Samsung reports highest profit in 3 years on global chip shortage

Samsung Electronics has estimated that its profits jumped to the highest level in three years in the third quarter on record sales and elevated semiconductor prices.

But the upbeat earnings report from the world’s biggest producer of memory chips, smartphones and electronic displays was tempered by analyst concerns that computer chips could be entering a downcycle.

Samsung said operating profit hit Won15.8tn ($13.2bn) between July and September, up 28 per cent from Won12.3tn a year earlier. It was slightly lower than the Won16.1tn estimated by analysts polled by Refinitiv.

Sales rose 9 per cent to a high of Won73tn as surging demand for consumer electronics during coronavirus lockdowns boosted chip orders.

But Samsung’s earnings are expected to fall in the current quarter, with chip prices coming under pressure as the homeworking boom fades and economies reopen. US rival Micron Technology warned last month that its near-term memory chip shipments would slip because of parts shortfalls.

“As we enter the ‘with Covid’ era, with more people returning to normality, demand for electronics such as laptop computers and TVs is weakening,” said Kim Young-woo, an analyst at SK Securities. “Rising inflation will also drive up their production costs, which will subsequently damp demand.”

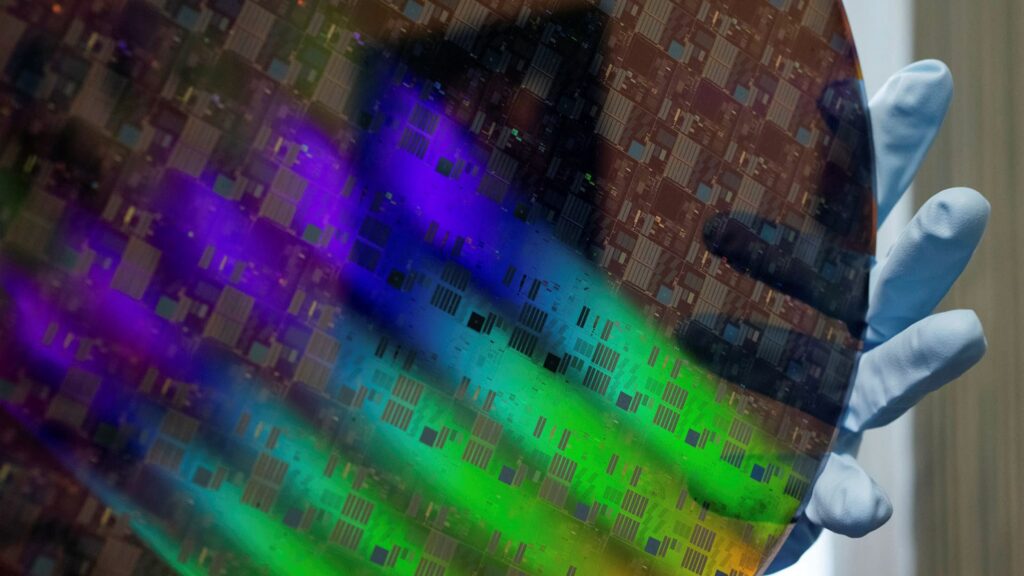

The global shortage of non-memory chips also boosted profits at Samsung’s foundry business, which is planning to invest $17bn in a new US plant for contract chip manufacturing.

Samsung shares have fallen more than 20 per cent from a January peak on concerns that the semiconductor industry could be entering a prolonged downcycle. Its shares gained 0.84 per cent on Friday morning.

The company was trading at less than 11 times forward earnings, close to its five-year average, but much cheaper than smartphone rival Apple’s 25 times.

Detailed results will be announced later this month.

“Samsung’s share price is under pressure due to worries that the semiconductor cycle will peak out and the company’s pricing power could be undermined by increasing inventories of customers,” wrote Kim Dong-won, an analyst at KB Securities, in a recent report.

But analysts projected that Dram memory chip prices would recover after a modest demand dip, as chipmakers’ supplies and inventories remained tight.

Samsung is a dominant producer of Drams, which enable short-term storage for graphic, mobile and server chips, and Nand chips. Dram chip prices rose 7.9 per cent from the previous three months, while those of Nand flash chips, which allow for files and data to be stored without power, gained 5.5 per cent, according to data from research provider Trendforce.

The launch of Intel’s new central processing unit in the second quarter of 2022 is also expected to drive demand.

“Dram prices will remain under pressure from December through March on weak demand,” said Kim at SK Securities, adding that “the price decline will be slower before a turnround in the third quarter, although Nand chip prices are likely to remain weak throughout next year”.

Samsung sold about 2m units of its new foldable smartphone, which it launched in August after slashing prices in a bid to boost sales. But mobile earnings were dented by marketing costs, while the chip shortage hampered production.

The company’s smartphone shipments fell to 69m in the third quarter from 80m a year earlier, according to Claire Kim at Hana Financial Investment, which had boosted Samsung ahead of Apple to the top of the handset leaderboard.

#techAsia newsletter

Your crucial guide to the billions being made and lost in the world of Asia Tech. A curated menu of exclusive news, crisp analysis, smart data and the latest tech buzz from the FT and Nikkei