Alt Lending Week ending 25th June 2021

JP Morgan wealth management strategy becoming clearer

It seems like JP Morgan operating under the Chase Manhattan banner’s plans for its UK digital banking start up are a little bit more than just plans for the UK market. Nutmeg is a digital fund manager which has been operating since 2011 and has amassed a considerable number of clients. It apparently manages funds of some £ 3.5 billion on behalf of 140k customers. It uses smart technology to invest money on clients behalf based on their own input digitally acquired. JP Morgan sees the acquisition as something more than just a foray into the UK market saying that the Nutmeg offering will form the basis of the banks retail wealth management strategy globally in the coming years. Nutmeg however, like many of its contemporaries has never been profitable and the latest accounts show a loss of £ 22 million. On this basis the estimated cost of acquisition is around £ 700 million. Nevertheless it is clear that JP Morgan’s ambitions for the UK are ambitious and a warning to all the other wannabees in what is already a crowded space. Retail banking in the UK is not very profitable but at least JPM have lending expertise in spades.

UK Infrastructure Bank opens for business.

UK Chancellor of the Exchequer, Rishi Sunak, has officially opened the Government owned British Infrastructure Bank in the Provincial City of Leeds. Its key objectives are undoubtedly political firstly to help drive the Governments levelling up agenda and secondly to help move the UK to net zero emissions target. I have to say that I am sceptical of all government driven initiatives which always tend towards white elephants. Just look at HS2. However infrastructure spending is undoubtedly a priority not just for the UK but everywhere. We don’t want any more collapsing Italian bridges do we. The other side of the pond is even worse. I am frightened to cross most of New York City’s rusty bridges. Infrastructure is like anything else and the smart money will always follow bang for buck. However if you don’t start attaching real revenues to projects everything falls back on the taxpayer and the dead hand of government budgets. The more that infrastructure projects can be made profit centres with actual returns thought through and implemented and invested in by the professionals the better. Sadly most of the projects I have seen are poorly thought through for their revenue potential.

10x Future Technologies raises $ 178m on valuation of $ 700million

Blackrock helped with this one led by ex Barclays Chief Antony Jenkins who ironically was ousted due to concerns that he was not moving the technology fast enough. I can sympathise and it is true that legacy systems are the bête noire of established banks. As one of the founders of automated FX trading I can sympathise with the wish to provide soup to nuts operating systems. However the difficulties of this in practice are almost unbelievably complex. Technology is moving so fast that almost nobody can keep up with it. Every new piece of software presents a new challenge in term of connectivity and integration. 10xFT is also working with JP Morgan on its digital UK start up. Perhaps something will come of it. In the meantime a lot of start ups will raise oodles of capital for things that just aren’t worth it. Banking is a simple business. The technology behind it is not.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

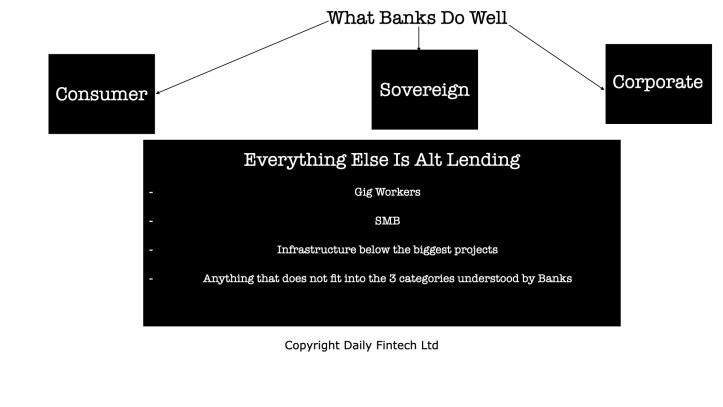

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.