The Lex Newsletter: Nadella wants Activision sales more than metaverse

With 390m monthly active users, it is easy to see why the video game publisher’s numbers have appealed to Microsoft

Receive free Microsoft Corp updates

We’ll send you a myFT Daily Digest email rounding up the latest Microsoft Corp news every morning.

This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Here in San Francisco commentators are touting the mystical metaverse as Microsoft’s prompt to buy Activision Blizzard at a record-breaking enterprise value of $68.7bn. But the idea of consumers playing Candy Crush in virtual reality was not what attracted chief executive Satya Nadella to the largest US-based video game publisher. The real lure was Activision’s subscription revenue — and its weak share price.

Microsoft is a $2.3tn company with $130bn burning a hole in its pocket. Foiled attempts to bag social media platforms TikTok, Discord and Pinterest mean it is reinforcing its position on gaming instead.

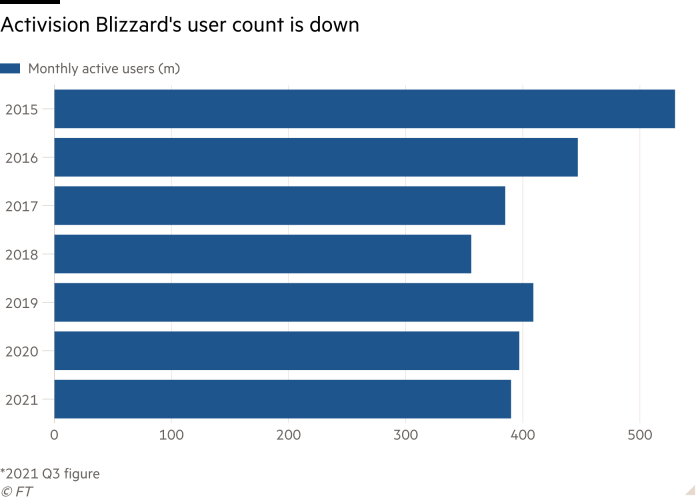

It is easy to see why the numbers were appealing. Activision has 390m monthly active users. Microsoft’s Games Pass subscription service has 25m. Adding popular Activision titles such as Call of Duty should lift that total. Making the games exclusive would crank sales up even higher and hurt rival Sony. But that would cause a backlash from players and regulators. Expect top games to remain multi-platform.

The fact that the biggest deal in the tech industry’s history involves video games should give the sector pause. Comparisons to Disney’s $71bn purchase of 21st Century Fox’s film and TV assets are a good reminder of just how big the gaming sector has become — something non-gaming commentators forget. Rival big tech companies such as Apple and Amazon are trying to build up their gaming businesses too. More acquisitions are inevitable.

Before then, here is Lex’s breakdown of the deal:

Why is Microsoft doing this?

For Microsoft, gaming is a fairly small part of the overall business. In the past fiscal year, gaming revenue increased 33 per cent to just over $15bn, driven by growth in Xbox content and sales of hardware. That was less than 9 per cent of total revenue. But as Microsoft says, gaming is the fastest-growing sector in entertainment. Activision brings PC, mobile and console games, covering all bases. And yes, OK, there’s the vast potential business of the metaverse. Though, of course, that does not yet exist.

Is Microsoft paying too much?

Activision is not running at peak performance. Monthly users are down from 530m in 2015. Titles due this year have been delayed. Accusations of a toxic workplace have hammered the stock price.

However, the company still has some of the world’s most popular games and boasts a 40 per cent operating profit margin. Plus, the share price decline means Microsoft has secured a discount. It is buying Activision shares for $95 a piece. That may be a 45 per cent premium on Friday’s closing price but it is almost a tenth below last year’s record high.

Will regulators let the deal go ahead?

Lawmakers and regulators are on the lookout for monopolies in the tech industry. Microsoft has already made some large gaming acquisitions, buying ZeniMax Media in 2020 and Minecraft maker Mojang in 2014. Buying Activision will make it the third-biggest video game publisher in the world, behind Sony and Tencent. But it will not be the largest. We will have a long wait to find out if this will placate regulators. The deal is expected to close some time in Microsoft’s 2023 fiscal year, which ends in 18 months.

How will Activision be run?

Microsoft has a habit of allowing the big companies it buys to operate independently. See LinkedIn, acquired in 2016 for $26bn. Being left alone would be popular with some gaming creators. But the company’s workplace problems demand change.

A lawsuit filed last summer accused Activision of ignoring complaints by female employees of harassment and discrimination. Critics say the management led by chief executive Bobby Kotick should have acted decisively.

This is a difficult subject for Microsoft. Last year, shareholders backed a protest vote demanding the company reveal more about its own handling of sexual harassment claims. If the deal goes ahead, expect Kotick to step aside. Note that his carefully worded statement did not say he would be chief executive after the acquisition. A clean-up operation would then begin.

Enjoy the rest of your week,

Elaine Moore

Deputy Head of Lex

If you would like to receive regular updates whenever we publish Lex, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Get alerts on Microsoft Corp when a new story is published