Climate policy takeaways from the G20 finance meeting

This article is an on-site version of our Moral Money newsletter. Sign up here to get the newsletter sent straight to your inbox every Wednesday and Friday.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

Liberté, egalité, fraternité: Happy Bastille Day to our French readers. We are hoping the weather here in New York co-operates for a big celebration in Central Park this evening.

Until then, we are covering today’s action in Brussels where the EU will unveil a transition plan to become net zero by 2050. According to the leaked draft text, seen by our colleague Mehreen Khan, certain business sectors will be gradually eased into the Emissions Trading System, which has got more expensive this year.

With France and Italy voicing concerns about a repeat of the gilets jaunes protests against rising petrol prices that hit France in 2018, the European Commission plans to use some of the new revenues from its carbon market to alleviate energy poverty among its most affected citizens.

The EU programme, known as the “Fit for 55” (referring to the 55 per cent emissions reduction target by 2030), is already having global ramifications. In June, Toyota Motor warned shareholders that the plan posed a new regulatory risk.

Please follow the FT’s coverage of the Brussels developments today and stay tuned for Moral Money’s analysis later this week. —

Patrick Temple-West

G20 souvenir: face masks and climate policy

What is the new souvenir for conferences? Once it was pens or golf balls. Now it is embossed face masks: at this weekend’s meeting of G20 leaders in Venice, guests were handed sturdy KN95 face masks with the blue Italian G20 logo, and expected to wear these much of the time.

On a more serious note, however, a set of messages was also distributed to the wider business, finance and policymaking world about where climate policy is heading.

We’d like to send out a big thank you to our readers who submitted questions for us to ask the G20 attendees.

Here are our top takeaways:

-

There is rising frustration among many climate policy leaders — and some financiers — about the lack of innovative blended finance solutions currently available. Blended finance could channel funds to emerging markets to invest in transition policies by using public money to “wrap” (or guarantee) private investment. In the eyes of people such as Larry Fink of BlackRock, this should be a top priority for institutions such as the World Bank, but hitherto few projects have emerged. Some blame a lack of imagination or bureaucratic inertia; others a shortage of investible projects. Either way, pressure is rising for this to change.

-

The International Financial Reporting Standards Foundation’s upcoming International Sustainability Standards Board is now the main venue for efforts to harmonise green accounting standards, based on Task Force on Climate-related Financial Disclosures frameworks. The Financial Stability Board has thrown its weight behind this, and the G20 is backing it too. This may not please Europeans, since the IFRS approach appears designed to get a common minimum base that focuses on one-way materiality (what the environment is doing to companies, not the other way round); groups such as the Global Reporting Initiative and European Commission want double materiality systems that capture companies’ carbon footprints. But the IFRS will be the key focus in Glasgow.

-

The carbon tax is set to generate a lot of controversy in the coming months. Although there is a rising chorus of support for this measure among most global policymakers — and Europe is introducing a version of this — the Biden administration remains resistant, since it fears this will inflame Republicans too far. This will run and run.

-

Policymakers want to clamp down on energy divestments that put dirty assets into private markets — and out of sight of public investors who are championing ESG standards. A new committee is being formed that will be run by BlackRock’s Larry Fink, Jane Fraser of Citigroup and Oliver Bate of Allianz to stop energy companies simply dumping dirty assets in this way, and pressure is rising for regulators to exert more scrutiny over private markets in this respect.

(Gillian Tett and Kristen Talman)

Al Gore: climate finance has reached a tipping point

The biggest question coming out of the G20 is when, if ever, will all of this talk about reducing emissions translate into action? Martin Wolf’s latest column (see more below) is particularly bleak on this front.

After decades of seeing his warnings about climate change ignored, one might expect former US vice-president Al Gore to be equally gloomy. But in an interview this week he was effusive and upbeat about the future.

“We are going to win this,” he told Moral Money.

As Gore sees it, climate finance has finally reached critical mass. Thumbing through the latest annual sustainability trends report from his company Generation Investment Management, it is easy to understand why.

Inflows to ESG funds in Europe have grown tenfold since 2015, the report states. Sustainable debt issuance is up ninefold over the same time period, and the list goes on from there.

“I’ve often quoted the late economist Rudi Dornbusch, whose eponymous law says things take longer to happen than you think they will. And then they happen faster than you think they could,” Gore told Moral Money. “Where climate finance is concerned we have reached the tipping point between stage one and stage two. It’s really happening very rapidly.”

Gore is not so naive as to think things are at a point where they will take care of themselves. Greenwashing is a big problem that needs to be dealt with. He also notes that many of the world’s biggest polluters have not made credible net-zero plans and agrees with BlackRock’s Larry Fink that more needs to be done to promote clean energy in emerging markets.

Investing in fossil fuels is a “mug’s game”, he said. “The multilateral development banks in particular need to just get out of fossil fuels for God’s sake, and start doing what the world needs them to do.”

