Alt Lending week ended 9th July 2021

HSBC bucks trend as European banks decline in importance

The Banker magazine has released new data on the standing of the worldwide banking industry. There are no surprises but why should there be banking is not the business it used to be and the transparency of accounting standards across continents does not look like it is improving. From memory the Banker used to define banks by the size of their balance sheets but the Telegraph article seems to focus on the importance of Tier 1 capital. Chinese banks grab the top four spots for primary capital and the only brightspot for European banking interests is HSBC which at 8th Position is the only European bank in the worlds top ten. This relates to the fact that despite being based in London most of its business is conducted in Asia which has proved more resilient to the pandemic. What it does tell us all is that Europe is becoming a smaller part of the global banking pie and that lending which used to be what the whole thing was all about is declining in importance.

Monzo and others warned by UK Competition and Markets Authority over missing statements

This was a bit of a surprise to me. The open banking initiative which supposedly makes it easier for clients to switch banks are all in favour of supporting this initiative. However one of the leading challenger banks Monzo has received a rap over the knuckles for failing to write to no fewer than 143,000 former clients and provide them with historic bank account statements. The upshot is that these former clients have found it much more difficult to access credit services with their new banks. What surprises me is that a digital bank like Monzo does not respond automatically to a clear breach of rules like this one. Former customers must receive their banking history within 40 days of closing their account with 95% receiving their histories within 10 days. The CMA identified that some former clients had to wait for over a year. Must do better.

Sunak to use UK sovereignty as equivalence talks go nowhere.

The English have an expression “flogging a dead horse” which means in essence it is a worthless exercise. The UK Chancellor of the Exchequer has recognised, and not a moment too soon, that the EU powers that be are not interested in granting equivalence to the UK. Not necessarily the best outcome for the UK possible but not disastrous either. The mere fact that Europe is prepared to give equivalence to the United States tells you something about the antagonistic mindset in Brussels. Rishi is going to tear up the more rigid aspects of MIFID 2 and other EU regulation and make the UK a more competitive place to do business in finance. As I have said before the world is a very big place and there is plenty of room for a less regulated environment without lowering standards. Europe will not stop regulating, it is part of its raison d’etre. The bureaucrats have total control and will only become more powerful as time goes on. After all there is no way of getting rid of them. There is no good way out of this but I cannot help thinking that the UK will come out the stronger for using its own sovereignty to control its own destiny.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

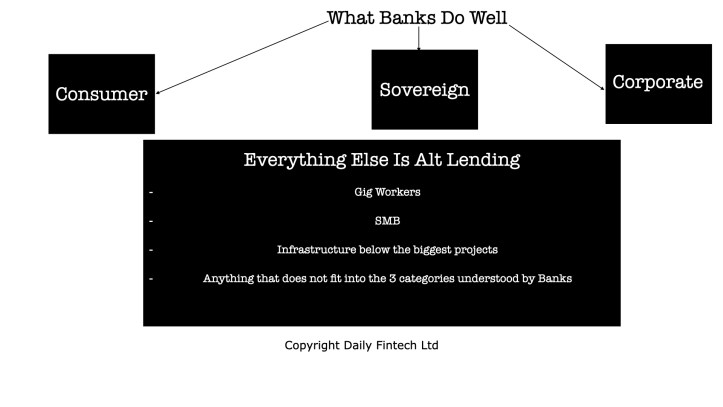

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.