Elon Musk ensures he’ll never get Twitter-banned

One thing to start: Norway’s $1.3tn sovereign wealth fund has backed calls for a special audit at Credit Suisse and warned it would not absolve executives and board members from blame over multiple scandals as pressure grows on the Swiss lender to revamp its senior management.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

Elon Musk shoots the $44bn bird

Last week the world’s richest man took to Twitter to warn that “the Barbarians are at the gate”, alluding to the 1989 tale of KKR’s takeover of RJR Nabisco for $25bn.

Elon Musk’s far-larger deal to buy Twitter for $44bn runs in sharp contrast to the KKR deal that has long been hailed as the seminal leveraged buyout.

Unlike in RJR, where Henry Kravis and George Roberts spent months conjuring debt financing to cover an ever-escalating takeover price, the South African billionaire has inked one of the largest leveraged buyouts in history with his first — and final — offer in a matter of 11 days.

On Monday, Elon Musk sealed his victory over the San Francisco technology company without raising his offer beyond $54.20 per share, or a $44bn purchase price. It thrusts control of the social media platform into the hands of one of its most avid users — and outspoken critics.

Twitter initially sought to work with Musk after he disclosed a passive stake in the company on April 4, offering to add him to its board. Musk agreed, then backtracked.

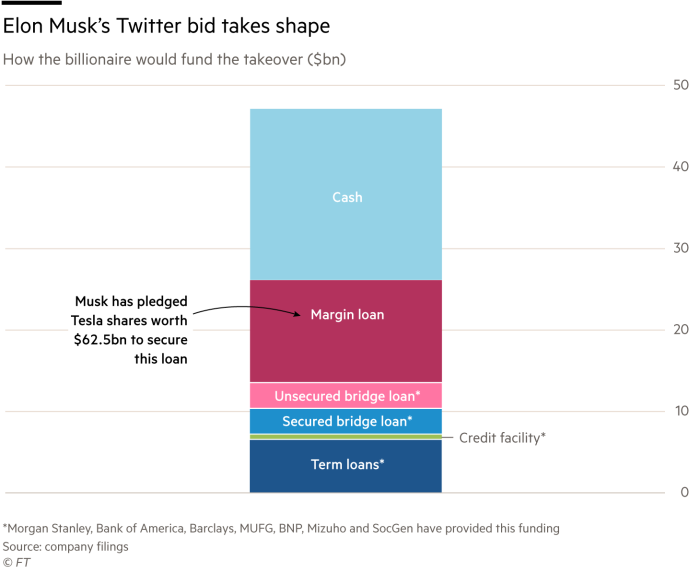

Then 10 days later, he floated his takeover offer. Twitter implemented a poison pill defence, but was forced to the negotiating table after Musk assembled a $46.5bn financing package last Wednesday.

This weekend, pressure mounted on Twitter’s board, led by Salesforce co-chief executive Bret Taylor, as shareholders pushed the company to accept Musk’s fully-financed offer, people briefed on the matter told the FT.

Critical was Musk’s willingness to put a significant chunk of his net worth on the line. The Tesla chief executive raised $25.5bn in debt — including a margin loan of $12.5bn against his shares in the carmaker — and committed to providing $21bn in equity financing for the takeover. It leaves him on the hook for more than 70 per cent of the purchase price unless he finds other backers.

The $33.5bn that Musk is putting on the table is 15 times greater than the cash KKR stumped up to win RJR.

The billionaire is in talks with a number of wealthy individuals and institutional investors about backing that portion of his bid, people briefed on the negotiations told DD. Musk could bring in a private equity firm such as Thoma Bravo, or wealthy investors in his network, lowering his cash costs.

Or he could just swallow Twitter whole.

Bankers financing Musk stood ready to lend him billions knowing that he’s in for more money than they are and his shares in Tesla are worth about 10 times the money he’s committed to Twitter.

“There is $30bn of equity plus or minus underneath us,” said one banker. “We are going to get our money back.”

Musk, a self-described “free speech absolutist”, has hinged his offer on overhauling Twitter’s content moderation policies. But it’s an expensive stance to take, as Lex points out.

What’s certain is that his impending reign will herald another era of change for Twitter employees.

Musk’s free speech campaign follows the ousting of former chief executive, co-founder Jack Dorsey, who was ushered out by Elliott Management. The activist complained Dorsey was too distracted by his other job running payments company Square, and dabbling in cryptocurrency.

Now, Twitter will fall under control of quite possibly the only person on earth busier than its former boss.

Blackstone bids to be the king of Reits

“In the short run,” Benjamin Graham, the doyen of value investing, once said, “the market is a voting machine. In the long run, it is a weighing machine.”

Yet a growing cohort of investors don’t want the liquidation value of their holdings to be set by clattering market machinery. Instead, they’re happy to trust the judgment of Wall Street’s increasingly powerful private capital firms.

This surprising trend has driven Blackstone’s recent streak of real estate dealmaking, DD’s Antoine Gara and Mark Vandevelde report.

