XBRL News from Oman, about strong results and important standards developments

Here is our pick of the 3 most important XBRL news stories from the last week.

1 Oman prepares to launch XBRL disclosure portal

The final countdown to XBRL reporting in Oman has begun! Oman’s Capital Market Authority (CMA) and its stock exchange, the Muscat Securities Market (MSM), has organised a second round of workshops in preparation for the launch of its new disclosure portal, which will enable the reporting of both financial and non-financial information in XBRL format.

Good to see yet another market joining the world of digital reporting!

2 Workiva announces second quarter 2021 financial results

“We beat guidance for revenue and operating results,” said Jill Klindt, Chief Financial Officer. “Due to continued broad-based demand and the resulting top-line growth, we are raising our full-year revenue guidance range to $430 million to $432 million.”

Workiva continues to be on a roll. Strong revenue growth, client base expansion and rising gross margin provide the basis for further extension of Workiva’s leadership position. Another interesting, but not trivial to pull off right development is its launch of a SaaS marketplace platform recently. Note that this author has a commercial interest.

3 IFAC, AICPA, CIMA support ISSB formation to set sustainability standards

The International Federation of Accountants (IFAC) reiterated its support for the changes, stating: “With its independence, good governance, and track record of due process, the IFRS Foundation is uniquely positioned to establish an independent ISSB within existing IFRS governance,” and noting the importance of the proposed multi-stakeholder expert consultative committee in getting all the right people round the table. It strongly welcomed the IFRS Foundation’s proposed four-point strategy, of focusing on investors, prioritising climate, building on existing initiatives and taking a building blocks approach.

The advent of truly standardised, mandatory, audited and therefore comparable and decision useful sustainability reporting standards is making great strides. EFRAG’s work is already progressing, but with its much wider remit and stakeholder footprint, it remains to be seen whether it can hold its head start.

—————————————————————

Christian Dreyer CFA is well known in Swiss Fintech circles as an expert in XBRL and financial reporting for investors.

We have a self-imposed constraint of 3 news stories each week because we serve busy senior leaders in Fintech who need just enough information to get on with their job.

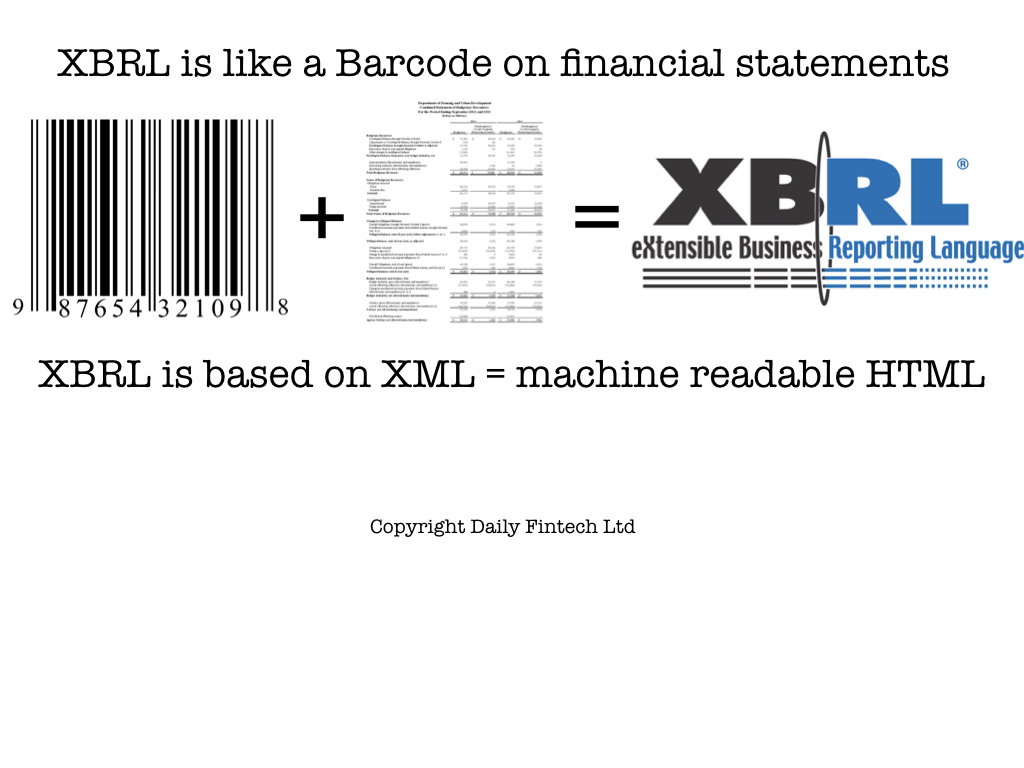

For context on XBRL please read this introduction to our XBRL Week in 2016 and read articles tagged XBRL in our archives.

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just USD 143 a year (= USD 0.39 per day or USD 2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.