XBRL News about case studies, structured data and Oman

Here are the three most relevant developments in the world of structured reporting we became aware of in the course of last week.

1 A broader and deeper use of structured data

2 CMA joins XBRL International and launches XBRL platform

The Capital Market Authority (CMA) joined the XBRL International concurrently with the launch of the XBRL platform as part of the CMA’s strategy to prepare for an appropriate investment environment to enhance the performance of the capital market and insurance sectors through continued development of the legislative and technological systems related to disclosure of the issuers of securities and insurance companies in line with the Oman Vision 2040 to reach digital transformation which is a requirement to ease the services for all the parties as an important part of the national priorities.

The introductory paragraph actually is just one sentence, would you believe it.

3 Data how you need it: XBRL US case study explores huge RoI

XBRL US recently published yet another interesting case study, this time examining how Liberty Mutual Surety has used XBRL to automate the generation of structured, normalised data in the format the company requires.

These case studies are always valuable reminders of the optionality for value creation introduced by generic mandates for structured data reporting. Yes, thinking about you, Switzerland …

—————————————————————

Christian Dreyer CFA is well known in Swiss Fintech circles as an expert in XBRL and financial reporting for investors.

We have a self-imposed constraint of 3 news stories each week because we serve busy senior leaders in Fintech who need just enough information to get on with their job.

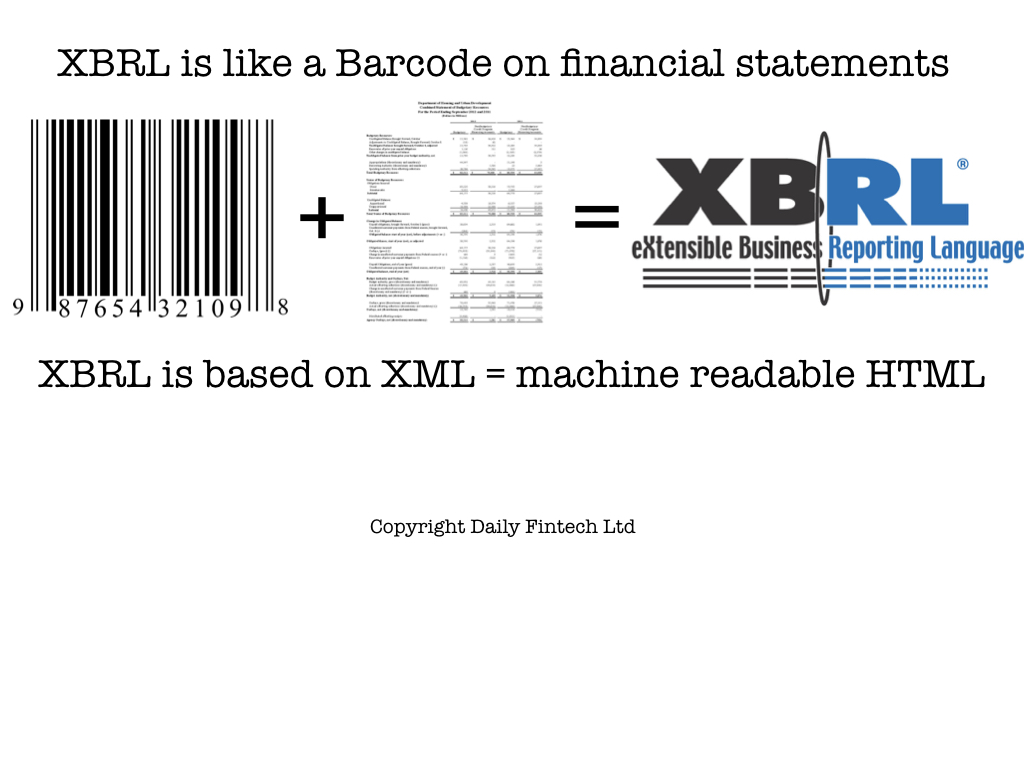

For context on XBRL please read this introduction to our XBRL Week in 2016 and read articles tagged XBRL in our archives.

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just USD 143 a year (= USD 0.39 per day or USD 2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.