XBRL News from the UK, Ukraine and racing horses

Here is our pick of the 3 most important XBRL news stories from the last week.

1 Choppy waters or smooth sailing? The Bank of England’s move to XBRL

In the late months of 2020, the Bank of England announced that the submission of statistical data would be moved to the Bank of England Electronic Data Submission (BEEDS) portal, making it possible for firms to complete and file data submissions online. Subsequently, in 2021, the BoE confirmed that the change in the filing of statistical data would require a much bigger vessel: the move from XML to XBRL.

Despite Brexit, the old lady of Threadneedle Street still has a voice that is heard in the central banking community. Hence, the British banking sector’s transition will be carefully monitored, hopefully also in Zürich.

2 Building blocks are key: IOSCO and IFAC support for sustainability standards

Jean-Paul Servais, Vice Chair of the International Organization of Securities Commissions (IOSCO) and Chair of the International Financial Reporting Standards (IFRS) Foundation Monitoring Board, recently explored why IOSCO believes in the IFRS Foundation Trustees’ sustainability initiative and how IOSCO will support it. He spoke in a keynote address at the European Commission’s high-level conference on its proposal for a new Corporate Sustainability Reporting Directive (CSRD).

It is interesting to watch how the EU is putting its horse by the name of EFRAG in the race for the leading global sustainability standard, whereas IFRS’ horse goes listens to ISSB. We hope the co-development rhetoric is meant seriously, as the preparer and user community really cannot afford to accommodate two sets of standards with overlapping goals. Politicians may very well think so, but markets will act. Our money is on the ISSB.

3 Banks were given a transition period for financial reporting in XBRL

The National Bank has established a transition period to ensure that banks form and submit financial statements on the basis of taxonomy according to international financial reporting standards in a single electronic format.

The National Bank in question referred to in the article above (in the original Ukranian, to give you an opportunity to practice your translation button hitting skills) is not the Bank of Russia for once, but of neighbouring Ukraine. The region’s banking regulators are obviously cranking up the speed of change in digital reporting.

—————————————————————

Christian Dreyer CFA is well known in Swiss Fintech circles as an expert in XBRL and financial reporting for investors.

We have a self-imposed constraint of 3 news stories each week because we serve busy senior leaders in Fintech who need just enough information to get on with their job.

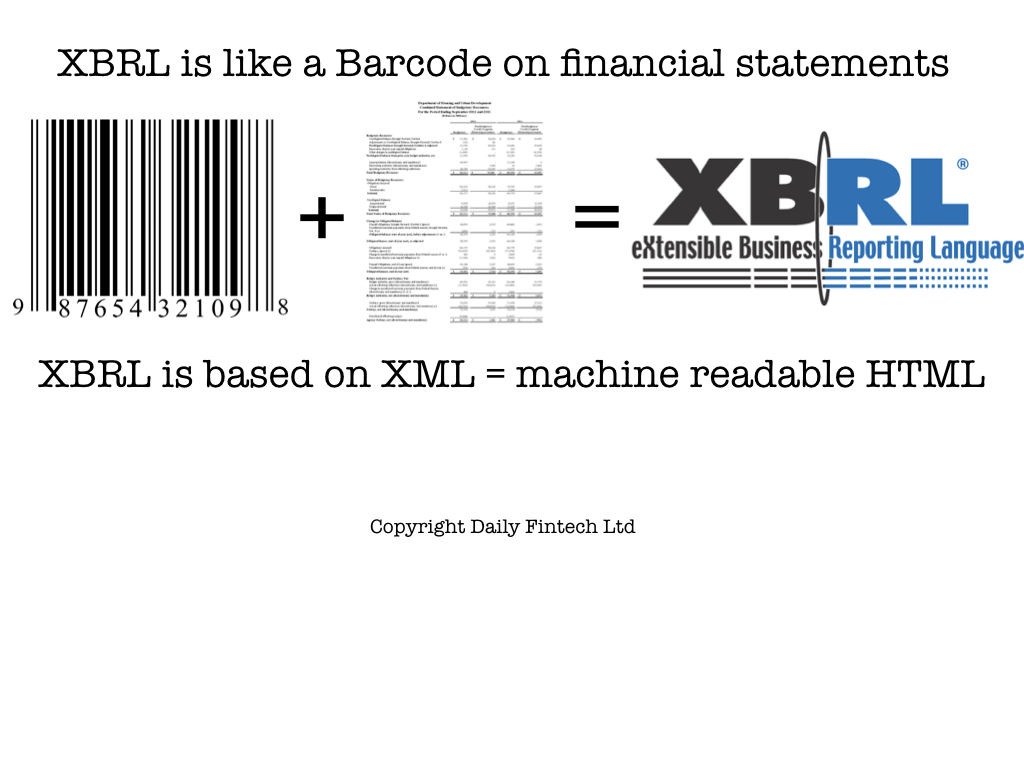

For context on XBRL please read this introduction to our XBRL Week in 2016 and read articles tagged XBRL in our archives.

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just USD 143 a year (= USD 0.39 per day or USD 2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.