A ‘launch pad’ to China’s green economy?

This article is an on-site version of our Moral Money newsletter. Sign up here to get the newsletter sent straight to your inbox.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

Some breaking news to start: the First Movers Coalition, launched last year to help build markets for clean technologies, has unveiled a significant expansion at the World Economic Forum’s annual meeting in Davos. Seven countries are joining, including India and Japan, while the number of companies in emissions-intensive sectors committing to buying zero-carbon technologies has almost doubled.

That is “an incredibly important demand signal” to help unleash the trillions of dollars of investment needed for the climate transition, says Rich Lesser, global chair of Boston Consulting Group. It is also a reminder that, for all the rightful attention on the war in Ukraine, Davos has not lost its focus on the climate.

Indeed, it is difficult to overstate just how mainstream the environmental, social and governance agenda has become this year in Davos. A decade ago, these topics were a fairly niche area. Now about half of all sessions have some loose ESG theme. Or as one WEF official said: “The people working on ESG used to have to say, ‘Listen to us!’ and there was often a sense we were being patted on the head. Now we are in the centre.”

This is not necessarily welcome for all ESG enthusiasts: the prominence of these themes is swelling a backlash in some quarters, and the sheer multitude of sessions means many are overlapping. But, if nothing else, it helps explain why so many ESG teams have turned up in Davos — and are likely to be pitching to return next year. Read on for more highlights of a second day of intense discussions here in the Swiss Alps. (Gillian Tett and Andrew Edgecliffe-Johnson)

Davos day two in brief

-

The OECD’s landmark deal to raise more taxes from multinationals has fallen behind schedule, said Mathias Cormann, the organisation’s secretary-general. Citing “difficult discussions”, Cormann said there was now no chance the deal would be implemented next year, as originally planned.

-

Frozen Russian assets could be used to fund reconstruction in Ukraine after the war, said European Commission president Ursula von der Leyen. “We must leave no stone unturned, including if possible, the Russian assets we have frozen,” she said.

-

European Central Bank president Christine Lagarde played down the risk of recession in the continent, but said the ECB would move cautiously in scaling back monetary stimulus amid surging inflation. “We don’t have to rush and we don’t have to panic,” she said.

HKEX: a new green gateway to China?

There is only one delegation from Hong Kong attending Davos this year because of the territory’s Covid-19 restrictions (among other things). That is the mighty Hong Kong stock exchange, which has long been a prominent delegate at the event. Unsurprisingly, the exchange has been telling participants that it remains open for business, notwithstanding the pandemic and political turmoil. However, it has also been seeking to promote another, somewhat striking message: HKEX hopes to be a green gateway for international investors wanting to tap into the ESG-friendly parts of China.

More specifically, HKEX is seeking to make itself a bridge to what is known as the “GBA” — Greater Bay Area — of China, which has about 80mn residents and a rich ecosystem of dynamic start-ups, many of which are focused on green tech and other cutting-edge areas of climate transition. “We are using this sustainability and green focus as a key connection into China,” Laura Cha, chair of HKEX, told Moral Money.

It may turn out to be a fruitful marketing strategy. But there is competition: John Tuttle, vice-chair of the New York Stock Exchange, told a Davos session that he is constantly telling Chinese companies seeking listings on the NYSE that they need “to have a good grasp of ESG and be reporting on sustainability and carbon footprints, since that will attract institutional investors”. Indeed he estimates that 40 per cent of investors now focus on this when they look at listing. The green battle between HKEX and NYSE is on. (Gillian Tett)

Nature accounting heads down the track

Right now, many companies are frantically bracing themselves for new accounting reforms emanating from the International Sustainability Standards Board and the Task Force on Climate-Related Financial Disclosures (TCFD). Opinions about the merits of these groups are mixed: while some big companies and banks welcome them, there has been plenty of gossip in Davos about the coming backlash against these new reporting burdens from parts of the corporate world.

However, there is another set of standards coming down the track that companies need to be aware of: the Taskforce on Nature-Related Financial Disclosures (TNFD). Officials from this body told Davos delegates this week they will be issuing a preliminary blueprint next month that lays out how corporate boards could, or should, incorporate biodiversity issues into their corporate accounts, to recognise the cost of consuming natural resources and put a price on nature.

David Craig, who is spearheading this initiative, freely admits this is not going to be as simple a task as using TCFD since the latter focuses primarily on one metric — carbon emissions — while the former is chasing multiple goals. But the TNFD group is deliberately trying to model itself on the TCFD strategy, albeit with some twists. Instead of using Scope 1, 2 and 3, for example, the TNFD is likely to focus on distinguishing between “upstream” and “downstream” supply chain issues, Craig said.

