Stablecoin News for the week ending Wednesday 28th July.

Stablecoins are spooky!

Here is our pick of the 3 most important Stablecoin news stories during the week.

This week we saw a lot of talk from regulators about what we should be scared about, but it remains unclear if and what they will ever do.

Stablecoin Regulations Are Coming Soon – CoinDesk

Part of the problem is when the gamekeeper turns into the poacher, if the regulators decide to leap into the provision of stablecoins such as CBDC, who is going to protect our privacy when the protector is also the issuer, operator and regulator? Well maybe there is a technology solution, this paper lays out a technical architecture where you don’t have to trust humans because it is all in the code. Sounds familiar, a bit like Bitcoin for Central Bankers!

“Abstract. Most central banks in advanced economies consider issuing central bank digital currencies (CBDCs) to address the declining use of cash and to position themselves against increased competition from Big Tech companies, cryptocurrencies, and stablecoins. One crucial design dimension of a CBDC system is the degree of transaction privacy. Existing solutions are either prone to security concerns or do not provide full (cash-like) privacy. Moreover, it is often argued that a fully private payment system and, in particular, anonymous transactions cannot comply with anti-money laundering (AML) and countering the financing of terrorism (CFT) regulation. In this paper, we follow a design science research approach (DSR) to develop and evaluate a holistic software-based CBDC system that supports fully private transactions and addresses regulatory constraints. To this end, we employ zero-knowledge proofs (ZKP) to impose limits on fully private payments. Thereby, we are able to address regulatory constraints without disclosing any transaction details to third parties.“

With all of the fuss about what is actually backing Tether and Circle stablecoins, two co-founders of the Puerto Rico-based digital FV Bank say they have become the first in history to be awarded a U.S. patent for a stablecoin design based solely on government debt.

The patent application, filed last year on the back of a pre-existing patent by Nitin Agarwal and Miles Paschini, describes their instrument as a “tokenized crypto asset backed by sovereign debt.” Its working name is Yuga Coin, which in Sanskrit means the “joining of two things,” or in this case, “generations,” Agarwal told CoinDesk in an interview on Tuesday. “We aim to create multiple stablecoins that are government-friendly, know-your-customer (KYC), anti-money laundering and Financial Action Task Force (FATF) compliant based on different currencies,” Agarwal said.

US Patent Granted to Stablecoin Concept Backed by Government Debt – CoinDesk

So in summary, while the regulators increasingly talk the talk, we have a proposed solution so that they can maybe walk the walk. In the meantime some young entrepreneurs have jumped in and promised that if you really want government money, you can have it from a private issuer and it’s called Yuga.

____________________________________________________________________________________________________________

Alan Scott is an expert in the FX market and has been working in the domain of stablecoins for many years.

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

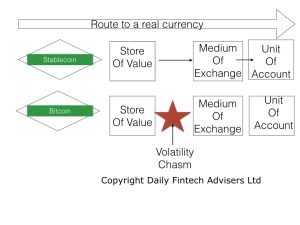

For context on stablecoins please read this introductory interview with Alan “How stablecoins will change our world” and read articles tagged stablecoin in our archives.

____________________________________________________________________________________________________________

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just US$143 a year (= $0.39 per day or $2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.