Concerns raised on tightness of EU FDI rules amid Chinese investments

Good morning and welcome to Europe Express.

A year after tightening the bloc’s foreign investment screening regime, the European Commission put out some numbers yesterday that show most deals are still getting through. We’ll unpack the findings and what the challenges are when Chinese companies are changing their tactics in acquiring European assets.

In economic news, the commission today is publishing its assessments of each member state’s budget plan for next year under the so-called European Semester.

Later tonight, the largest group in the European parliament, the European People’s party, will vote in a secret ballot on who should succeed Manfred Weber as group chair next year. In the run are Roberta Metsola from Malta, Othmar Karas from Austria and Esther de Lange from the Netherlands.

Meanwhile, Austria’s upcoming mandatory vaccination strategy is gathering support in neighbouring Germany — at least in some parts of the country. We’ll examine the pros and cons and what further Covid-19 restrictions kick in as of today.

And Ireland’s data protection commissioner, Helen Dixon, tells Europe Express what her strategy for 2022 is when it comes to cases against large tech companies.

This article is an onsite version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday morning

Eye on Chinese investments

Not too long ago, western countries boasted of the amount of foreign domestic investment they attracted. Now they brag about how much they have rejected, writes Andy Bounds in Brussels.

Yesterday the European Commission published its first report on the FDI screening regulation, which came into force in October 2020. The report also examines actions by member states to rein in on what is seen as hostile takeovers of sensitive technology or strategic assets by companies from outside the EU.

Both the bloc as such and at a national level, Europeans have followed the US and tightened their scrutiny over fears that Chinese groups could be plundering local technology from companies or using them to further Beijing’s foreign policy aims.

Some 18 countries now have an FDI screening system and six more are planning one. The holdouts are Bulgaria, Croatia and Cyprus.

The commission only examines sensitive deals that affect more than one member state or community programmes such as the Galileo satellite system. It cannot block deals itself but can ask national regulators to do so.

Over the past year, the commission looked at 265 projects and put conditions or tried to block only eight. Officials confirmed to Europe Express that they included the purchase of Italian semiconductor company LPE by Shenzhen Investment Holdings.

On the national side, member states’ regulators looked at a total of 1,793 cases and 80 per cent of FDI projects were approved without screening. Of those screened, just 2 per cent were blocked and 7 per cent aborted by one of the parties. Some 45 per cent of cases involved US purchasers, and just 8 per cent Chinese (though the Chinese share of FDI was just 2 per cent).

But the regulation might already need adapting, warned Noah Barkin, an expert in Chinese-EU investment at Rhodium Group, a US consultancy.

“China is shifting its approach,” he said. Chinese companies prefer to build their own factories in the EU rather than gain access by buying EU ones, which tends to attract scrutiny. “Greenfield investment has hit levels last seen in 2016,” Barkin told Europe Express.

Chinese companies also look for smaller deals and use offshore structures to avoid attention, he added.

“The EU needs to remain vigilant to track the shift in how Chinese firms approach the EU market,” Barkin said.

The Wall Street Journal reported this month that Italian authorities have discovered that the 75 per cent stake in drone maker Alpi Aviation was sold via offshore vehicles to China Railway Rolling Stock Corp — a state-owned rail company — and an investment group controlled by the Wuxi municipal government.

Scrutinising deals that are structured through offshore companies would require a whole different level of resources, both at a national and EU level, however. And that is unlikely to happen anytime soon, with commission officials admitting they are already struggling with the volume of cases.

Vax muss sein

German officials long ruled out mandatory vaccinations. But with the rate of vaccine hesitancy still stubbornly high and new infections climbing, they are changing their tune, writes Guy Chazan in Berlin.

The leaders of a number of German states — Bavaria, Baden-Württemberg and Schleswig-Holstein — have now called for the imposition of a universal vaccine mandate, similar to the one that Austria is to introduce.

The prime minister of Hesse, Volker Bouffier, yesterday became the latest regional governor to come out in favour of obligatory jabs. “I think that it has to happen to permanently break these waves,” he said. All previous attempts to increase the vaccination rate had failed, he said. “Either we go from wave to wave and each time impose restrictions, or we succeed in raising the vaccination status,” he said.

Others, though, are more sceptical. “Mandated vaccinations would come too late to stop the fourth wave of coronavirus,” said Andreas Bovenschulte, mayor of the northern port city of Bremen.

Jens Spahn, the federal health minister, is also opposed.

Even without a mandate, pressure is building on the vaccine holdouts.

From today, employees will have to show either a vaccination certificate, proof that they have recovered from Covid-19, or a negative test result to attend their place of work. The same goes for passengers on Germany’s buses and trains.

Some states are going further.

Bavaria is today introducing contact restrictions for the unvaccinated, decreeing that only five people from two households can meet, not counting children under the age of 12, vaccinated people and those who have recovered from Covid-19.

