Carbon pricing reaps $84bn but falls ‘well below’ climate goals

Governments across the world that have placed a cost on carbon emissions raised $84bn collectively in 2021, but the World Bank has warned that this is “far from adequate” in the effort to limit global warming.

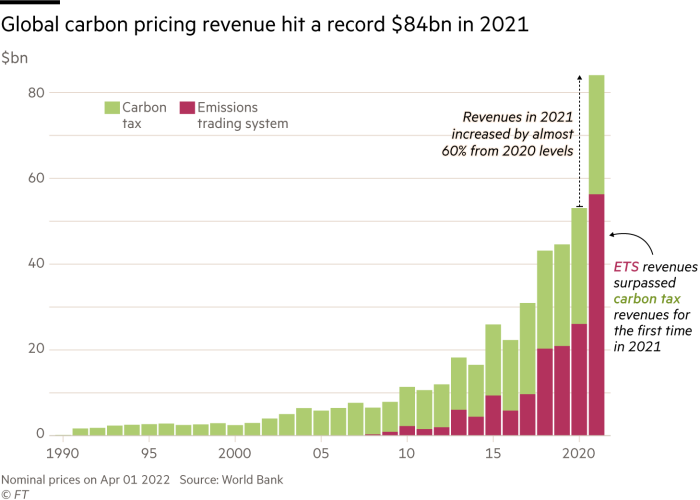

The 60 per cent rise from the previous year in the funds generated by countries charging companies for their emissions was because of rising prices and more countries deploying carbon pricing schemes, the latest World Bank report said this week.

The data on global carbon pricing revenues come as the EU looks to expand its carbon emissions trading scheme to fund its exit from Russian energy.

The EU operates the largest emissions trading scheme by value, reaping more than 40 per cent of all carbon pricing revenues last year. The buyer of allowances is permitted to emit a tonne of carbon.

The bloc’s move to raise another €20bn through the scheme has riled green groups, as the sale of more carbon permits would allow the release of about 250mn tonnes of CO₂.

Under the EU scheme, the carbon price rose to more than €80 a tonne by the start of this year, up from around €30 a tonne a year before.

While the World Bank’s report said the “impressive increase” in cash generated by such schemes showed the potential to incentivise companies to decarbonise, it also warned that it was not enough to stem the warming of the planet in line with the ideal 1.5C in the Paris agreement. The earth has already warmed by an estimated 1.1C since pre-industrial times.

Only four new carbon pricing instruments had been implemented last year, the report noted. “Despite record-high prices in some jurisdictions, the price in most jurisdictions remains well below the levels required to deliver on the Paris Agreement temperature goals,” it said.

A total of 68 regions are now pricing carbon to help reduce emissions and hit their national climate targets, or implementing a similar emissions trading scheme.

For the first time in 2021, emissions trading systems (ETS) generated more revenues than carbon taxes. Under a carbon tax regime, governments set the price per metric tonne of carbon to incentivise companies to reduce their emissions. Under ETS governments place a cap on the volume of greenhouse gases that can be emitted. Companies can often choose to buy additional allowances or sell surplus allowances to other companies.

The World Bank said the jump in ETS revenues reflected a faster rise in carbon prices among these schemes than in fixed-price instruments such as carbon taxes. It said a second factor was the increase in governments auctioning allowances rather than allocating them for free, as is the case in China.

Although China’s ETS is the world’s biggest scheme, as measured by the volume of emissions covered, the carbon allowances are allocated for free to companies and so its scheme generated no revenue.

Overall, carbon pricing schemes cover around 23 per cent of total greenhouse gas emissions. But only 4 per cent of global emissions are presently covered by a carbon price that is high enough to reduce emissions by the amount needed to meet 2030 climate targets.

Earlier this year, the UN’s Intergovernmental Panel on Climate Change report found that a 43 per cent cut to global greenhouse gas emissions by 2030, compared to 2019, would be needed to meet the goals of the Paris climate accord.

The IPCC report, compiled by 278 scientists across 195 countries, found that without immediate action the world was on track for a 3.2C rise in temperatures by the end of the century.

The World Bank noted that to date direct carbon pricing schemes, such as carbon taxes and ETS, have been concentrated in high to middle-income economies. It said that indirect schemes, such as fuel duties, were more commonly implemented than direct carbon pricing, including in many developing countries.

In the US, historically the world’s biggest emitter of greenhouse gases, only the states of California, Washington and Oregon have a direct carbon pricing scheme in place.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here