Alt Lending Week ended 7th. May 2021

Eurozone facing mass bankruptcies

A leaked report from the The European Sytemic Risk Board(ESRB) which is chaired by Christine Lagarde and is the key risk watchdog within the EU is forecasting a huge increase in bankruptcies once COVID support facilities are unwound. While this is not totally unexpected many European banks were already carrying large numbers of non performing loans before the impact of strict COVID lockdowns. This in turn is likely to impair the ability of many European banks to lend weight to funds needed to finance the essential recovery phase when economies open up once more. It is difficult to see how the ECB will react to this scenario but the usual default will be to kick the can down the road a little further.

Bank of England to simplify rules for UK’s smaller lenders

The Bank of England’s head of prudential policy has signified that in a post Brexit move it is moving from being a rule taker to being a rule maker. Key to this will be the simplification of the EU’s one size fits all legislative framework which imposes unwarranted levels of compliance on smaller institutions. By doing so it is taking a leaf out of the US’s book which allows smaller lenders (non systemic) to operate with far less red tape. This will be good news to the Uk’s growing digital banking market which will find it much easier and less costly to obey the rules as well as stimulating competition in markets which are lacking in innovative structured finance. Slashing red tape in the UK banking market is an obvious benefit of leaving the EU’s complicated regulatory approach which in the long run will probably do more harm than good.

Credit Suisse vulnerable to bid from UK major

In it’s weakened state following what seems an endless run of unforced errors Credit Suisse is indeed vulnerable and Barclays is named as a potential suitor. Certainly it would be a strategic snip at current valuations but on the debit side what is actually going on under the hood. One thing that really bothered me was the conflation of Risk and Compliance which became apparent as the same executive which headed up both disciplines was given the heave ho after Archegos and Greensill along with the head of Investment Banking. Compliance only works if it is good for the overall objectives of the business. Risk and compliance should be debating the pros and cons of innovative ideas not operating as two halves of the same coin. What looks like a really good deal might end up looking less attractive under a more critical microscope.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

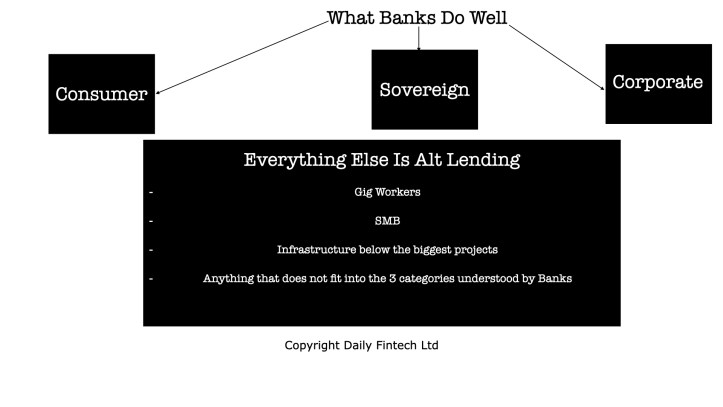

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.