Thuringia, which has been hit particularly hard by the new wave, is to close all clubs, bars and discos, as well as Christmas markets, while restaurants will not be allowed to stay open beyond 10pm.

Meanwhile, the case numbers keep rising. Germany recorded 45,326 new infections yesterday and 309 deaths from Covid-19. The number of cases per 100,000 over seven days reached 399.8 and the number of free beds in intensive care wards dropped about 300 to 2,400.

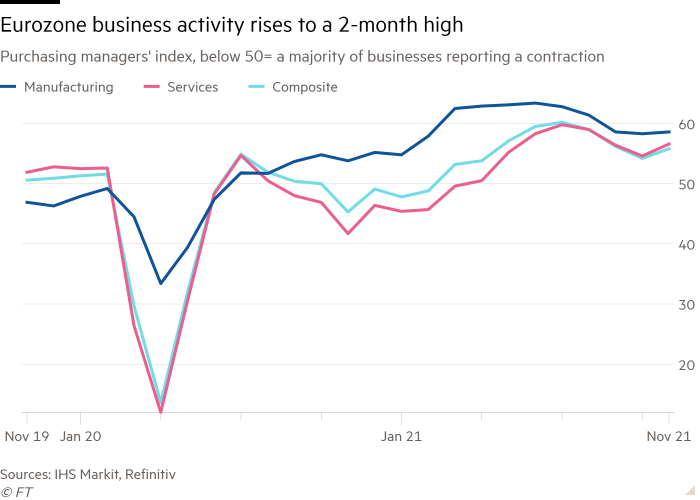

Chart du jour: Against all odds

Business activity in the eurozone picked up this month despite rising inflation driven by supply chain disruptions, rising energy costs and a rebound in Covid-19 cases. The survey showed services outperformed manufacturing for a third straight month, recording the strongest growth in activity for three months. (More here)

Going after big fish

The head of the Irish data privacy watchdog says her office will focus on high-risk cases next year, rather than pursuing every small complaint — in an attempt to stave off criticism about her alleged reluctance to go after Big Tech, writes Javier Espinoza in Brussels.

A recent analysis showed how the Irish Data Protection Commission (IDPC) had a huge number of complaints against large online platforms still unresolved. (Read about it here).

Dublin has even received harsh criticism from its peers. Ulrich Kelber, head of Germany’s data protection watchdog, recently complained that his country alone had “sent more than 50 complaints about WhatsApp” to the Irish authorities, “none of which had been closed to date”.

Now the IDPC is fighting back.

Helen Dixon, the Irish data protection commissioner, told Europe Express that she will make the enforcement of big tech cases a higher priority.

She said her office often gets bogged down with individual complaints that amount to not much as she seeks to dedicate resources to go after cases that involve the likes of Facebook or TikTok.

“Some of the complaints we deal with can take up a lot of time but they don’t expose any systemic risks and there is no significant risk to the individual,” she said, adding that the watchdog will “push back” more on such cases.

Dixon said pursuing cases on data breaches by Big Tech is “certainly one of the sub priorities” but rejected accusations that she’s not doing enough. She argued that the Irish authority became the lead enforcer only after the passing of privacy laws three years ago and that the system can only move at a certain pace.

Dixon continues to face fresh criticism, however. Yesterday, Austrian privacy activist Max Schrems accused the IDPC of trying to prohibit him from publishing material in relation to a complaint against Facebook.

“They basically deny us all our rights to a fair procedure unless we agree to shut up,” he said.

The IDPC said: “As a matter of fairness to all parties, the integrity of the inquiry process should be respected and the confidentiality of information exchanged between the parties upheld.”

What to watch today

-

EU commission publishes ‘European Semester’ on member states’ 2022 budgets

-

Belarus opposition leader Sviatlana Tsikhanouskaya speaks in the European parliament

-

European People’s party group in the EU parliament elects its new leader

Notable, Quotable

-

Wirecard fallout: Germany’s financial regulator BaFin is set to have to cut its ties to banking lobbyists and ensure it does not take orders from the finance ministry under rules being proposed by Brussels in the wake of the group’s scandal.

-

Political ads rules: The EU will unveil draft legislation aimed at curtailing the use of social media practices such as microtargeting and user profiling by forcing tech companies to share information on how they disseminate ads and target people online, or face fines of up to 5 per cent of their turnover.

-

Turkish rollercoaster: The lira suffered a historic retreat after President Recep Tayyip Erdogan praised a recent interest rate cut and declared that his country was fighting an “economic war of independence”. (Full explainer here .)

-

UK booster boost: An early booster campaign and broad immunity acquired during earlier Covid-19 waves has put the UK on a different trajectory from its continental neighbours.

Recommended newsletters for you

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET. Do tell us what you think, we love to hear from you: europe.express@ft.com.

Today’s Europe Express team: andy.bounds@ft.com, guy.chazan@ft.com, javier.espinoza@ft.com, valentina.pop@ft.com. Follow us on Twitter: @AndyBounds, @GuyChazan, @javierespFT, @valentinapop.