Can Tesla’s stock rally pay for Twitter?

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

-

Musk goes on the defence with Twitter

-

SoftBank’s dash for cash

-

Avaya’s debt deal gone awry

Investors go long on Musk/Twitter

Elon Musk wants you to know that he’s “not a hedge fund or private equity firm”.

But he may be creating a holding company with vast resources and otherworldly ambitions.

The Tesla chief has launched a Plan B in his fight to back out of his $44bn deal to buy Twitter, selling $6.9bn worth of shares in the electric carmaker, preparing for the event that he actually buys the company.

It’s a practical move for a billionaire accustomed to flying by the seat of his pants, Lex explains. Musk’s lawsuit to back out of the Twitter deal is two months away and he’s pressing a long-shot case based on an argument the social media giant withheld information on its fake account and bot problem.

The billionaire’s legal team has demanded that Twitter turn over the names of employees responsible for calculating the percentage of bots on the site, according to Reuters.

Twitter has pressed its stronger position by setting a Delaware trial for October. It flexed its legal muscles by subpoenaing the banks lending $13bn to Musk to finance the takeover and a slew of big-name Silicon Valley investors either funding the equity cheque or in the billionaire’s orbit, from hedge fund manager Ken Griffin to former “Spac king” Chamath Palihapitiya and PayPal co-founder David Sacks.

“In the (hopefully unlikely) event that Twitter forces this deal to close *and* some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock,” Musk wrote in a tweet on Tuesday.

Nate Anderson, the founder of short-seller Hindenburg Research, took the move as an “extremely bullish” sign that the deal will happen.

Musk just reported selling ~$2.9 billion worth of $TSLA shares.

This is an extremely bullish sign for the $TWTR deal.

We remain long. @HindenburgRes

— Nate Anderson (@ClarityToast) August 10, 2022

There have been other hints, too.

The billionaire formed a trifecta of holding companies under variations of “X Holdings” in Delaware earlier this year to facilitate his purchase of Twitter, a nod to X.com, his first online payments venture that merged with another company to become PayPal in 2000.

“I do sort of have a grander vision for what I thought X.com or X Corporation could have been back in the day . . . I think Twitter would help accelerate that by three to five years,” he told Tesla investors last week, five days before the share sales had gone through.

Musk is always a wild card. Will he use the new cash to try to negotiate a new deal, with more certainty to close?

Would Twitter entertain such a proposition, or drag out its lawsuit in courtrooms for years? Its financials and standalone value are deteriorating as the legal fight rages on.

Meanwhile, meme stocks, including Tesla, have regained lost ground, making his stock sales seem shrewd and Twitter a less costly deal than it was just a few months ago.

If Musk really plans on building a holding company for his next chapter, his next move could reveal under-appreciated skills in salvaging what otherwise looks like a disastrous deal.

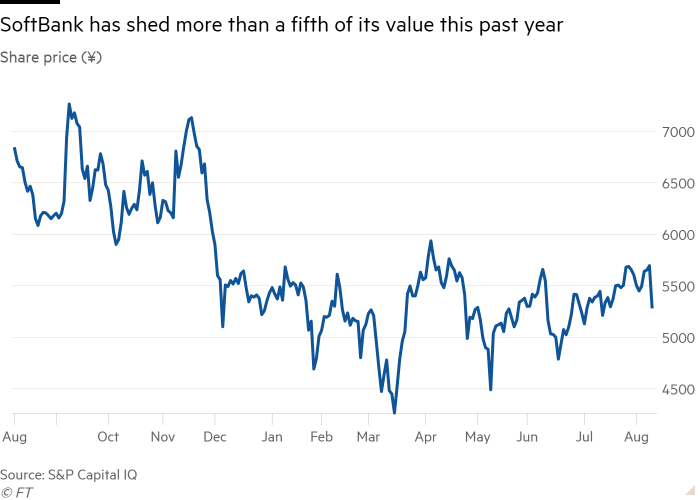

SoftBank: now what?

Every time SoftBank is in the doldrums, a similar question comes up: should it go private?

The Japanese conglomerate’s worst quarter in history has reignited the debate.

Masayoshi Son — however prone to shape-shifting — has always rejected the idea of taking his company private. Reasons for that include pressure from banking lenders including Mizuho among others.

Now that murmurs of a take-private are doing the rounds again among analysts and disgruntled investors, it’s worth looking at what would even be left in the event such a deal was possible.

Last week, we explained how SoftBank had made moves to cash out chunks of its holdings in Chinese ecommerce group Alibaba in a desperate scramble for cash.

Even then, it still had a safety line to Jack Ma’s ecommerce empire: SoftBank had made a series of complex derivative deals allowing it to raise cash on its Alibaba holdings while retaining the option to buy back the shares later.

