China’s carbon market scheme too limited, say analysts

China has launched the world’s largest carbon market in what analysts say is a cautious and limited attempt by the planet’s biggest polluter to cut carbon dioxide emissions.

Buying and selling of greenhouse gas allowances as part of China’s national emissions trading scheme began on Friday after a launch ceremony at the Shanghai Environment and Energy Exchange.

Within the first half-hour, the price per tonne of carbon dioxide equivalent rose from Rmb48 (€6.30/$7.42) at market open to nearly Rmb53 (€7/$8.19), nearing the daily 10 per cent upper limit, after 160 kilotonnes were traded at a total value of Rmb7.9m ($1.2m), according to Chinese state media.

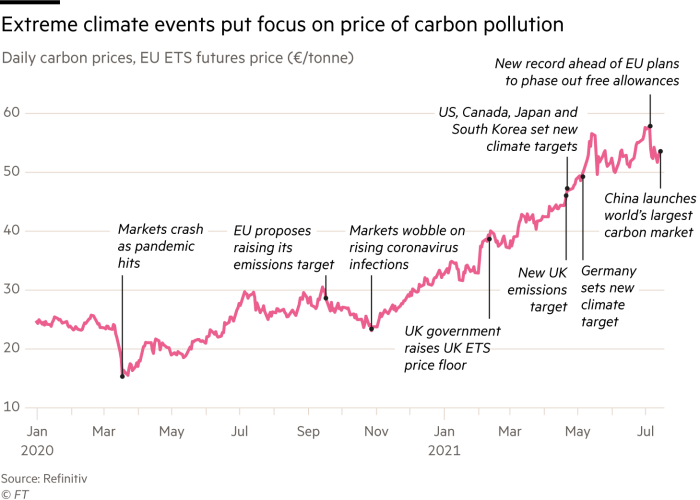

The price on the more established European emissions trading system has hovered around €55 recently, although the markets are not directly comparable. The most recent auction on the newer UK market, launched in May, put the cost of polluting at around £43 (€50) a tonne.

Analysts warned that oversupply, a limited scope and no cap on total emissions meant China’s scheme was unlikely to assume immediately its intended “central role” towards achieving the country’s goal of reaching peak carbon emissions by 2030 and reaching net zero emissions by 2060.

Only China’s energy sector is included in trading this year. Other polluting sectors such as steel and cement are expected to be added in future cycles.

Even so, due to China’s heavy reliance on coal-fired power, the 2,225 sites covered this year account for about 40 per cent of the country’s total CO2 emissions.

The total volume of greenhouses gases output covered in the scheme is about 15 per cent of global emissions or about three times the amount covered by the EU’s scheme, which had previously been the world’s largest.

The launch of EU plans this week to curb global warming by cutting emissions by 55 per cent by 2030 from 1990 levels placed renewed focus on its system, with proposals to include a phase out of free allowances.

The EU’s ETS faced similar oversupply of allowances as China until about 2016, when it introduced market reforms to remove surplus inventory. In recent months, EU carbon prices have reached new highs, nearing €60 a tonne on the expectations of tightening supply.

“The Chinese are just doing what the Europeans did for the first phase of the ETS, which is to treat it as a trial phase where the rules are relaxed to get buy-in from companies,” Gray said.

China’s trading scheme will at first hand out allowances to companies for free, rather than a portion being sold by auction, as is common practice in the mature carbon markets.

“If there is no move away from free allocations, it seems inevitable that the market will have marginal if any impact towards decarbonising,” said Matt Gray, co-chief executive of TransitionZero, a London-based financial research group.

Analysis by TransitionZero released in April found that China’s emissions trading scheme was oversupplied by 1.56bn tonnes of CO2 from 2019 to 2020, equivalent to a year’s worth of EU ETS emissions, making it unlikely that trading would result in a high carbon price.

The market will also at first use a measure of carbon intensity rather than following the EU, California or Canadian markets to adopt a “cap and trade” system, where emissions allowances are based on a single industry-wide quota.

In China, permitted emissions levels will be calculated relative to output and vary by the type of power plant, rather than on an absolute level.

Additional reporting by Emma Zhou in Beijing

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here