Amazon pins hopes on influencers to crack livestream shopping market

Amazon has stepped up plans to crack the QVC-style livestream shopping market as the $1tn ecommerce giant aims to replicate the success of social media rivals in an attempt to revive flagging online sales.

The group has been increasing investment in Amazon Live, a platform it quietly launched in 2019 but is now a central focus as it fights to grab a slice of a growing market that is viewed as the future of shopping by social media platforms.

This year, the company has hosted at least four events designed to attract more influencers to its platform, including a glitzy retreat at a Mexican beach resort. To the top names, it has offered up generous bonuses: thousands of dollars in added incentives to stream live on Amazon instead of elsewhere, according to leading influencer agencies.

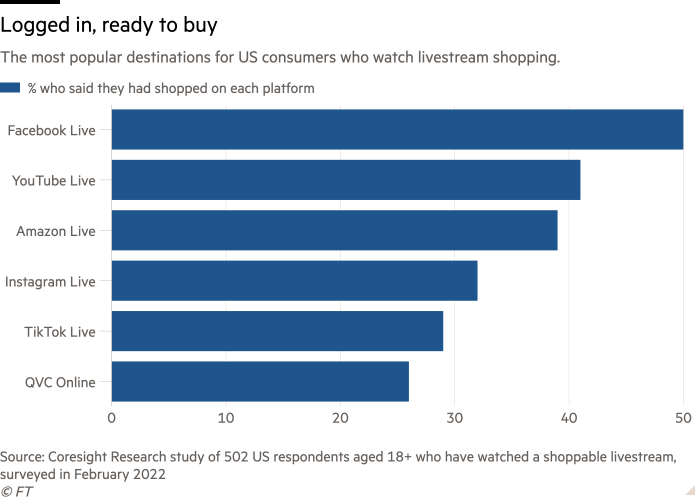

Amazon’s goal is to establish itself as the main destination for live online shopping, ahead of competing efforts from YouTube, Instagram and TikTok, but also a host of smaller start-ups backed by prominent venture capital firms, such as Andreessen Horowitz-backed WhatNot.

Each of these groups are betting that western consumers will adopt live ecommerce with the same enthusiasm as has occurred in China, where sales generated through livestreams are projected to surpass $400bn this year.

This represents about 15 per cent of all ecommerce sales in the country — up from 3.5 per cent just three years ago, according to Insider Intelligence, the research group. The model has proved lucrative for TikTok parent ByteDance — sales on Chinese sister app Douyin more than tripled year on year, selling more than 10bn products.

Wayne Purboo, the executive responsible for Amazon Live, said he believes “livestream shopping is the future of retail”.

“We know that video is a driving force in customer purchases. We know that when customers are on Amazon, they are already in shopping mode. So we wanted to lean into that,” he added.

As comfortably the largest ecommerce player, Amazon has a strong hand, said Gaz Alushi, from social media creator commerce agency Whalar, and formerly of Snap and Facebook.

“Amazon has fundamentally changed the game in terms of a seamless and non-sticky shopping experience,” he said. “Amazon Live is a very smart extension of what’s already been happening in the ecosystem.”

Alushi points to trends on TikTok where videos tagged “#amazonfinds” — meaning a product found on Amazon — have been collectively viewed more than 23bn times. With Amazon Live, Amazon is hoping to harness that virality, steering the audience to direct selling on its own platform, upping the rate of purchases.

The move is critical for the ecommerce giant as it seeks to boost flagging performance from its online store — sales fell 3.4 per cent in the last quarter to $51bn — and pushes into new areas it has been less successful with in the past, such as luxury clothing.

“Amazon has systematically squeezed the juice out of every category that it can,” said Andrew Lipsman, an analyst with Insider Intelligence. “They now have to start making inroads into all the categories that are harder and harder to sell online. Amazon is trying to port [influencers’] audiences on to Amazon Live. It’s easier said than done.”

