XBRL News about regtech and the USA

Here are the three most relevant developments in the world of structured reporting we became aware of in the course of last week.

1 2022 Regtech outlook

2 Coming soon: Structured data requirements for investment companies

On April 8, 2020, the Securities and Exchange Commission (the SEC) adopted rule amendments to require business development companies (BDCs) and closed-end funds registered under the Investment Company Act (Registered CEFs, and together with BDCs, the Affected Funds) comply with certain structured data and Inline XBRL requirements.

The scope of application of XBRL in regtech is ever expanding.

3 Tagging for finance lease liability, future payments, and …

Staff in the Commission’s Division of Economic and Risk Analysis has observed that some filers are not appropriately tagging disclosures about their finance lease liability, undiscounted future lease payments, and the excess amount of the undiscounted future lease payments over the finance lease liability (i.e., imputed interest).

The US SEC continues to offer detailed guidance on how to tag data – which is necessary to make the information as useful and usable as can be.

—————————————————————

Christian Dreyer CFA is well known in Swiss Fintech circles as an expert in XBRL and financial reporting for investors.

We have a self-imposed constraint of 3 news stories each week because we serve busy senior leaders in Fintech who need just enough information to get on with their job.

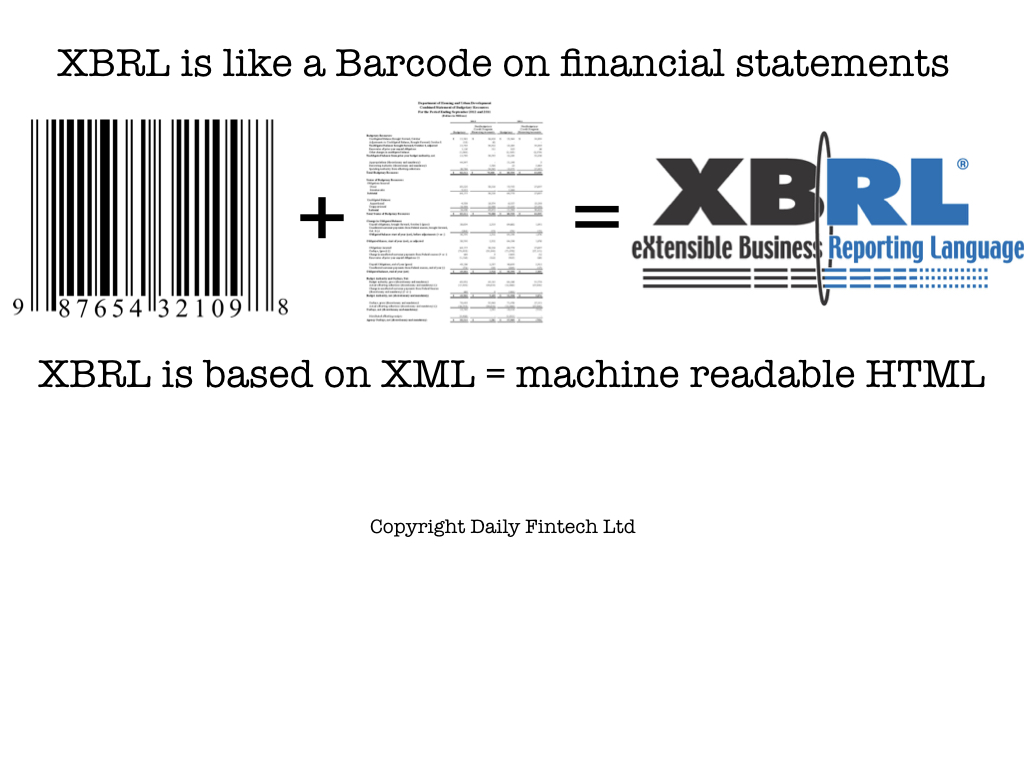

For context on XBRL please read this introduction to our XBRL Week in 2016 and read articles tagged XBRL in our archives.

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just USD 143 a year (= USD 0.39 per day or USD 2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.