Stephen Schwarzman’s firm, which famously made a killing by taking Hilton Hotels private just before the financial crisis struck in 2007, is today focusing on a different type of take-private: buying out a string of tax-advantaged vehicles known as “real estate investment trusts”.

Reits, as they’re commonly known, are required by law to pay out most of their income every year in distributions. In return, they’re exempt from paying corporate taxes.

Reits are often listed on the stock market, where their share prices have lately been taking a pounding as investors worry about rising interest rates and the effect of a possible recession.

So Blackstone has pounced, buying at least five public Reits since the start of the pandemic. Just yesterday the group agreed to buy PS Business Parks for $7.6bn.

Many of those deals have been funded by Blackstone’s own Reit, called Breit, which has raised $63bn since it was launched in 2017.

But here’s the twist: Breit is not listed on the stock market. That means there are no continuously traded shares and no volatile share price. It also means investors have fewer ways to cash out, although they can generally sell their shares back to the fund at fair value during a monthly window.

Breit’s rapid growth suggests some wealthy savers prefer to sacrifice liquidity for soothing stability in their investments.

That mirrors the preference of some big pension funds, which so dislike showing volatility in their accounts that they’ve embraced the unorthodox economic idea of paying an “illiquidity premium”.

A French cable billionaire’s American struggle

DD readers will be familiar with Patrick Drahi, the Franco-Israeli cable billionaire who built his empire with aggressive debt-fuelled dealmaking, and has taken a stake in the UK’s former telecoms monopoly BT.

We’re taking a dive into his adventures in America — where things aren’t looking good.

Shares in Altice USA, which he spun off from its heavily indebted European parent in 2017, are languishing at less than half of their IPO price — leaving Drahi, who owns 48 per cent, sitting on more than $4bn in paper losses.

The company has slashed costs and sought acquisition opportunities, but has failed to invest sufficiently in its network and service, causing customers to exit en masse, analysts told the FT’s Anna Gross and Harriet Agnew.

Drahi’s American dream has been difficult from the start. Back in 2015 he tried to buy Time Warner Cable, but the owners — fearful of Altice’s cost-cutting playbook — ran into the arms of rival Charter Communications. Instead, he bought two subscale regional telecoms companies, Suddenlink Communications and Cablevision.

“Everyone in the industry reviled Altice, they’d seen the film in Europe,” said Craig Moffett at MoffettNathanson.

Altice USA is hoping a fibre build will be enough to transform its fortunes. Most rivals are upgrading their copper networks but Altice is overlaying its network with state of the art fibre.

Investors think that in the shorter term its value might come from dealmaking. They’re considering the likelihood of either Drahi buying shares cheaply and taking the company private, or a rival such as Charter or Comcast snapping it up.

Unless you believe one of the two will happen, one investor said, “I struggle to see why you would own it over the next 12-24 months.”

Job moves

-

TikTok owner ByteDance has appointed Julie Gao, a former senior partner at Skadden in Hong Kong, as its new chief financial officer, according to an internal memo sent by the company’s chief executive Liang Rubo seen by DD.

-

Bank of America has appointed Bob Douglas, Deutsche Bank’s former head of consumer and retail investment banking for Europe, the Middle East and Africa, and internal hire Luke McMullan as co-heads of Emea consumer and retail investment banking. They replace Jayanti Bajpai, who will become chair of the unit.

-

Infrastructure investment firm Stonepeak has appointed Macquarie Capital’s former global co-head Daniel Wong as a senior managing director and head of Europe, based in London.

-

Royal Bank of Canada has hired Bank of America’s Rajat Bhatia as a managing director in its healthcare investment banking arm, per Bloomberg.

Smart reads

Opportunity cost Binance, the world’s largest crypto exchange, had been carefully building ties with a Kremlin-linked agency to capitalise on Russia’s once-budding market before its invasion of Ukraine, a Reuters investigation reveals. It remained active in Russia after many of its rivals fled.

Below deck A captain who has steered the megayachts of Russian oligarchs speaks to the Guardian about the ships’ convoluted ownership structures and the prostitution, sexism and drug abuse in the yachting world.

Unsubscribed Netflix’s troubles could be the beginning of a “great cancellation” as surging inflation leads consumers to turn their backs on the subscription economy, the FT reports.

News round-up

Norway’s wealth fund backs calls for special audit at scandal-hit Credit Suisse (FT)

Vodafone investors demand telecoms group speeds up dealmaking (FT)

Activist urges investors to move against Just Eat Takeaway’s board (FT)

Ares backs two bidders for Abramovich’s Chelsea FC (FT)

‘Assassin’s Creed’ publisher Ubisoft draws buyout interest (Bloomberg)

Elliott investment in travel group is rare bright spot for Spacs (FT)

Gates-backed company accused of firing whistleblowers who flagged misconduct (FT)

KPMG wins UK government contracts despite withdrawing from bidding after scandals (FT)

Rupert Murdoch returns to British TV as UK newspapers look beyond print (FT)

UK competition regulator probes Maersk-Noble £2.6bn offshore drilling merger (FT)

Private equity: maturing sector is increasingly adding shadow leverage (Lex)