US curbs China investment and iPads head to Vietnam

Hello, this is Kenji from Hong Kong. Normally at this time of year, the city would be preparing to mark the anniversary of the Tiananmen Square crackdown on pro-democracy protesters that took place on June 4, 1989. But Beijing’s tightening control of the city means that for a third year in a row, no major commemorations are being planned.

Another date involving the Chinese military, however, is also coming up: On Friday, a US ban on investment in companies linked to China’s armed forces is set to take full effect. Thirty-three years on from Tiananmen, it is another reminder of how the US is still grappling with its relationship with Asia’s leading economy.

Elsewhere this week, we have learned that Apple is shifting part of its iPad production from China to Vietnam after lockdowns in and around Shanghai caused turmoil throughout the supply chain. Venture capital funds are also moving away from China, turning their attention instead to tech start-ups in south-east Asia and India.

Crunch time

This coming Friday marks the deadline for US individuals and entities to divest from Chinese companies deemed to have links to the country’s military.

It is a date Beijing has been preparing for, writes Nikkei Asia’s Kenji Kawase.

The sanction originated under the previous Trump administration and was taken up by President Joe Biden a year ago. During that time, the number of blacklisted companies has grown from 31 to 68.

Among them is AI solutions provider CloudWalk Technology. The company listed on the tech-heavy Shanghai STAR Market last Friday, and its shares soared 78 per cent from their offer price in their first days of trade.

It is a promising sign for Beijing, which will be hoping that domestic investors and state funds can cushion the blow from lost US capital. Chinese tech has been an appealing target for US investors despite regularly flaring geopolitical tensions.

But there are signs that China’s tech companies themselves may be growing uncomfortable with being linked explicitly to the military-industrial complex.

China Shipbuilding Industry Group Power, another blacklisted company, has substituted the phrase “military-civil integration” with “XX” in its annual report published at the end of April — including in the name of its major investors, the National Military-Civil Integration Industry Investment Fund.

Funds rising

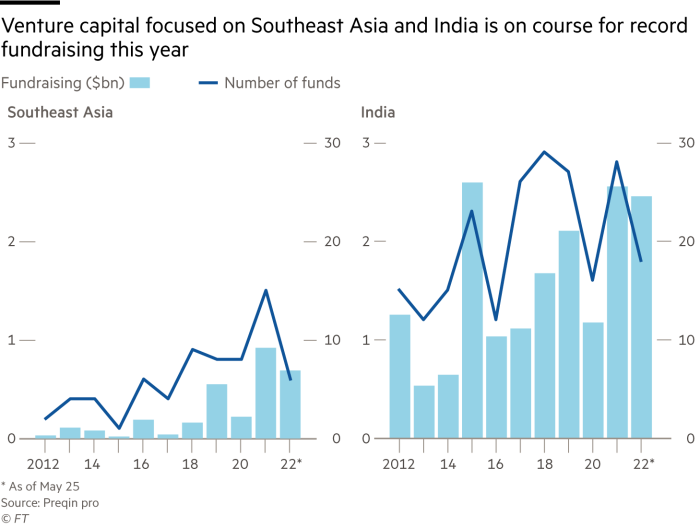

Tough new rules for tech platforms, coupled with a persistent “zero-Covid” approach, are causing venture capital firms to shy away from China, writes Nikkei Asia’s Wataru Suzuki.

VC funds focused on south-east Asia and India have already raised $3.1bn this year, nearly the same as they raised in all of 2021. China-focused funds meanwhile have raised just $2.1bn, a fraction of last year’s $27.2bn.

The watchword these days is diversification. Amit Anand, co-founder of Singapore-based Jungle Ventures, told Nikkei Asia that half of the investors he has talked to recently are trying to diversify from China. “They’ve had a fair amount of success there but are mindful about the headwinds, and hence, they wanted to put more money in south-east Asia and India.”

Pay checking

Corporate disclosures on executive pay in Japan are typically fairly mundane affairs, dominated by incremental tweaks to remuneration levels that on average tend to lag US and European counterparts, writes the Financial Times’ Antoni Slodkowski in Tokyo.

Not so at Masayoshi Son’s SoftBank Group.

Pay levels on SoftBank’s board are closely monitored for signals about the overall direction of the company, but they also serve as the latest reminder of who is up and who is down in the never-ending turf wars inside the conglomerate.

When SoftBank logged its previous worst performance on record two years ago, the pay of the head of its Vision Fund, Rajeev Misra, more than doubled, stirring controversy among employees.

But there were no such excesses when SoftBank announced pay for its directors earlier this week. It probably helps that the powerful former Deutsche Bank trader has been removed from the board, so details on his pay are not available.

Top executives at the world’s largest tech investor have had their pay cut, including chief financial officer Yoshimitsu Goto, Son’s right-hand man and the company’s financial wizard. Goto made ¥293mn ($2.3mn) in the fiscal year that ended on March 31, down from ¥480mn a year earlier.

Son’s pay stayed the same — a “dismal” ¥100mn — but analysts say that’s largely irrelevant given the billions of dollars he has tied up in the group’s shares. He owns about a third of the company.

In general, the disclosures are in line with the message Son has been sending since the Vision Fund revealed a historic annual loss of ¥3.5tn in May: we are more conservative, more prudent, more cautious.

Subtle shift

Apple is shifting some iPad production from China to Vietnam for the first time ever, according to this scoop by Nikkei Asia’s Cheng Ting-Fang and Lauly Li. Even though initial volumes are expected to be small, the move highlights the importance of Vietnam for Apple in its ongoing quest for supply chain stability.

The move — mooted last year but delayed by Vietnam’s own COVID surge — also reveals the vulnerabilities in China’s complex tech supply chain. To guard against further turmoil, Apple is also asking suppliers in China to build up extra inventories, though how enthusiastically they will respond remains to be seen.

Another interesting aspect to this story is who is helping Apple accomplish this shift: BYD. The Guangdong-based company is more known for its electric vehicles and for having Warren Buffett as an investor for over a decade. But it is also an assembler of key electronic products, and like other Chinese suppliers in Apple’s supply chain, is heading the iPhone maker’s call to diversify production. It is an ironic example of co-operation amid the rising US-Chinese rivalry.

Suggested reads

-

Xiaomi battles law enforcement and competition in India (FT)

-

Alibaba boosts local warehouse network to speed up daily orders (Nikkei Asia)

-

Sony accelerates push into car sector in diversification drive (FT)

-

Taiwan, EU to boost economic ties to secure chip availability (Nikkei Asia)

-

Intel deal with Vietnam’s Vingroup reflects shared EV ambitions (Nikkei Asia)

-

Alibaba warns of Covid hit even after beating sales expectations (FT)

-

Indonesian double unicorn GoTo posted $1.5bn net loss in 2021 (Nikkei Asia)

-

Japan’s regional banks turn to tech under pressure to evolve (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp