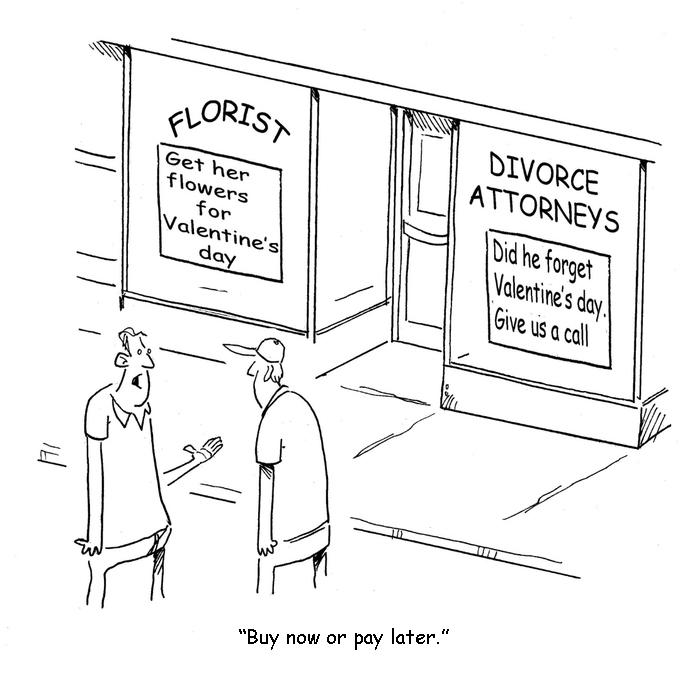

Buy now, pay later. Better with crypto?

Shoppers have flocked to BNPL (Buy Now Pay Later) over the last couple of years as online shopping has surged amid the pandemic.

Shoppers have flocked to BNPL (Buy Now Pay Later) over the last couple of years as online shopping has surged amid the pandemic.

While the idea is not particularly new, its rise in popularity among financial institutions, merchants, and consumers has been phenomenal. In fact, nearly half of all US consumers have made a purchase with a buy now, pay later option, according to a CreditKarma study.

Similar to credit cards, BNPL services like Affirm, Klarna, and Afterpay let consumers buy something today, then pay for it over time.

But one of the biggest differences with credit cards is that many do not charge any interest fees, as long as the scheduled payments are made.

Consumers can take advantage of BNPL almost anywhere, be it a regular online store or a high-end outlet. BNPL services promise convenience and an alternative to credit with no interest or surprise fees.

During the same period, the collateralized lending space within Defi has exploded. Protocols such as AAVE and Compound have pioneered the space and solidified themselves into multibillion-dollar protocols. Combining BNPL with Defi could create a way to effectively utilize the influx of capital in Defi to service off-chain borrowers.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet.

The simplicity of financing purchases at the checkout, whether online or offline, is the core value of BNPL.

While the product is similar to traditional credit products, such as installment loans and credit cards, BNPL stands out because of its smooth and real-time customer experience.

Users of BNPL services will typically buy a product or service either online or in-store utilizing the selected app of their service provider.

BNPL lets a consumer buy a product immediately and pay for it over time, usually in fixed installments. In some ways, it is a reverse lay-by system where the product or service is immediately accessible to the purchaser followed by the payments.

Today, BNPL reflects a small portion of the overall spending on payment cards (including credit, debit, and prepaid cards), an industry that sees roughly $8 trillion in annual spend volume in the US.

However, there is growing evidence that BNPL is at an inflection point. By 2026, the global BNPL industry is expected to top $1 trillion in annual gross merchandise volume. This growth trajectory has incumbents paying close attention and increasing their efforts to improve the digital user experience.

BNPL providers are delivering more value to retail partners. According to an Afterpay presentation in 2020, 83% of its retailers saw improved conversion rates, 72% had larger purchase baskets, and 66% of retailers saw improved customer satisfaction.

Much of the growth of BNPL has been driven by younger shoppers. GenZ and younger millennials have been more cautious about spending, debt, and hidden fees, compared to older generations. As digitally savvy customers, they have new expectations for financial services. They want comfort and ease of use and value goods that seamlessly interact with the other applications they use.

Until recently, only a few popular companies were offering the service, including Affirm, Afterpay, Klarna, Sezzle, PerPay, OpenPay, ZipPay and SplitIt, but a growing number of new players are entering the space.

Last year, Apple joined forces with Goldman Sachs to launch Apple Pay Later. In the UK, Revolut said you’ll soon be able to switch on a button and “your card becomes a buy now pay later product.” Last year, Monzo announced a similar service, Monzo Flex.

But BNPL has also been fueled by acquisitions. Square bought Afterpay for $29 billion in August, while PayPal acquired Paidy for $2.7 billion in September.

Temenos launched Buy Now Pay Later banking services, powered with patented Explainable AI. Temenos BNPL aims to support banks and non-banks in the creation of transparent lending programs, based on automated decisions, matching BNPL customers with appropriate credit offers, based on their history.

But we are also seeing crypto making its way into BNPL.

- Klarna’s customers will be able to buy digital assets.

- Affirm added cryptocurrencies, letting customers buy and sell digital currencies from its app.

- Uquid.com has integrated with Binance Pay to allow users to buy using more than 40 digital tokens without fees.

- XRPayNet’s crypto-powered BNPL solution, processed by the XRP ledger, ensures low transaction costs at just a fraction of a penny and ultra-fast speeds.

- BNPL Pay is taking it one step further with its decentralized lending platform to help businesses raise capital without collateral.

- AtPay is merging blockchain and crypto technologies with the BNPL concept to enable consumers to shop online and offline and use specific cryptocurrencies when paying from the platform’s native wallet.

Crypto and blockchain may be able to help BNLP services get out of the red.

While consumers are hot for BNPL, companies in the sector have lost over $1 billion in 2021. BNPL as a standalone business is probably not viable based on current figures published by the major services. While the lack of regulation has helped BNPL firms grow rapidly and keep costs down, it is inevitable this will change.

Potentially by using blockchain, BNPL services will be able to lower their costs and achieve profitability much faster. This means that there is no need for third-party payment processors, hidden charges, or late-payment fees.

BNPL services want to cater to the younger generation, mainly those opting against credit card ownership and those who are more comfortable with digital currencies as payment methods.

Potentially, it opens the door for BNPL platforms to become super apps where users can transact a range of products and services within an ecosystem where they are rewarded.

Subscribe by email to join the other Fintech leaders who read our research daily to stay ahead of the curve. Check out our advisory services (how we pay for this free original research.