But on Wednesday, SoftBank announced that will relinquish its right to redeem those shares, drifting further from its most successful investment.

SoftBank expects to post a gain of more than $34bn by turning over the Alibaba holdings, bringing its 23.7 per cent stake at the end of June to 14.6 per cent by the time the settlement process is completed in September. That is below the threshold required to retain its board seat at the Chinese group.

It’s also preparing to sell off other parts of its business such as Fortress Investment Group, the asset manager it bought in 2017, and Arm Holdings, the UK chip designer that it plans to take public by the end of the first quarter next year.

The moves will leave SoftBank to focus more exclusively on its two Vision Funds.

But the two funds have been battered by collapsing global tech valuations and many of its private holdings may still face further writedowns. Son is effectively betting that he has another Alibaba-type investment inside one of his two funds.

Charting a turnround will also depend on Son restoring investors’ faith in what was once SoftBank’s biggest selling point: himself.

Inside Avaya’s messy restructuring

When the checks cleared, the problems began.

Avaya, a long-storied but now troubled US telecom services company, raised $600mn in fresh capital in June through a senior loan and convertible bonds with the help of Goldman Sachs and JPMorgan Chase.

The company was facing a debt maturity next year, and the capital raised, through the gnashing of teeth, was supposed to provide some relief.

The calm only lasted a few weeks. In late July, Avaya said it was canning its then-chief executive while explaining that its already weak Ebitda forecast for the current quarter would come in a remarkable two-thirds lighter than previously forecasted.

Naturally, debt buyers were wondering how things could get so bad so fast and what the company knew when it was selling them the debt.

According to reports from Bloomberg and LevFin Insights, lawyers are now being hired by creditors to consider their options — and the options aren’t looking good, Lex writes.

The company’s $3bn of debt is unsurprisingly trading at distressed levels. Avaya’s equity value has fallen to less than $100mn and a bankruptcy filing may be in the cards as the company has issued a “going concern warning”.

As for what happened in July, Avaya said it was launching a board investigation whose results will be eagerly anticipated. DD has marvelled at the nonstop fireworks in distressed credit markets and yet, we continue to be surprised at what arises.

Job moves

-

Jan Skarbek, a senior dealmaker at Citigroup in London, has resigned from the bank, according to people with direct knowledge of the matter. Skarbek, who was named co-head of banking, capital markets and advisory in the UK and Ireland last year, had been suspended pending the outcome of a probe into allegations of misconduct at a company off-site. Citigroup and Skarbek declined to comment on the news first reported by Bloomberg.

-

Carlyle’s global head of investor relations Nathan Urquhart is leaving the private equity group to become president of hedge fund Coatue Management, according to sources. Investor relations managing director David McCann will replace him in the interim.

-

Nikola chief executive Mark Russell is retiring in January. He will be replaced by Michael Lohscheller, the former chief of Stellantis brand Opel, who joined Nikola in February as president.

-

Private equity firm Permira has appointed Klarna’s former technology chief Koen Köppen as a senior adviser to its global technology team. He is currently the technology chief of digital payments provider Mollie.

-

Houlihan Lokey has hired Adam Raucher, Deutsche Bank’s former head of capital solutions for the Americas, as a managing director in its capital markets group based in New York.

Smart reads

Gupta’s curious accounts Sanjeev Gupta, whose metals empire plunged into crisis last year following the collapse of its main funding source Greensill Capital, has gone from filing accounts signed off by a little-known audit firm to filing accounts with no auditor whatsoever. FT Alphaville pored over the latest paperwork from his Scottish smelter.

Acquisition addiction TikTok owner ByteDance can’t kick its habit for bad deals, writes Reuters’ Breakingviews. Its latest $1.5bn healthcare foray will do little to help its shaky apps business as Beijing cracks down on tech, and similar bets by rivals Alibaba and Tencent haven’t played out well.

And here’s a smart listen The venture capital bonanza is over. The FT’s Richard Waters explains why on the latest episode of Behind the Money. Listen here.

News round-up

Robinhood suffers harshest hangover after pandemic stock trading boom (FT)

Deutsche Bank’s push to tighten controls is quietly boosting costs (Bloomberg)

Mubadala, Raizen in final round to buy BP-Bunge Brazilian ethanol venture (Reuters)

Two former JPMorgan metals traders convicted at spoofing trial (FT)

Ripple Labs interested in bankrupt crypto lender Celsius’ assets (Reuters)

This political veto on City regulation can only end in trouble (FT Opinion)

Baillie Gifford has thoughts on stock selection versus natural selection (Alphaville)