Driverless taxis in China and online loan-sharks in India

Hello everyone, this is Akito from Singapore.

I would say that one of the best privileges of being a reporter covering the tech industry is getting an early opportunity to try out some of the world’s most exotic products on behalf of our readers. In 2009, I had the chance to test drive Tesla’s first electric roadster, and reported on the explosive acceleration delivered by its high-pitched, emission-free power train. Over a decade later, this technology is challenging the dominance of the internal combustion engine in auto markets worldwide. A few years ago, I rode in Google’s self-driving prototype vehicle near its headquarters in Silicon Valley. And most recently, I had an early taste of lab-grown chicken in Singapore.

These are all great opportunities for getting a glimpse of the future. But turning a radical idea into a commercial reality requires years of research and development and massive amounts of investment — and even this is often not enough for success. Another key ingredient is backing by authorities, which must recognise the innovation, confirm its safety and support its commercialisation. Only then can the public have the chance to try out these cutting-edge technologies themselves.

Driverless in China

The Chinese public is getting just such a chance after Baidu announced on Monday it has secured permits to put driverless taxis on the road in two major cities, writes Nikkei Asia’s CK Tan in Shanghai.

In a first for the country, the company, better known as a search engine giant, will be allowed to offer taxi rides to the public in cars with no human safety drivers on board.

These “robotaxis” will be available on the streets of southwestern Chongqing and central Wuhan. Operations are limited to eight hours a day in designated zones ranging from 13 to 30 square kilometres in both cities, with just five cars in each city. Nevertheless, the company hailed the permits as a “key milestone.”

Baidu released its latest generation of autonomous vehicles in July, touting a production cost roughly half that of its previous model. According to co-founder and CEO Robin Li, this will translate to saving for riders. “We are moving towards a future where taking a robotaxi will be half the cost of taking a taxi today,” he said of the launch.

Meanwhile, in the US, Cruise, a General Motors subsidiary focused on autonomous driving, has begun operating fully self-driving taxis in San Francisco. This puts the world’s two largest automobile markets in a head-to-head race to commercialise and deploy industry-defining driverless technology just as tensions between Washington and Beijing reach new heights.

Under pressure to unwind?

Foxconn could be forced to unwind the $800 million investment that made it a major shareholder in China’s Tsinghua Unigroup last month, Kathrin Hille writes for the Financial Times.

Taiwanese national security officials believe the deal could make the world’s largest electronics contract manufacturer, which is also a major Apple supplier, a trump card for Beijing in its technology competition with the U.S.

Foxconn describes the deal as a financial investment and argues that Tsinghua Unigroup is no longer the heavyweight it used to be after a debt restructuring that forced it to drop key chip manufacturing assets.

But Taipei believes that the Chinese group is still at the heart of Beijing’s plans for semiconductor self-sufficiency.

Taiwanese officials think that having one of Taiwan’s largest companies back the Chinese government in this will pose a national security risk to Taipei and undermine its closer alignment with the U.S.

SoftBank the seller

SoftBank Group is hungry for cash. As Masayoshi Son’s tech conglomerate strives to outlast a protracted “tech winter,” it is selling off assets at an accelerated pace, Nikkei Asia’s Wataru Suzuki and Cissy Zhou write.

SoftBank is slashing its stake in China’s Alibaba Group Holding, its most successful investment, and Son says the company is also in talks to sell Fortress Investment Group, the US investment company it bought in 2017 for $3.3 billion.

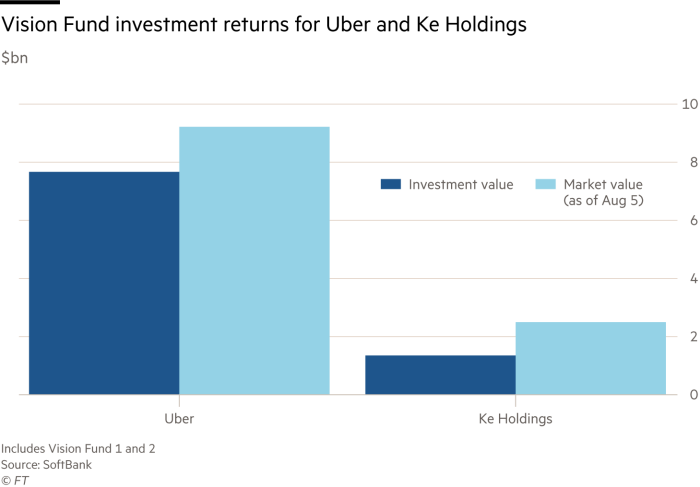

Another pool of assets up for sale is the two SoftBank Vision Funds’ portfolio of publicly traded stocks. The funds sold off their stakes in ride hailer Uber and Chinese property company Ke Holdings in stages, generating $11.7 billion in sales and a profit of $2.7 billion.

The market downturn, however, is making it harder for SoftBank to generate big returns from such sales, and no one can say how long this winter will last.

Borrower beware

The wide adoption of fintech has benefited many people in Asia, especially among the region’s large unbanked populations. But rapid tech developments can also come with a darker side, Quratulain Rehbar writes for Nikkei Asia.

In India, where many in the nation of nearly 1.4 billion lack access to traditional banking services, illegal loan apps are becoming a social problem. Credit checks are rare in these apps, and interest rates can be exorbitant. Even more worrying are cases of apps tracking borrowers’ smartphone data, such as contacts and photos, and using it to harass them for repayment. One victim said that even his sister was targeted with threatening WhatsApp messages.

Almost 600 illegal digital loan apps are operating in the country, according to the nation’s central bank, while a non-profit organisation has blamed abusive recovery tactics for 17 suicides over the last year.

Experts are demanding stricter laws to regulate these apps, but they also acknowledge that tracking down the groups behind these apps may be challenging.

Suggested reads

-

Foxconn stands by China chip deal as cross-strait tensions rise (Nikkei Asia)

-

Apple warns suppliers to follow China rules on ‘Taiwan’ labelling (Nikkei Asia)

-

SoftBank’s record $23bn loss could push Masayoshi Son to reconsider taking group private (FT)

-

Samsung to begin making semiconductor parts in Vietnam in 2023 (Nikkei Asia)

-

Taiwanese Apple supplier battles activists over $4bn cash pile (FT)

-

SoftBank/Son: downhill march proves painful for Grand Old Duke of Tech (FT)

-

China’s new iron chefs: Robots and AI dish out $4 menus in Shanghai (Nikkei Asia)

-

Panasonic, Nikon quit developing low-end compact digital cameras (Nikkei Asia)

-

Alibaba revenue falls for first time since New York listing (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp