Big Oil stays the course after investors flex climate action muscle

This article is an on-site version of our Energy Source newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday and Thursday

Two things to start:

1. Oil prices continue their upward march. West Texas Intermediate, the US marker, yesterday crossed the $70 a barrel threshold for the first time since October 2018.

2. US officials have recovered $2.3m worth of the ransom payment made to hackers who shut down the Colonial Pipeline last month.

Another Tuesday, another Energy Source. It is just about two weeks since Big Oil’s bad day, when the sector was hit by a string of upsets as both investors and courts flexed their muscles to demand greater action on climate.

But for all the fanfare, not much has changed, writes Justin Jacobs in today’s first item. Neither of America’s oil giants — Exxon and Chevron — are signalling strategic shifts.

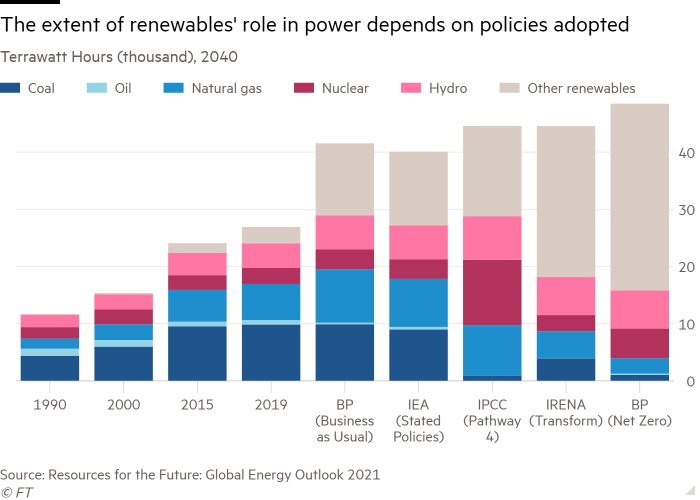

Our second item is on a report from Resources for the Future, which breaks down the plethora of scenarios on emissions and energy demand — and underlines the chasm between current trajectories and the shifts needed to meet Paris agreement goals.

Thanks for reading. Please get in touch at energy.source@ft.com — Myles

Big Oil sticks to its guns after climate defeats

The bosses at ExxonMobil and Chevron suffered stinging rebukes to their climate strategies at this year’s shareholder meetings, a sign of the significant shifts affecting Big Oil.

Yet in the wake of those defeats, neither are signalling that they intend to make a strategic about-face of the sort that has seen European rivals, including BP, Shell and Total among others, tie their fortunes to an accelerated transition to cleaner fuels.

Exxon’s chief executive Darren Woods has stayed out of public view since the shareholder meeting, but in a statement to the Financial Times following the vote he highlighted that many of the company’s 3m shareholders “supported the work that we’re doing” on climate and capital spending, before acknowledging a “desire to further these efforts”.

The tiny activist hedge fund Engine No 1 won its audacious campaign, netting three seats on Exxon’s board, a quarter of the total, in part by warning of the “existential risk” posed by a faster shift away from oil than the supermajor’s sanguine expectations of future demand.

Woods’ post-vote comments did not indicate a change of heart since the bitter proxy fight.

He defended a climate strategy focused on reducing operational emissions and laying the groundwork for possible carbon capture and storage while continuing to invest in new oil projects.

Chevron’s chief executive Mike Wirth meanwhile defended his strategy at his first appearance since losing his own shareholder battle during a virtual event hosted by the investment group Bernstein last week.

Shareholders approved a measure, opposed by Wirth and the board, asking Chevron to “substantially” reduce its so-called scope 3 emissions in the “medium- and -long term” — referring to the emissions generated from the sale of its products.

The measure gave Chevron’s management flexibility in how to achieve the goal. Wirth said the board would consider the proposal: “Enough of our shareholders said they wanted to see something happen here that we’ve got to really sit down and look at all the different alternatives.”

But he argued against winding down Chevron’s oil and gas production while pivoting to cleaner fuels — something BP and some other European majors have said they will do to meet their own targets for slashing scope 3 emissions.

“There’s a difference between making a company’s emissions footprint lighter and kind of greening the company and really helping the whole earth achieve some of these reductions,” said Wirth.

If demand did not fall, offloading oil and gas assets to “the dirtiest producer” would result in “more emissions rather than less”, he added.

“My argument would be, you should want the best producers to be meeting the most demand that they can,” Wirth said, noting that Chevron was among the producers with the lowest carbon intensity for each barrel produced.

Some analysts have pointed to BP’s sale of its Alaska business to Hilcorp as a warning of how this shift to higher emitting producers could play out. The environmental group Clean Air Task Force revealed in a recent analysis that Hilcorp, a privately held producer, was among the US’s worst methane emitters, with a leakage rate six times higher than the national average.

Jason Bordoff, founding director of the Center on Global Energy Policy at Columbia University, echoed that warning in a sharp Foreign Policy essay, arguing that “forcing oil majors to curb investment only leads to emissions reductions if global oil demand declines, too”.

Otherwise, Bordoff adds, “under-investment creates economic, political, and geopolitical risks that could actually undermine the rapid decarbonisation needed to combat the climate crisis”. (Justin Jacobs)

The need to align climate ambitions and action

There remains an enormous gulf between the lofty climate ambitions of countries around the world and existing policies on how to get there.

That is the key takeaway of a report released today by Washington think-tank Resources for the Future, which analyses a host of scenarios set out by different climate and energy bodies.

“There’s a very, very big distance between the trends that are in action now and where the system would need to go to achieve climate goals that the international community has agreed upon,” Richard Newell, RFF president and former Energy Information Administration head, told ES.

The chart below compares emissions levels under a select group of climate policy scenarios — ranging from “business as usual” to sweeping policy changes. A host of other scenarios from other organisations can be compared here.

The different scenarios underline the disconnect between far-reaching climate targets at both the national and international level and the changes that still need to be made to achieve them.

Whether or not those changes are enacted have big impacts on future demand for both fossil fuels and renewables. A few takeaways:

-

Wind and solar are set for take-off under practically every scenario. The difference is the speed and scale of the take-up — which is accelerated under the more ambitious pathways.

-

Conversely, coal demand declines in scenarios across the board. At stake is the pace of that decline, with the industry trudging along for a while longer under current policies, but rapidly fading from view under ambitious scenarios. “The basic message for coal is: ‘are we in a world where coal levels off and gradually declines, or are we in a world where coal rapidly declines and has basically already peaked?’,” said Newell.

-

Oil consumption under current policies looks set to even out and flatline. But under far-reaching policies to contain warming, it tumbles.

-

The path ahead for natural gas consumption is the least clear cut, given the debate over its role in the energy transition. Some transition scenarios envisage natural gas demand increasing as economies switch away from dirtier coal. Others see natural gas sidelined as just another fossil fuel. “In many ways natural gas has one of the most uncertain futures — from, significant expansion to decline,” said Newell.

The transition has reshaped the way the world sees the energy future. GDP and population growth are no longer the key factors shaping how analysts calculate demand pathways: climate policy outweighs everything else.

And those demand pathways have changed significantly over the past decade. So called “business-as-usual” scenarios in recent years showed consumption of all energy sources rising across the board. Now they show fossil fuels plateauing.

“That’s a substantial change,” said Newell. “The thing is, it’s not fast enough to meet the needs of achieving climate goals.”

(Myles McCormick)

Power Points

Energy Source is a twice-weekly energy newsletter from the Financial Times. It is written and edited by Derek Brower, Myles McCormick, Justin Jacobs and Emily Goldberg.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here