Alt Lending week ending 30th July 2021

Criminal Case Review Commission (CCRC) takes another look at alleged LIBOR rigger Tom Hayes case.

Tom Hayes has been fighting to clear his name ever since 2017 and despite not knowing the case intimately I feel a certain amount of sympathy for him. Once powerful institutions have decided that you must take the rap then it is very difficult to wriggle free even if you are as clean as the driven snow. The CCRC has agreed to consider an independent and as yet unpublished report produced by Raphael Yahalom a researcher at MIT Sloan School of Management. He apparently argues that “ the grossly inadequate” processes and policies set up by the banks are to blame for the Libor rigging scandal than individuals such as the hapless and perhaps grievously wronged Mr. Hayes. I can’t wait to read it. I was involved in the syndicated loan business in the early 1970. In those days lead managing banks deliberately sought Japanese Banks to act as reference banks for rollover pricing. Japanese banks were at the time subject to a premium over other banks thanks to very high leverage and perceived enhanced credit risk. This premium could be as high as 3/8%. Typically with three reference banks the borrower would pay an extra 1/8% over and above the agreed risk margin. The borrowers were not informed of this but the banks new full well what they were doing. It was unethical, dishonest and arguably fraudulent. I am still surprised that no class actions have been launched.

NatWest suffers because of the dead hand of government

Another very good piece by the Telegraphs Matthew Lynn about why the government should aim for a quick clean all at once break from NatWest. I agree with him. The drip drip strategy currently being pursued by the Clueless UK government might bring in a bit more money but in the meantime NatWest is left to suffer under the dead hand of government in a market that is fizzing with new technologies and ideas. Revolut a digital newcomer has a higher valuation than the tired and plodding residue of Fred the Shred’s RBS. Some years ago RBS markets alone were running nearly 400 disparate applications. Needless to say it never did work very well.

Starling’s Boden says Revolut’s new travel feature clutching at straws

There is obviously no love lost between digital challenger banks Starling, Revolut and Monzo. It is a shame because they all have a lot in common. They are all run by teckies rather than bankers, are great at managing deposits but not so good on the asset side of the balance sheet and they all lose money to a greater or lesser extent. Nevertheless Boden’s comment that ”banks are not the best people to book your holiday” was a somewhat arrogant and unprovable statement. On the face of it Revolut’s foray into travel has something going for it. Travel involves credit, payments money, foreign exchange, and a network of digital connections. Why not see if there is an opportunity in vertically integrating. Personally I would not book a holiday through a bank but this is what digital banking is all about disrupting traditional suppliers. The Revolut app is undoubtedly a risk but probably not any worse than lending money when you don’t know much about it. You never know it might just work rather well.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

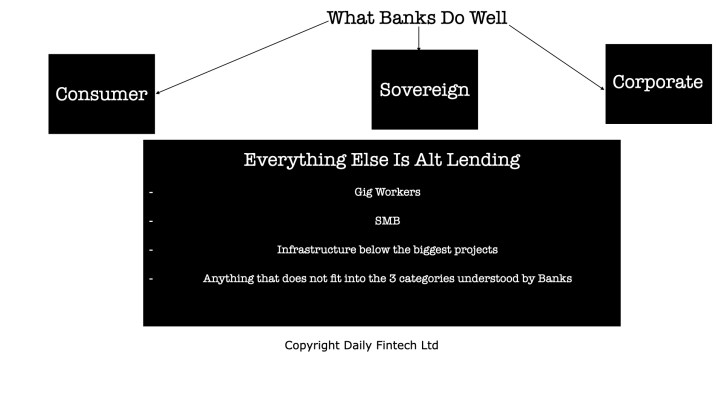

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.