Chip games without frontiers

This article is an on-site version of our #techFT newsletter. Sign up here to get the newsletter sent straight to your inbox

The Frontier supercomputer at the Oak Ridge National Laboratory in Tennessee has become the first officially recognised exascale supercomputer in the world, ranking Number One in the latest Top 500 list of such machines.

Due to political tensions with the US, China did not submit for consideration two of its supercomputers thought to have already broken through the barrier of systems that can handle 10 to the power of 18 calculations per second. AMD microprocessors powered Frontier’s breakthrough, but China has weaned itself off chips from the US company and developed its own processors for its exascale efforts.

The battle for a geopolitical advantage or just an even playing field in chipmaking continues all the way down from building the world’s fastest computer to the elemental level. Access to basic materials, a smooth-running supply chain, production scaling and advanced processes and designs are all of vital importance.

Significantly, a Samsung chip fab was President Joe Biden’s first port of call on a three-day trip to South Korea this month. Nikkei Asia reports that the chief executive of Intel, Pat Gelsinger, has followed up with a visit to South Korea to meet Samsung Electronics vice-chair Lee Jae-yong to discuss co-operation. Both major chipmakers are trying to catch up with Taiwan’s TSMC in expanding their foundry businesses.

When it comes to chip designs, Tim Bradshaw and Anna Gross have the scoop that Qualcomm wants to be part of a consortium that could take a stake in Arm to preserve its neutrality, as its owner SoftBank prepares to float it on the New York Stock Exchange.

“We’re an interested party in investing,” Cristiano Amon, Qualcomm’s chief executive, told us. “It’s a very important asset and it’s an asset which is going to be essential to the development of our industry.”

He added that Qualcomm, one of Arm’s biggest customers, could join forces with other chipmakers to buy Arm outright if the consortium making the purchase was “big enough”.

In a report today, Bank of America analysts say geopolitical conflicts are redrawing the map of the $556bn chip industry. “In our view, there is no quick fix to eliminating the interdependence between the design-intensive west, and manufacturing-intensive east,” they say.

It would take a minimum of three to four years and a sustained $50bn+ of annual funding from the US and EU to create a duplicate ecosystem, with each leading-edge fab costing $10bn to $15bn.

That level of ramping would risk creating an oversupply and a slump in prices. “The chip industry will need to carefully balance the need to build more fabs outside of China/Taiwan, while preventing an overbuild that could enhance industry cyclicality,” they conclude.

The Internet of (Five) Things

1. UK tackles stablecoin instability

The UK Treasury is proposing an insolvency regime to manage the failure of major crypto stablecoins, after the collapse of terra earlier this month sent shockwaves through the global crypto market. The Bank of England would take the lead in managing the collapse of a stablecoin that had systemic importance to the financial system. Eswar Prasad, author of The Future of Money, comments that the crypto shakeout might help the long-term viability of blockchain-based finance by damping rampant speculation while prodding regulators to act expeditiously.

2. Brazil’s fintech sector falters

High interest rates, double-digit inflation and a weak economic outlook are testing what had been a flourishing fintech sector in Brazil, reports Michael Pooler. “There may be consolidation,” says Nubank CFO Guilherme Lago. “Maybe some fintechs will have to shut down and stop operating in certain segments.” This week’s #fintechFT newsletter looks at the prospects for consolidation elsewhere.

3. BT and Ericsson offer turnkey 5G network

BT has joined forces with Swedish telecoms equipment manufacturer Ericsson to offer private 5G networks to companies in the UK. The multimillion-dollar agreement signed between two of the biggest European telecoms groups is the first of its kind to offer an out-of-the-box private network to companies.

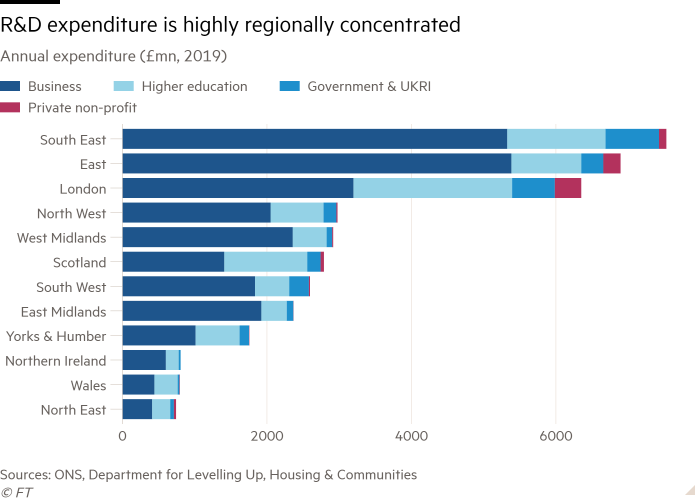

4. UK levelling up to raise R&D spend

The British government wants to increase R&D spending from 1.7 per cent of gross domestic product to 2.4 per cent of GDP by 2027, although that would still fall short of the current OECD average of 2.7 per cent. Jenn Williams has been investigating how innovation hubs being developed in regions outside the better-funded South East could help make this happen.

5. Devolver Digital — the indie game hit factory

Fall Guys, a video game in which players steer fluorescent jelly beans around an obstacle course, was a joyous viral hit in 2020 at the height of the pandemic, while last year’s Inscryption set a very different tone — a spooky card game with a strong postmodern streak. Both came from Devolver Digital, writes Tom Faber, an indie game publisher whose titles inevitably make their way on to best-of lists each year.

Tech tools — Snap’s Spectacles

Snap’s newest “Spectacles” are not widely available, but the demo given to Tim Bradshaw at the company’s offices showed promise: “When I held out my hand, a butterfly appeared to land on it. I clicked a button on the frames and the glasses told me what I was looking at. Images were bright and clear — although a big limitation is the batteries last just 30 minutes.” Read more