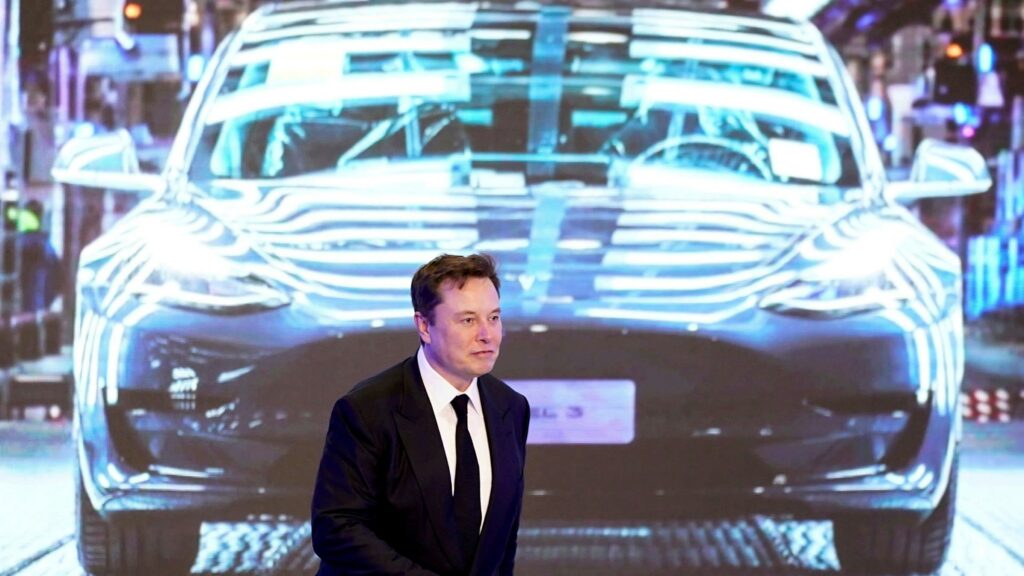

Elon Musk offloads $1.1bn in Tesla shares

Elon Musk sold about $1.1bn worth of his Tesla shares on Wednesday, days after promising he would cash in 10 per cent of his stake if Twitter users voted for him to make the sale.

The disposals, revealed in a regulatory filing late in the day, were made under the kind of blind trading plan executives often use to avoid suspicions of insider trading, and which are frequently used to spread sales over a period.

Musk has been silent on the possible share sales since he announced in a tweet on Saturday that he would sell the 10 per cent stake, currently worth some $18bn, if a Twitter poll backed the idea. It was unclear whether Wednesday’s sales were the first instalment in making good on his promise. The disposals amounted to about half a per cent of his interest in Tesla.

Although Musk attracted huge attention by appearing to leave it to the Twittersphere as to whether he sold shares, the regulatory filings showed that he set Wednesday’s sales in motion when he adopted the blind trading plan in September.

He has also said in the past that he expected to sell a significant part of his Tesla stake to cover the taxes that will fall due on tens of billions of dollars worth of options that have to be exercised by next August.

The transactions disclosed on Wednesday showed Musk had exercised options on the stock worth about $2.3bn by the close of trading. He paid only $13.4m for the shares underlying the options, which had an exercise price of $6.24, compared to Tesla’s closing price of $1,067.95.

Musk has said he expected to face a personal income tax rate of more than 50 per cent on the profits he made from exercising options, meaning he would have to sell more than half the stock acquired at the time of each option exercise to cover his tax bill.

The Tesla chief executive was silent on Saturday about the need to pay taxes on his expected options profits. Instead, he tweeted that he was throwing it open to Twitter users to decide if he should sell his shares since “much is made lately of unrealised gains being a form of tax avoidance”.