China tech listings drop sharply as Beijing cracks down on sector

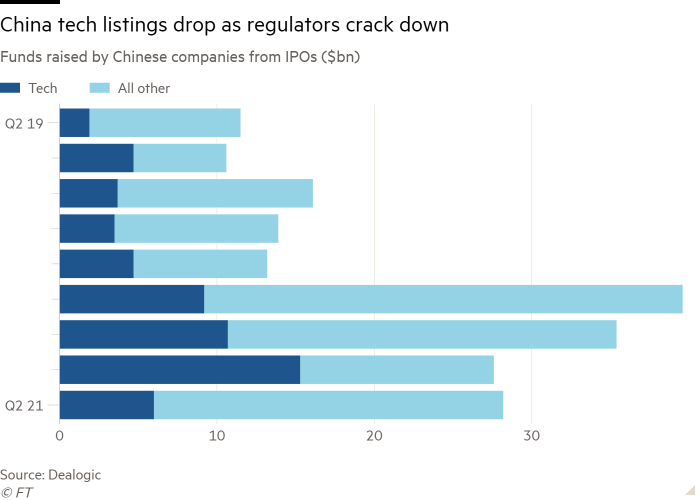

The value of stock market listings by Chinese technology companies dropped more than 60 per cent in the second quarter, as regulators in Beijing broadened their crackdown on the sector.

Since the start of April, initial public offerings by China’s tech groups on exchanges worldwide have raised just $6bn, down almost two-thirds from the first quarter, according to data from Dealogic.

The share of tech listings as a proportion of all Chinese IPOs also fell to the lowest level in two years, at just 21 per cent of the more than $28bn raised during the period.

The decline comes as Chinese tech groups have faced pressure from Beijing, which in recent months has stepped up regulatory scrutiny of some of the biggest names in the sector.

Regulators blocked the $37bn IPO of Ant Group, the fintech group controlled by billionaire Jack Ma, in November, and have ordered the business to restructure. Authorities have also punished tech groups for what they deem to be monopolistic practices, including fining Ant’s sister ecommerce group Alibaba a record $2.8bn.

“The regulatory issue in China is something that’s more fundamental because it’s going to question the valuation you can give to your business — that’s particularly true for financial technology companies,” said Frank Benzimra, head of Asia equity strategy at Société Générale. “Certainly this matters a lot for the companies looking at an IPO.”

The sharp fall in tech IPOs in the second quarter contrasted with a bumper first quarter, in which such groups raised more than $15.3bn from share sales in Shanghai, Shenzhen, Hong Kong and New York.

It also came despite a boom for Chinese IPOs more broadly, as primary and secondary listings worldwide raised a record $65.4bn in the first six months of the year, Dealogic data show.

Much of the drop came in Hong Kong. The city’s exchange has not hosted a single tech listing from mainland China in the past three months, following $8.6bn in IPOs in the first quarter.

Louis Tse, managing director of Hong Kong brokerage Wealthy Securities, said the fall-off was because of both a global shift by investors away from high-growth stocks and a fall in Chinese companies seeking secondary listings in the city.

Over the past year, US-traded Chinese internet groups including JD.com, NetEase and Baidu have raised billions of dollars in Hong Kong as concerns grew that they could be delisted in New York. The US passed a law in December that forcibly delists companies that fail to comply with American audit rules.

“That has died down because . . . after quite a few waves of applications to list in Hong Kong there aren’t that many companies left,” Tse said.

However, Chinese tech IPOs could be set for a comeback. Chinese electric vehicle maker Xpeng said on Friday it would seek to raise up to $2.3bn in a Hong Kong listing with trading to start next month. Ride-hailing group Didi Chuxing plans to raise $4bn in a potential listing on the NYSE listing in the coming weeks.

Jason Elder, a partner at law firm Mayer Brown, said the absence of Chinese tech listings in Hong Kong in the second quarter was “unusual and anomalous” but added there was no way the pace of listings at the start of the year could go on forever.

“I don’t think it’s a harbinger of the market losing its attractiveness or not being open for tech — I see this as a timing issue,” he said.

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday