China taps markets for $10bn to cement clean tech supremacy

Three Chinese electric vehicle battery and material companies are tapping investors for more than $10bn in new funding as the country cements its dominance over global clean tech supply chains.

China’s Contemporary Amperex Technology, the world’s biggest battery maker, this week concluded the second-largest global equity capital market transaction this year, as a wave of battery and rare earths companies rushed to meet booming demand.

The combined fundraising by the three Chinese groups — CATL, Tianqi Lithium and Huayou Cobalt — eclipsed the hundreds of millions of dollars being spent by Washington and US allies including Australia and South Korea to chip away at China’s supremacy in the sector.

“China is trying to position itself as the Saudi Arabia of clean tech hardware, being the lowest cost supplier and achieving the highest market share,” said Neil Beveridge, a senior analyst at Bernstein in Hong Kong. “This is a massive geostrategic competition between China and the west.”

Factories in China account for nearly three-quarters of global EV battery production and command 90 per cent of the market share for processing rare earth elements — the oxides, metals and magnets used in batteries — a level of dominance akin to its stronghold over the solar industry.

CATL, a critical supplier to Tesla and Chinese homegrown automakers such as Geely, kicked off its Rmb45bn ($6.7bn) private placement last week, pricing at Rmb410 per share on Wednesday. Including the latest jumbo stock sale, CATL has raised about $13bn since listing in Shenzhen in 2018, according to Financial Times calculations and Refinitiv data.

Foreign investors were keen to participate. JPMorgan, Barclays, Morgan Stanley, Macquarie and HSBC all grabbed a slice of the share sale, accounting for about 32 per cent of the total offered shares.

Shenzhen-listed Tianqi Lithium, one of the world’s top producers of lithium chemicals for electric vehicle batteries, is aiming to raise between $1bn and $2bn in a secondary listing in Hong Kong, according to an investor close to the firm.

The fundraising will be the Hong Kong exchange’s biggest this year, even at the lowest range, according to Dealogic. Mainland shares of Tianqi have surged more than 21 per cent since the start of June.

Hong Kong-listed Huayou Cobalt, another big Chinese raw material supplier, plans to raise up to Rmb17.7bn via a private replacement. Most of the cash will be used to expand production at its joint venture in Indonesia, where it processes nickel, a critical material for EV batteries.

More than 90 per cent of the world’s battery-grade lithium is produced from refineries in China, which also processes the vast majority of cobalt and nickel, other critical battery materials, according to Trafigura.

The west has been slow to respond to China’s grip on the market. This month, the US Department of Defense signed a $120mn deal with Australian-listed Lynas Rare Earths to build one of the first domestic American heavy rare earths separation facilities. In February, the Australian government stumped up a $100mn loan to Hastings Technology Materials to develop a rare earths mine and refining plant in Western Australia.

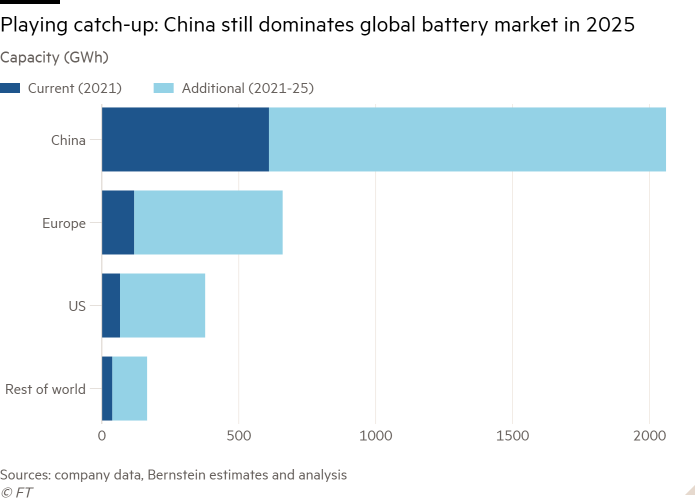

As EV demand grows, global battery capacity is expected to increase by 40 per cent annually through 2025, to 3,252 gigawatt hours from 823GWh in 2021, according to Bernstein forecasts. China’s EV battery capacity market share will decline marginally as the US and Europe offer generous subsidies to build plants closer to carmakers, but is projected to still stand at about two-thirds by 2025.

Europe’s footprint is projected to expand to 20 per cent from 15 per cent today, and the US to 12 per cent from 8 per cent. CATL is expected to hold on to its 20 per cent global market share through 2025.

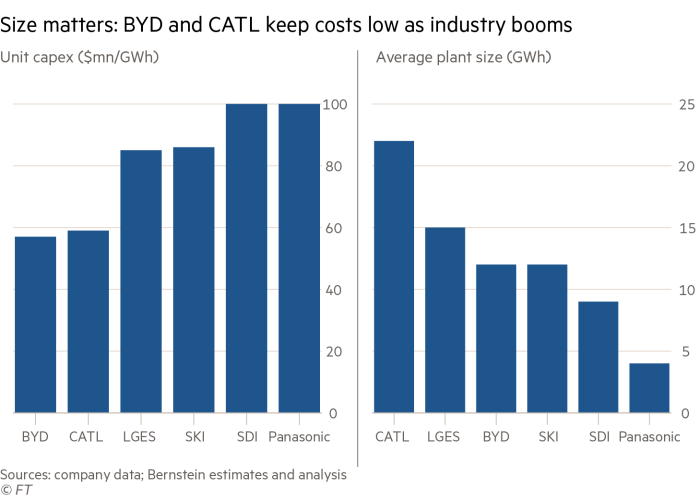

However, China’s cost advantage is set to improve. Factories built in China have a per unit cost of about $60mn/GWh, thanks to their scale. But it will shrink even further, to about $50mn/GWh in the coming years as the size of the plants expand rapidly.

That compares with a global average of about $78mn/GWh over the next 10 years. The cost of new European battery plants already tops $120mn/GWh.

Ross Gregory, of advisory New Electric Partners, said competitors’ concern about Chinese rivals extended beyond geopolitical risk to the difficulties of competing with the country’s enormous domestic demand for EV batteries.

“It’s not just a fear that China might act egregiously, it’s simply a fact that they have huge local demand,” said Gregory.

South Korean companies, including CATL rivals LG, SK and Samsung, are racing to reduce reliance on China for critical battery materials, from a level of more than 60 per cent today.

But in a sign of the allure of China’s cheap batteries, the Kia brand of Korean auto group Hyundai plans to use CATL batteries in a new EV model, marking the first entry of non-Korean-made batteries in to the domestic market.

Additional reporting by Song Jung-a in Seoul and Neil Hume in London

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here