Intel’s 2025 semi final

Technology sector updates

Sign up to myFT Daily Digest to be the first to know about Technology sector news.

This article is an on-site version of our #techFT newsletter. Sign up here to get the complete newsletter sent straight to your inbox every weekday

Intel chief executive Pat Gelsinger became its first chief technology officer in the early 2000s and I remember him explaining to me back then the significance of the “tick-tock” model he had introduced, to give the Silicon Valley chipmaker world leadership in semiconductor technology.

He was talking about a two-year cycle, where the “tick” was reducing the size of transistors to the next level or “node” of miniaturisation. That was followed the next year by a “tock”, where a new microprocessor design was introduced. The process was then repeated for the next generation.

However, that Intel clock has been running slow in recent years, with smaller optimisations introduced as well, and Samsung and Taiwan’s TSMC have overtaken the company in advanced manufacturing. When Gelsinger returned to take charge of the company in February, after a 12-year break, he said the tick-tock model was being brought back with the aim of returning Intel to leadership in 2025.

At an “Intel Accelerated” event on Monday, Gelsinger detailed the road map to 2025. It’s not as easy to explain or understand as “tick-tock”, with new naming conventions no longer having anything to do with node sizes.

As Richard Waters reports, Sanjay Natarajan, an Intel senior vice-president, denied that the change was an attempt to obscure Intel’s manufacturing issues. The company was enacting the shift to ease comparisons with rivals for customers as it moves into the foundry market, where it will make chips for other companies, he said. Qualcomm and Amazon Web Services were named as future customers.

Size doesn’t always matter, it’s performance that counts, and Intel touted new packaging and interconnection advances, along with first access to cutting-edge chip tools by 2025 that would allow it to overtake rivals.

Investors seem unimpressed, given the capital costs implied and Intel’s poor execution record in recent years. Its shares are down more than 3 per cent today.

Western governments will be encouraged though as they seek to reduce dependence on Asian chipmakers. Upgrades to Intel’s fabs in the US and Europe means access to the latest chips will soon be closer to home. That too has a cost though — Kathrin Hille explains that TSMC’s plans to open fabs in the US and Europe come with an expected 25 to 50 per cent hike in the total cost of ownership compared to Asia, weakening the business case despite the strong geopolitical forces at play.

The Internet of (Five) Things

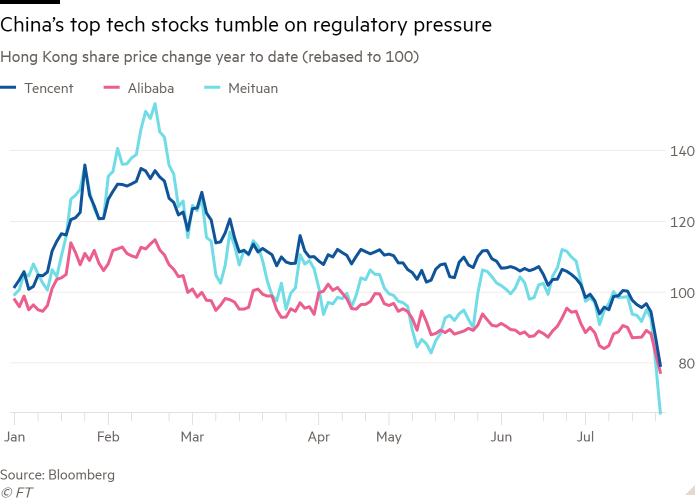

1. Chinese tech stocks sink

Chinese tech stocks plunged for a third day as investor fears mounted over a broadening regulatory crackdown, with shares of Tencent falling the most in a decade after the internet group halted registrations on its flagship app. Its shares shed 10 per cent, while ecommerce group Alibaba dropped 7.7 per cent and delivery platform Meituan dropped 17 per cent.

2. Tesla boosts profit margins

The electric carmaker overcame severe supply chain problems in its latest quarter, boosting its profit margins and pushing its revenue above Wall Street expectations. Elon Musk used the upbeat moment to announce he would no longer take part in most Tesla earnings calls. Alphaville says Tesla’s results are impressive.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

3. NSO owner’s internal battle

The private equity firm that owns the Pegasus spyware provider NSO has been stripped of control of its own fund after a dispute between its co-founders. Investors in Novalpina Capital’s €1bn fund voted this month to seize control, leaving its ownership hanging in the balance. In case you missed it, here’s our weekend profile of NSO co-founder Shalev Hulio.

4. Just Eat Takeaway risks hostile takeover

One of Just Eat Takeaway.com’s largest shareholders has called for the food delivery group to take urgent action to prop up its share price, to avoid a hostile takeover. Cat Rock Capital blamed the 27 per cent drop in the group’s share price this year on “broken communication” with investors.

5. Tiger Global burns bright in Valley

In the two decades since it was founded in 2001, Tiger Global has become one of the most profitable tech investors, holding stakes in more billion-dollar private start-ups than any other firm. But today’s Big Read looks at how the more than $70bn group has recently gained notoriety for something else: a fast-paced style of investing that has unsettled the clubby ranks of Silicon Valley venture capitalists.

Tech tools — Nothing ear (1)

The world hardly needs another consumer electronics company offering earbuds and there has been a ridiculous amount of hype ahead of the launch of Nothing’s ear (1) today. They had better be good after all this, says Wired, and “almost annoyingly, they are”, ruling out punning headlines such as “Nothing ‘ere”. Costing just £99 here or $99 in the US, they are significantly less than half the price of Apple’s AirPods but “are lighter, last longer and have a bigger driver and chamber”. There is also active noise cancelling, fast charging and water resistance. This is the first product from the London-based company led by OnePlus co-founder Carl Pei and the aesthetic is a stripped-down transparency that exposes the engineering, including microphones, magnets and circuit board. Open sales begin on August 17 across 45 countries and regions, including the UK, US and Canada.