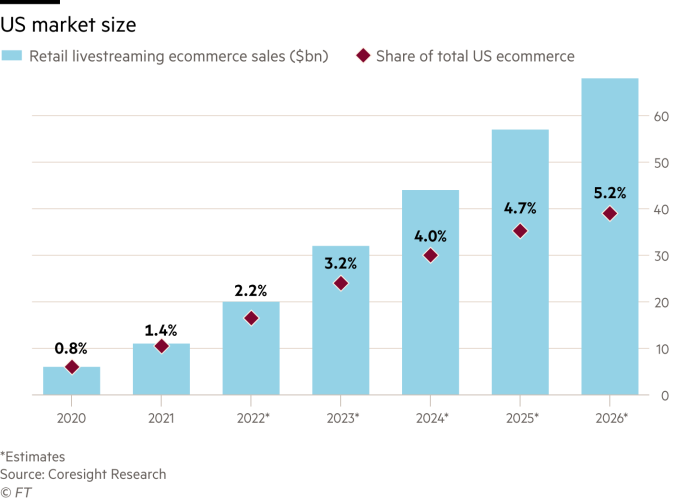

While Chinese shoppers have embraced live ecommerce, the US market is in its infancy, according to analysts. Coresight Research estimates that the value of goods sold to US consumers via live shopping streams could reach almost $70bn by 2026 — representing about 5 per cent of all online shopping — up from $20bn this year.

The success in China was “inspiring” to Amazon as it built its live platform, according to Munira Rahemtulla, the former executive at the company who lead the development and launch of Amazon Live.

“We started experimenting before [Chinese live shopping platform] Taobao Live went big,” said Rahemtulla, who left Amazon in October after 16 years. “But we were certainly inspired by what we saw there. We’d be crazy not to be. I really think there is no reason why something similar wouldn’t happen in the US.”

But replicating the model in the West has not proved easy so far. TikTok has abandoned plans to expand its live ecommerce initiative in Europe and the US this year after its launch in the UK has been hit by internal problems and struggled to gain traction with consumers.

It has yet to be established, said Lipsman, whether western shoppers are behind the curve on live commerce — or simply not interested.

“I think there has been this conventional wisdom that it is inevitable that it is going to become a major trend here,” he said. “And I haven’t seen evidence yet to suggest that’s really the case.”

On Amazon Live, typical streams on the site last for an hour or more, during which time about a dozen products can be featured, purchasable with a couple of clicks or taps, and likely delivered in two days or less.

For influencers, commissions vary: according to the rates published on Amazon’s website, a physical book earns an influencer a 4.5 per cent cut, while luxury beauty products net 10 per cent. Digital video games get just 2 per cent, unless that game happens to be from Amazon’s own games studio, in which case commission jumps to 20 per cent.

Chicago-based mother of two Lindsay Roggenbuck was one of the influencers approached by Amazon to start streaming on Amazon Live. Her TikTok videos demonstrating the various products she has bought online exploded in popularity during the pandemic, gaining a following of roughly 1mn across various platforms.

“I was very familiar with being comfortable in front of the camera and everything,” Roggenbuck said, saying she had experimented with streaming on Facebook Live. “So I was like, why not?” The terms of her agreement with Amazon forbid Roggenbuck from sharing specific details.

In selling their wares, influencers must be careful not to break strict rules. For example, when selling alcohol-related products, such as a wine opener, Amazon’s policy states streamers must avoid suggesting customers might enjoy a drink “every night”. Shot glasses for liquor cannot be described as a “must have”.

But influencers have faced issues building an audience, said Addi McCauley of influencer marketing group IZEA.

“There’s not many people,” she said, referring to the number of viewers typically tuned in to the Amazon Live homepage. “That’s why Amazon is having to go to these influencers, saying we will pay you thousands of dollars a month on top of the commissions.”

But interest from influencers in Amazon Live is slowly growing. “I would not say that it is a roaring cry yet, but we are starting to hear the volume rise,” McCauley said.