Alt Lending week ending 27th August 2021

Revolut to take on payday loans industry

Revolut is certainly not averse to enter new areas and has recently announced that it is launching a new reason why workers should get their salaries paid into a Revolut account by essentially providing clients with the ability to draw them down in advance of payday. So what’s the difference between that and a payday loan? One may well ask but I suppose there are arguments for and against. What is obviously attractive is that Salary Advance schemes are an unregulated sector of the market. I have an interest in this as some years ago I part owned and founded a cheque cashing company which my partner and I sold to an American competitor. I didn’t like the business as it seemed to me to encourage people to do things that they could not possibly afford. Salary advances do the same thing and there is of course no doubt that those punters that use the schemes will surely end up in a worse position that they would otherwise be in. The regulators know this but are reluctant to wade into a sector which might well be seen as disadvantaging poorer clients. The fact is that at the lower end of the market place there are sometimes legitimate reasons why loans should be made but certainly not in any case. For example the purchase or repair of a new boiler in the middle of winter is certainly legitimate. A pony on a runner in the 3.30 at Chepstow is not. These schemes do not differentiate and consequently will always produce unwanted outcomes. BTW Klarna and other buy now, pay later providers will find they have a large number of the same clients.

Lloyds Bank entering residential property rentals.

Interesting take by Matthew Lynn on Lloyds Bank Citra Living brand which has major ambitions in the property rental market. He points out the upsides, high demand, cash generated, a fragmented and largely unprofessional market, market size and a prodigious growth rate over the past decade. He is also upfront on the downsides diminishing demand from students, immigrants and a fairly dismal overall yield of around 3.6% with little chance of it rising. There are also political and regulatory risks of mainstream banks entering into a politically sensitive area any more than they are already through mainstream mortgage lending. And Lloyds are not the only one a lot of other large non financial groups are looking for other ways of making some money. Retail for example. One presumes that these people have done their sums properly but I can’t help feeling that banks should be involved as part of the process of ensuring leveraged finance should be available to proper businesses to finance production, trade, research etc. It seem they have lost the skill sets necessary to do this and are instead clutching at the increasingly difficult straws of becoming property companies or wealth managers. Wealth management in particular when you are managing money that other people have made at a much faster rate than the banks have.

UK Branch closures controversy heats up.

I could have chosen any number of articles to cite concerning this highly controversial strategy. In fact Ben Marlow writing in the Telegraph took a rather socialist position in the Daily Telegraph that those clients who are not tech savvy, the old etc should not be forgotten about. He is of course right but I fail to see why the government might intervene to get privately owned banks to subsidise loss making activities. If the government thinks this way then it should start paying the bill for it. It is not the traditional banks fault that interest rates are at virtually zero. Nor that money printing, QE, funny money or whatever you want to call it has essentially destroyed a key part of the way resources are allocated. Contrary to popular opinion RBS and other outfits did not have to be nationalised. Politicans failed everybody except the very rich in 2008 everybody else is still picking up the tab.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

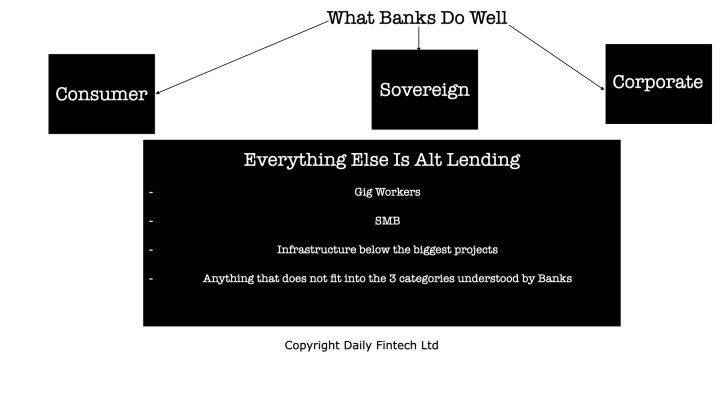

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.