowances from €50 in late July to a high of €90.75 last week has led to forecasts that it could rise to at least €200 in coming years as supply dwindles.

The carbon market is effectively controlled by the Commission which sets the number of allowances in the system.

In the long term, the carbon price is driven by the EU’s commitment to reducing greenhouse gas emissions to net zero by 2050.

Poland, which relies on coal power for about 70 per cent of its energy, has been one of the harshest critics of the attempt to make it more expensive to use coal through a carbon market. Prime Minister Mateusz Morawiecki told EU leaders the ETS was taking “money from the poor to give to the rich”, said a diplomat familiar with the discussions.

French president Emmanuel Macron and Czech prime minister Andrej Babis also challenged the EC’s assessment that there was little evidence of market speculation.

Brussels last month commissioned two agencies, the European Securities and Markets Authority and the EU’s energy body ACER, to carry out an in-depth study of the trading dynamics to answer concerns about ETS price manipulation. An initial assessment found no evidence of irregularities.

The Commission has also insisted the system, which is the centrepiece of the EU’s emissions reduction strategy, benefits all member states by providing them with lucrative revenues from the sale of allowances.

Brussels estimates that the rising price of carbon credits has generated at least €11bn in profits for EU governments this year compared with 2020. It also estimates that only 10-13 per cent of the current energy price rises can be attributed to the higher carbon price.

During this week’s summit, one leader suggested the Commission should place a ceiling on the carbon price to prevent excess volatility, said diplomats familiar with the discussion. Other countries mentioned increasing the supply of allowances to help dampen prices.

German chancellor Olaf Scholz, attending his first summit, defended the ETS but also expressed concern at the cost of allowances, said diplomats. Germany is among the biggest supporters of carbon markets, and has implemented a comprehensive system of CO2 trading.

However, it is due to shut 4GW of nuclear-fired power capacity this year, which is likely to increase the use of fossil fuels and demand for EU credits.

The surging cost of polluting comes amid an EU debate about whether to extend the ETS to sectors such as cars and housing. The proposal has met fierce resistance from France, Spain, Portugal and eastern countries in the bloc, where they argue it will impose a direct tax on consumers who cannot afford to switch their vehicles and domestic goods to those with lower emissions.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here