Big Tech’s Jedi empire under scrutiny

The EU and UK have partnered again in a tag-team regulatory wrestling match with Big Tech. Their opponents, Google and Meta, are now being investigated over alleged collusion to increase their dominance of online advertising.

Google’s “Jedi Blue” agreement with Meta is already being probed by US antitrust investigators. It allows Facebook Audience Network (FAN) to participate in the Google Open Bidding programme, along with dozens of other companies. The duo argue this increases competition for ad placements, and the increased demand for publishers’ ad space means those publishers can earn more revenue.

But the regulators fear rival ad services may be disadvantaged. “We’re concerned that Google may have teamed up with Meta to put obstacles in the way of competitors who provide important online display advertising services to publishers,” said Andrea Coscelli, chief executive of the UK’s Competition and Markets Authority.

Google has more than a 90 per cent share of the £7.3bn search advertising market in the UK and Meta controls more than half of the £5.5bn display advertising market.

The CMA’s co-ordinated investigation with Brussels marks the second time in under a year that the two regulators have mounted a joint assault on Big Tech, following a probe into Facebook launched in June. The European Commission and CMA are assessing there to what extent Meta abused its dominant position in the social media or digital advertising markets through its use of data.

Meanwhile, Meta is in a different kind of trouble in Russia. A criminal case was brought there on Friday after the social network changed its hate speech rules to allow users to call for “death to the Russian invaders” in the context of the war with Ukraine. Russian prosecutors asked a court to designate Meta as an “extremist organisation”, while the communications regulator said it was restricting access to its Instagram app.

The Internet of (Five) Things

1. China tech groups become propaganda tools

The internet platforms of tech giants in China, including Tencent, Sina Weibo and ByteDance, are promoting content backing Russia’s invasion of Ukraine, while suppressing posts that are sympathetic to Kyiv. This poses difficult compliance issues for foreign investors, reports Edward White, potentially conflicting with international funds’ corporate and social responsibility commitments and their public statements against the war.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

On other questionable content issues, Hannah Murphy looks at the heart-warming stories being spread on social media to cheer up doom-scrollers and Richard Waters addresses the dangers of information warfare, in Swamp Notes. John Thornhill comments on the further politicisation and fragmentation of the internet.

2. Chinese tech stocks at lowest ebb

The Hang Seng Tech Index was down nearly 9 per cent at one point on Friday, but finished 4.3 per cent lower, at its lowest-ever close. Tougher regulation at home and abroad were blamed. Five Chinese companies listed in New York were named by US regulators on Thursday as the first of as many as 270 groups that will be delisted if they do not hand over detailed audit documents that back their financial statements.

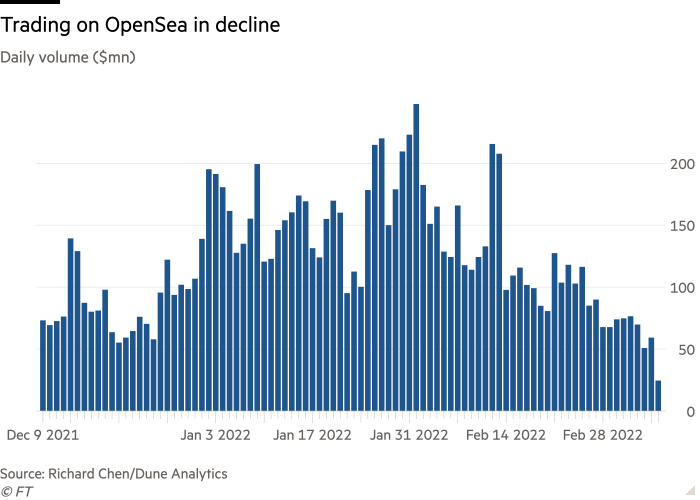

3. Are we past peak NFT?

Internet collectibles ranging from cartoon apes to artsy doodles have plunged in value as real-world conflict and a broader cryptocurrency slump begins to unwind one of the past year’s biggest speculative frenzies. The average selling price of a non-fungible token has dropped more than 48 per cent since a November peak.

4. Supply chain problems ravage Rivian

Shares in Rivian are down 7 per cent today after the Amazon-backed electric vehicle maker warned that supply chain problems would halve its production capability to 25,000 units this year. It told investors the supply chain would be a “fundamental limiting factor” in 2022.

5. WeWork co-founder Adam Neumann on his next steps

After a fall as spectacular as his rise, the charismatic salesman is back. This time he plans to found start-ups, fund others and create a new property empire, he tells Andrew Edgecliffe-Johnson.

Tech tools — Digital diet aids

My phone was controlling me, so I went on a digital diet, writes Madhumita Murgia. For two weeks, she tried to build a new healthier relationship with technology, looking at aids such as Mind over Tech’s product, a physical deck of 50 cards, and Space, an app that analyses your screen time. Check out how she fared.