But he is “personally optimistic” that we have a good chance of stopping the climate crisis.

“It is daunting, but we’re on that curve now.,” he said. “Overall, we are moving very powerfully in the right direction.”

A big reason for this shift is that it is “viscerally obvious” to people all over the world that the climate crisis “is getting worse faster than we’re deploying solutions”.

“Mother Nature is far more persuasive than any of us in the climate community.”

Gore believes the pandemic has only heightened that awareness. It had shown that we should pay attention to experts when they were “setting their hair on fire to try to get our attention with warnings”, he said. It also showed that the economy could suddenly be turned upside down and that new technologies (such as mRNA vaccines) can be developed rapidly to provide solutions.

“All three of those lessons apply directly to the climate crisis, and that is really important,” he added.

(Billy Nauman and Patrick Temple-West)

Tips from Tamami

Nikkei’s Tamami Shimizuishi helps you stay up to date on stories you may have missed from the eastern hemisphere.

Moral Money predicted 2021 would feature companies and bankers pushing for a more nuanced definition of “green” to ensure a wider range of corporations, including high emitters, were rewarded in the market as they move in the general direction of green. Now, the wave of “olive” finance has arrived in Asia, too.

Nippon Yusen, Japan’s largest shipping company, is set to issue the country’s first “transition bonds” this month. The proceeds from the bonds — targeted to raise ¥20bn ($180m) — were likely to be used to purchase ships fuelled with liquefied natural gas, the company said.

The transition finance framework has given “flexibility” to the maritime shipper, as LNG ships are not considered “green” but are qualified as a transitional effort to cut emissions, the company’s spokesperson said.

Japan Inc is looking at transition finance as an important tool to achieve Prime Minister Yoshihide Suga’s 2050 net-zero commitment. In May, the ministry of economy, trade and industry — alongside the ministry of the environment and the Financial Services Agency — published its “basic guidelines on climate transition finance”. Kawasaki Kisen, another major shipper in Japan, tapped the transition loan — the first of its kind for the country — to buy LNG ships in March.

Japan is not the only country to acknowledge the high potential of transition finance. This year, Bank of China issued its first transition bonds. While many shades of green are on the rise in finance, the concern of greenwashing is also rising. Please email us if you spot any “transition washing”.

Chart of the day

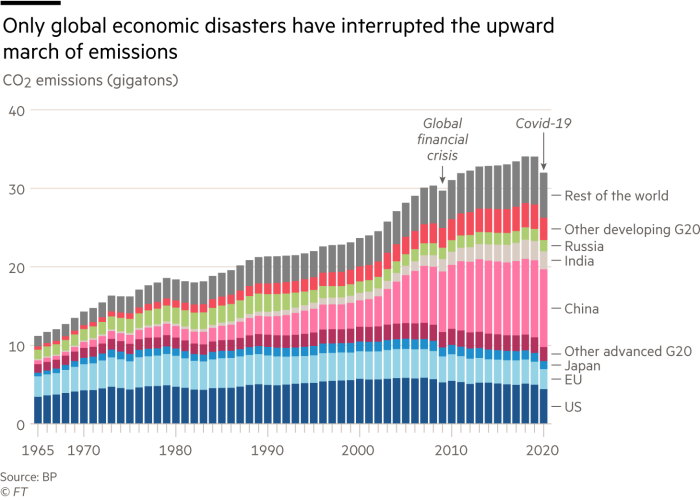

Given the global effort to successfully combat Covid-19 signal failure, “it is impossible to imagine we will do much more than fiddle while the planet burns”, writes FT columnist Martin Wolf. “I would be delighted if COP26, the conference to be held in November in Glasgow, proves me wrong. I would also be surprised.”

Grit in the oyster

Many emerging market investors point to a dilemma for the ESG sector: if they steer clear of Belarusian bonds, what about other countries with dubious human rights records? Many worry privately it will be hard to make money if the likes of Russia, Saudi Arabia or China are off-limits. Please read this report from our colleagues about the conundrum facing ESG investors.

Smart reads

-

Plenty of credible definitions of sustainability have been developed over the past decade, but what’s required instead is investment-level classification: how can investments with good system-level impacts be separated from those with bad ones? asks Max Krahé, a political economist at the University of Duisburg-Essen.

-

Index provider MSCI has called out some of the biggest carbon emission emitters that have failed to make any disclosures about their pollution. The list of climate laggards is led mainly by state-backed publicly listed companies based in India and China, writes our colleague Leslie Hook.

Recommended reading

-

Fund numbers double in two years amid ESG boom (Australian Financial Review)

-

Musk to testify over Tesla’s $2.6bn acquisition of SolarCity (FT)

-

Southern Water fined record £90m for deliberately dumping sewage (The Times)

-

Do white founders in Africa have an easier time getting capital? (Quartz)

-

Saudi sovereign wealth fund scopes banks for ESG framework — sources (Reuters)