Biden’s climate law boosts US green spending but provokes Europe

Joe Biden’s multibillion-dollar Inflation Reduction Act has delivered a big green bonus for climate experts and US business while infuriating America’s trading partners.

The bill, passed last summer by the US Congress, earmarked $369bn for clean energy and climate-related projects, provoking a litany of complaints from EU governments who claim it violates trade rules and distorts competition.

But business leaders and US climate envoy John Kerry argue that instead of expecting major concessions from the US, the EU and other partners need to take urgent steps to make their own green investment conditions more attractive. The alternative could be lost business and slowed efforts to address climate change.

European companies that are already drawing up plans to boost US spending include BMW, Italian energy group Enel and Norwegian battery group Freyr.

“The basic issue is that the US has created a business case for investment in green technologies,” said Luisa Santos of BusinessEurope, a corporate lobby group based in Brussels. The EU faces more complex regulation and higher energy costs, which “is a very substantial incentive to go to the US”.

What is the Inflation Reduction Act supposed to achieve?

By offering companies billions of dollars — largely through a system of tax credits — the law aims to jump-start investment in new and nascent clean energy technologies. It also rewards companies for setting up in the US, and for reorganising supply chains to be located either in the US or among allies and partners.

The aim is the government subsidies will accelerate the pace at which new technologies become widely available and affordable, as well as create a new economy of “green jobs” in the US while reducing reliance on China.

Aside from its ambition to scale up a domestic US green industry, Washington has one eye on its Paris Agreement climate commitments.

An analysis by Rhodium Group, an independent research group, estimated the IRA could put the US on track to reduce greenhouse gas emissions by 31-44 per cent by 2030 against its 2005 levels, going some way towards the country’s 50-52 per cent Paris goal. This is compared with a low 24-35 per cent reduction without the legislation.

The hope, says Paul Bledsoe, a former Clinton White House climate adviser, is that the tax incentives and public money will “unleash trillions of dollars in new private sector investment”.

Why are companies excited?

There are broadly two types of subsidy: for companies and for consumers. While most of the money is handed out through the US tax system, there are also some grants and loans in the mix.

According to analysis by McKinsey, the bulk of the climate funding is slated for private companies, who will receive about $216bn of the tax credits.

In addition, many of the consumer tax credits are increasing the potential customers for cleaner products. For example, a tax credit of up to $7,500 is available for buyers of electric or hydrogen-powered cars for anyone earning less than $150,000 a year.

There are also tax credits available for making homes greener and upgrading appliances to more energy-efficient versions.

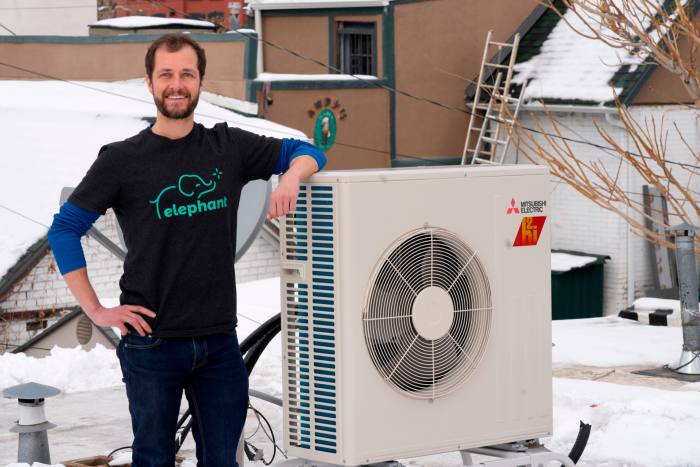

One-off tax rebates of between $1,200 and $8,000 each are available for homeowners to install energy-efficient heat pumps, and improve the insulation and electrification of their homes.

Why the complaints from overseas?

Washington is using the money to incentivise business to cut China out of the supply chain and boost US manufacturing. But that has implications elsewhere.

For an electric car to be eligible for the full tax credit, it has to be made in North America, and specific percentages of its battery components and critical minerals have to be extracted or processed in the US or countries with a trade agreement with the US.

The EU has set up a task force with the US to soften some of the impact of rules requiring North American sourcing. But a swath of makers of electric vehicles and batteries have already announced investments in the US as they anticipate demand for more affordable EVs from US buyers.

Among them are large European companies. BMW announced a nearly $2bn investment in South Carolina late last year, for example, as it expands its existing plant and builds an additional battery plant nearby. In Georgia, the Freyr announced a $1.7bn initial capital investment late last year.

Enel also announced it would build a solar photovoltaic cell and panel factory in the US.

Since the IRA’s passage at least 20 new or expanded clean energy manufacturing plants have been announced in the US, according to the American Clean Power Association.

How is Europe going to fight back?

EU officials expect some concessions from the US in the area of electric vehicles and batteries, but they accept the overall thrust of the US regime will not change.

Accordingly, the EU is scrambling to make conditions on the continent more amenable to green investment. This will involve softening rules limiting public subsidies for green technologies, speeding up permits for new wind farms and solar panel arrays, and potentially mustering pools of cash to incentivise spending.

European Commission officials contend that the union already has major sources of green investment on tap. EU capitals must devote some 37 per cent of their spending under the €800bn NextGenerationEU post-coronavirus pandemic recovery scheme to the green transition. In addition, about €100bn of the EU’s 2021-27 cohesion plan, which boosts regional development, is expected to be green spending.

But business leaders complain that the EU programmes are laborious and time-consuming to access, especially compared with the simplicity of tapping into federal tax credits under the IRA.

European Council President Charles Michel has called for existing EU funds to be deployed more quickly and for it to be easier to “rechannel” money to new priorities. But that is by no means easily achieved given the need to get buy-in from multiple institutions and nations.

And while he and other EU officials vow to summon up fresh funding to counter the US handouts, they face opposition from frugal member states, among them Germany and the Netherlands.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here