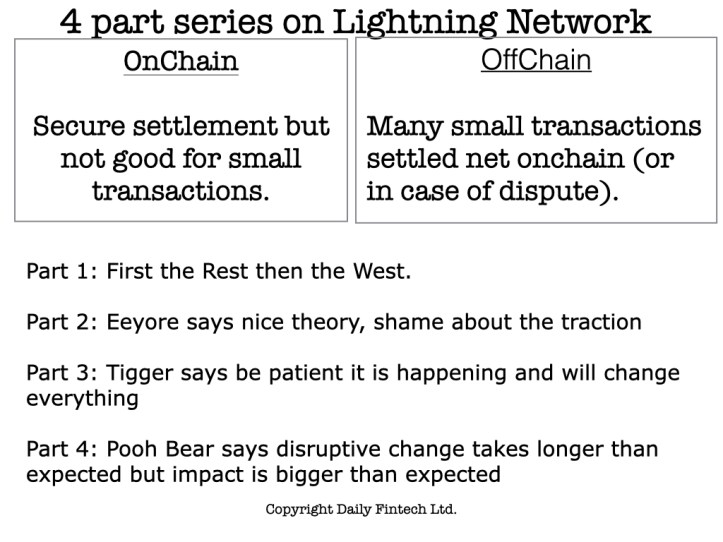

4 part series on Lightning Network Part 1: First the Rest then the West.

Lightning Network matters; if Bitcoin is ever going to become money it needs massive scalability that will enable totally new types of transaction such as micropayments, real time payments and mobile money for the unbanked. Linear scaling is not enough. It must be the kind of non-linear scaling that powered the Internet – like 100x the 2,000 Transactions Per Second that Visa routinely handles. Those transactions also need to be super reliable, lightning fast (a few seconds max) and dirt cheap.

And programmable. And permissionless.

Wow, that is a super tough scope of work!

The main hope for this is Lightning Network, which is one example of an off-chain transaction processing system.

Transactions are done off chain and settled on chain on a net basis; transactions can be enforced on-blockchain in case of dispute using parsable scripts. For more, please click here.

We devote our July 4-parter to Lightning Network, because a lot rides on its success or failure and it is complex.

In the West, where we have effective money and payments, Lightning Network is a solution looking for a problem. Startups will need to serve unarticulated needs. Unarticulated does NOT mean the needs are not real; for example, few consumers asked for streaming video until Netflix arrived and used the lightning fast, massively scalable, super reliable, dirt cheap, programmable, permissionless Internet.

Lightning fast, massively scalable super reliable dirt cheap programmable open & permissionless Bitcoin may happen and maybe Twitter will be part of enabling that innovation, but it will certainly take time.

It is different in the Rest of the World, where many currencies are failing and consumers desperately need reliable money (good store of value + currency for everyday spending + unit of account) to “put food on the table”. In these economies we are seeing both top down government approach in El Salvador and the bottom up people’s approach in Venezuela.

Enough blue sky theory. Next week Eeyore says “nice theory, shame about the traction”.

Some subjects are too complex for our short attention spans, so we do 4 posts one week apart (see here for 2,3, 4 some may not be published yet), each one short enough not to lose your attention but in aggregate doing justice to the complexity of the subject. Stay tuned by subscribing.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.

Bitcoin Bitcoin, Blockchain, Cryptocurrencies first the rest lightning network pooh corner debates