Meanwhile, the pressure on companies to look at these issues is rising, given that 50 per cent of global GDP is closely tied to natural resources, according to the WEF. And some companies, such as the Swiss cement group Holcim, are already embracing the concept — not least because Swiss ministers told the Davos meetings they are likely to look at making TNFD compulsory in some form in the years ahead. Watch this space — and the TNFD report next month. (Gillian Tett)

Quote of the day

Environmental disclosure standards will do little to improve corporate practice until they are clearly linked to valuations and the effects on cash flow, according to Peter Bakker, president of the World Business Council for Sustainable Development (WBCSD), which represents 230 “forward-thinking” companies ranging from Accenture to Yokohama Rubber.

“We are building a massive system of ESG disclosure but it’s all non-cash. Cash is king. Discounted cash flows are core for shareholders and the capital markets. Sustainability has made amazing progress, but it will not scale up until the capital markets are the driver,” Bakker told Moral Money on the sidelines of the World Economic Forum.

While praising efforts to measure and harmonise environmental disclosures, he also called for broader social disclosures by companies, warning that “inequality is the next big crisis”. He added that a commission set up by the WBCSD would produce recommendations by the end of this year on how executives could tackle issues including tax, inequality, the living wage, human rights, reskilling and diversity. (Andrew Jack)

Elsewhere in ESG: tempers flare at annual meetings

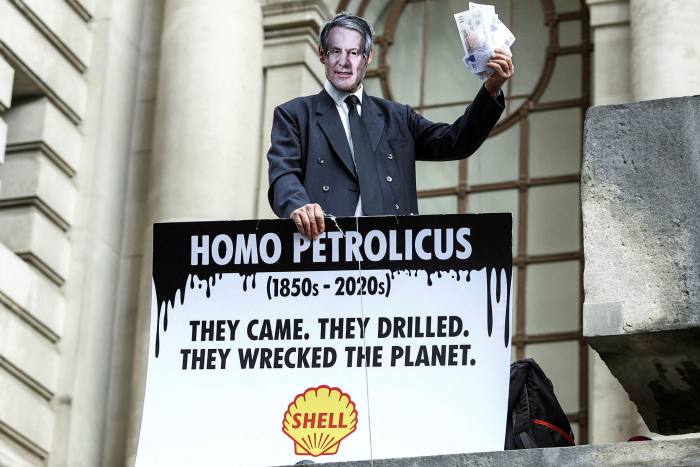

The Central Hall Westminster in London, one of the City’s swankiest event spaces, is well known for hosting the BBC’s annual New Year’s eve concerts. But on Tuesday, the hall was the site of a raucous scene during Shell’s annual meeting, where climate activists allegedly glued themselves to seats.

The AGM was delayed by almost three hours as protesters disrupted proceedings. (Read Tom Wilson’s full report for all the details, and Reuters video footage here).

Today, the demonstrations are heading for New York. About 100 religious leaders and youngsters are planning to protest outside BlackRock’s annual meeting in midtown Manhattan. The protesters are demanding that BlackRock divest from companies expanding fossil fuel production.

Wednesday marks one of the busiest days of the year for annual shareholder meetings in the US. Amazon, Twitter and Facebook will hold their meetings. All three are facing mounting pressure from companies ranging from executive pay to non-disclosure agreements. Amazon, for example, faces a whopping 15 shareholder proposals — the most it has faced since at least 2010.

Investor support is already building for the shareholder petitions at these meetings. Asset manager Neuberger Berman said this week it was voting for a content standards shareholder proposal at Meta, Facebook’s parent. Additional disclosures about content enforcement would help shareholders see if risks at the platforms were being addressed, Neuberger Berman said. Facebook recommended shareholders vote against the proposal.

Not all meetings will see fireworks. Exxon and Chevron, the climate activists’ top two targets in the US, will hold virtual meetings and conveniently dodge the disruption Shell faced.

The votes on Wednesday will indicate the impact of environmentalists’ and social activists’ campaigns at annual meetings, and whether their provocations are changing corporate behaviour. (Patrick Temple-West)

Smart Read

-

As the controversy continues to rage around remarks by HSBC Asset Management’s head of responsible investment at last week’s Moral Money Summit Europe, the FT’s Pilita Clark argues that Stuart Kirk’s speech has exposed “widespread, muddled thinking around a central aspect of climate change: financial risk”.