Carney defends plans for carbon offset market with oversight board

Mark Carney defended plans for a new market for carbon offsets with a proposal for a governance committee to oversee what the former Bank of England governor has estimated will be worth at least $50bn by 2030.

Environmental groups have accused the Carney-led initiative of greenwashing and complained that the latest plan to address those concerns fell short.

The market initiative backed by more than 250 companies and organisations, known as the Taskforce on Scaling Voluntary Carbon Markets, released its proposals for a new governance board and new standards for trading carbon offsets.

Carbon offsets are generated by projects that reduce or remove emissions, such as afforestation. The market for offsets — which could reach as much as $100bn a year eventually, according to Carney — will help companies meet their net zero goals by paying for emission reductions projects elsewhere.

“Addressing greenwashing is precisely why this task force has been set up, and precisely why the governance recommendations it is unveiling today are so important,” Carney said on Thursday.

“The task force was established with the express intention of improving supply side integrity . . . and demand-side integrity,” he added. “Carbon markets can be catalytic in driving green innovation. This is an essential market that is coming at a critical time.”

Task force chair Bill Winters, chief executive of Standard Chartered, said that by October the task force would have in place an oversight board, a secretariat, and an external expert panel.

Some board members will be independent, some will be drawn from task force sponsors such as the Institute of International Finance, and some will be market participants. It will set criteria for the so-called core carbon principles of the offsets to be used under the scheme.

The goal of the task force is to expand and improve the global carbon offset market, by creating standardised commodity-like contracts that allow companies to buy and sell carbon offsets at a large scale.

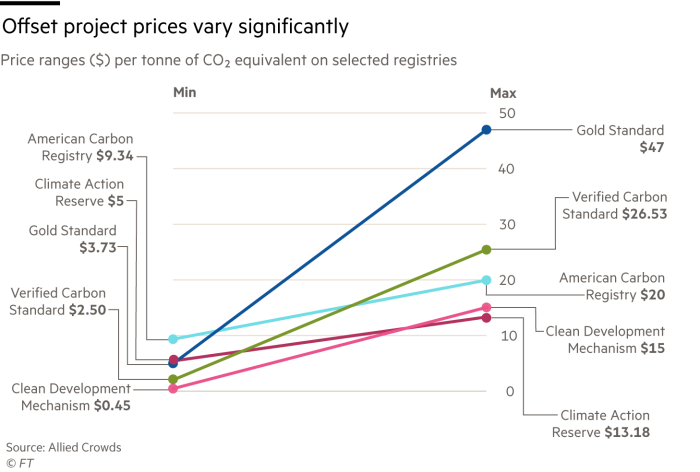

At present, there is little standardisation for voluntary offsets, which can range in price from $1 per tonne of carbon dioxide, to as much as $1,000 per tonne of carbon dioxide sequestered at a state-of-the art direct air capture project.

But several environmental groups said the latest proposals did not address key concerns about the climate change effects of the offsets, nor acknowledge the limits of the size of the potential offset market.

“This is a self-appointed group of people who are actually going to profit from this market,” said Charlie Kronick, senior adviser at Greenpeace. “So it’s a question of whether you have the fox looking after the chicken coup, frankly.”

Several previous efforts to set up voluntary carbon offset trading on a large scale failed to deliver the environmental benefits expected.

Unlike the mandatory emissions allowances that are traded by polluters in Europe, voluntary offsets instead rely on a patchwork of different verification standards to ensure quality.

The task force plan to set out core principles, would determine which carbon offsets are, and are not, to trade under its stamp of approval.

Several key elements of the core principles have not yet been decided — including how many years the carbon offset project must store the carbon, and what types of forestry projects will be acceptable.

A handful of nascent carbon exchanges have recently launched new contracts to tap into the growing market for offsets. In the UK, a task force led by Dame Clara Furse, former chief executive of the London Stock Exchange, is examining whether the City of London could play a role in global voluntary carbon markets.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here